- United States

- /

- Electrical

- /

- NasdaqGS:AMSC

American Superconductor (AMSC): Exploring Valuation After Recent Double-Digit Share Price Surge

Reviewed by Simply Wall St

American Superconductor (AMSC) has seen its shares climb sharply in the past 3 months, gaining nearly 38%. This performance is drawing attention as investors weigh the company’s financial momentum and strategic positioning within the broader energy technology sector.

See our latest analysis for American Superconductor.

Momentum around American Superconductor has been building, with the share price surging 131.94% since the start of the year and a remarkable 153.68% total shareholder return over twelve months. Despite a minor pullback this week, these moves hint at investors growing more optimistic about the company’s growth prospects and potential valuation upside.

If the renewed interest in American Superconductor has you wondering where else momentum is building, it might be the perfect time to discover See the full list for free.

With shares soaring so dramatically, the question for investors is clear: is American Superconductor still trading at a discount, or are the company’s future gains already reflected in today’s stock price?

Most Popular Narrative: 11.1% Undervalued

With American Superconductor’s last close at $59.26 and the narrative’s fair value set at $66.67, analysts are wagering on continued business transformation and expansion. A gap remains between today’s price and the most popular forward-looking view, sparking debate about the path ahead.

*“Accelerating semiconductor and data center investments are driving robust demand for AMSC's grid and materials solutions, as demonstrated by strong backlog and recurring orders. This is expected to enhance top-line revenue growth in future periods. Global expansion of renewable energy, especially the doubling of wind capacity in markets like India, positions AMSC's wind and grid businesses for long-term volume growth and reduces customer concentration risk, supporting sustained revenue and earnings growth.”*

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Interested in which bold financial projections support that price target? Dive deeper to see the surprising numbers that drive this fair value calculation.

Result: Fair Value of $66.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the stock’s momentum faces risks such as possible one-off gains or cyclical swings in semiconductor demand, which could put pressure on future growth.

Find out about the key risks to this American Superconductor narrative.

Another View: Multiple-Based Valuation Poses a Challenge

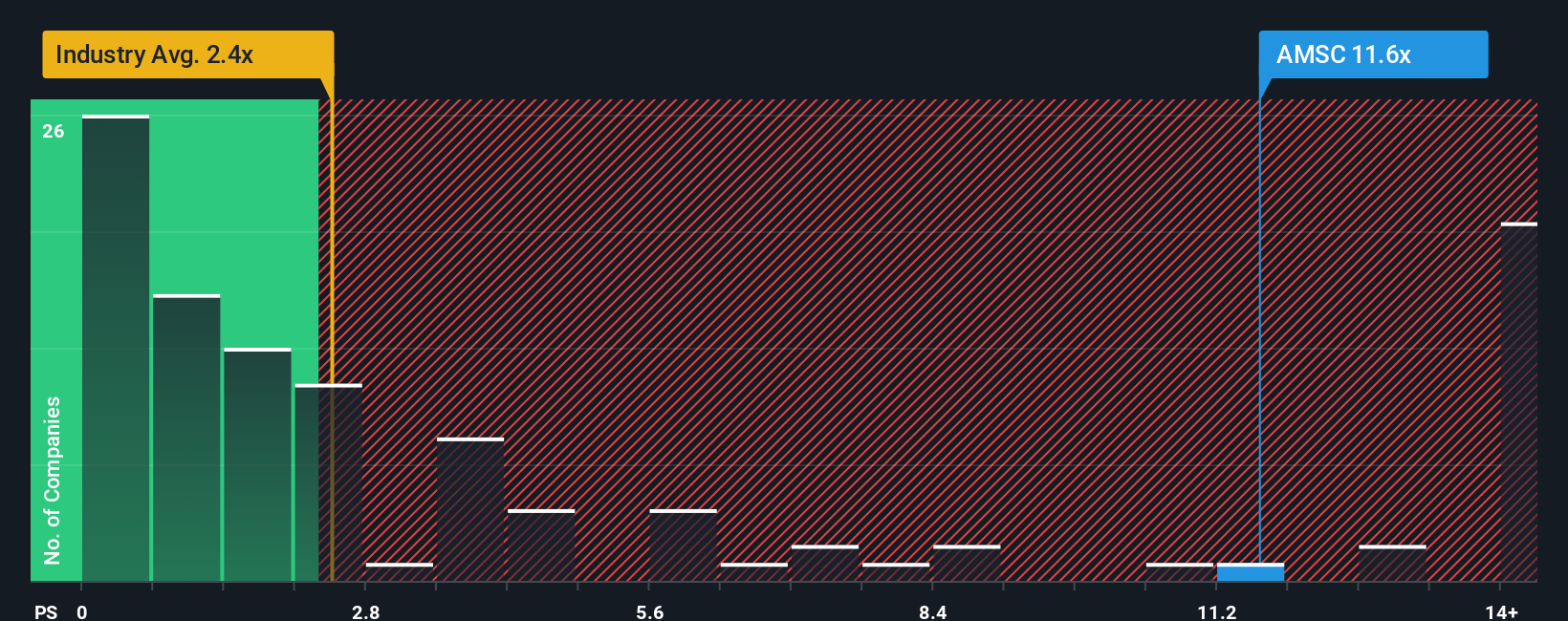

While analysts see American Superconductor as undervalued based on future growth, a look at the price-to-sales ratio tells a cautious story. Trading at 10.5 times sales, the company stands well above the industry average of 2.5 and peer average of 4.2. This is far from the fair ratio of 2.3. This sizable premium suggests the market already expects exceptional growth and leaves little margin for error. Could investor optimism outpace reality, or is there more upside ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Superconductor Narrative

If you have a different perspective or want to delve deeper on your own terms, you can shape your own story from the data in just a few minutes. So why not Do it your way?

A great starting point for your American Superconductor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize the chance to get ahead of the market by uncovering other standout stocks and trends using powerful tools tailored for forward-thinking investors like you.

- Unleash your potential for triple-digit growth with these 3574 penny stocks with strong financials, delivering standout returns from up-and-coming companies with solid financials.

- Capture long-term passive income opportunities when you check out these 17 dividend stocks with yields > 3% and see which businesses are offering yields above 3%.

- Ride the AI revolution and energize your portfolio by reviewing these 24 AI penny stocks, featuring companies at the forefront of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMSC

American Superconductor

Provides megawatt-scale power resiliency solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives