- United States

- /

- Electrical

- /

- NasdaqGS:AMSC

A Fresh Look at American Superconductor (AMSC) Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

American Superconductor (AMSC) shares have drawn some attention after recent moves, as the stock has shown strong growth over the past month and past 3 months. Investors are evaluating what is driving this momentum and what it could mean going forward.

See our latest analysis for American Superconductor.

After a phenomenal run this year, American Superconductor’s 120% year-to-date share price return stands out among capital goods stocks. Its 134% total shareholder return over the last twelve months suggests sustained optimism around its growth trajectory. A swift pullback over the past week has not dulled long-term momentum, with investors continuing to factor in both recent progress and the company’s multi-year track record, highlighted by an eye-popping 1,353% total return over three years.

If you’re curious where this kind of energy might show up next, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with the stock’s meteoric rise and robust fundamentals, are investors overlooking untapped value? Or has the market already factored in every bit of future growth, leaving little room for a fresh buying opportunity?

Most Popular Narrative: 15.6% Undervalued

American Superconductor’s most widely followed valuation narrative sees significant room above its last close price. This suggests support for further upside rooted in key market catalysts. This perspective stands out in the context of the recent rally and points to future potential that goes beyond historical returns.

Elevated policy-driven focus on grid reliability and modernization, including increased government and utility spending on infrastructure and grid resilience, is likely to create a tailwind for grid solutions. This may expand AMSC's addressable market and backlog, ultimately supporting recurring revenues and potentially higher net margins.

Want to unlock the full narrative behind this bullish fair value? The secret is audacious profit margin growth and an earnings multiplier more common to disruptive tech giants. What are the bold analyst forecasts that power such a premium? Explore exactly which forecasts and assumptions are moving the needle for this company.

Result: Fair Value of $66.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in semiconductor orders or a less favorable project mix could quickly challenge bullish forecasts for American Superconductor's future momentum.

Find out about the key risks to this American Superconductor narrative.

Another View: Are High Multiples a Warning Sign?

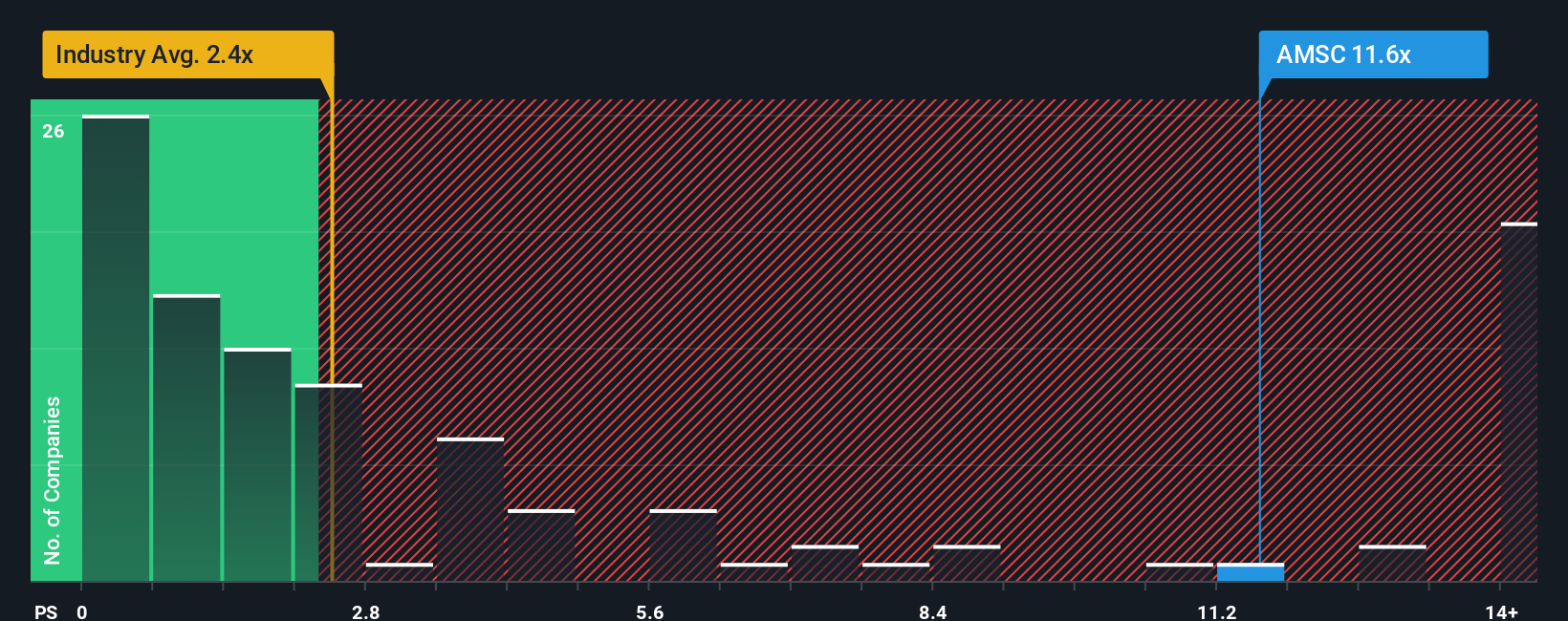

While bullish narratives paint an upside, a closer look at American Superconductor’s price-to-sales ratio (10x) tells a more cautious story. That is far above the US Electrical industry average of 2.3x and also exceeds peer companies at 3.4x. The fair ratio suggests the market could adjust lower. Could these lofty multiples put investors at risk if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Superconductor Narrative

If you see things differently, or want to dig into the numbers on your own terms, crafting your own view takes just a few minutes. Do it your way

A great starting point for your American Superconductor research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip by. Make your next bold move by searching smart and uncovering companies that match your style before others do.

- Spot trendsetters shaking up artificial intelligence. Seize the opportunity with these 24 AI penny stocks positioned for the next tech wave.

- Secure reliable income streams by tapping into these 19 dividend stocks with yields > 3% with robust yields and strong track records.

- Capitalize on price gaps and future market leaders by scanning these 898 undervalued stocks based on cash flows before they catch the spotlight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMSC

American Superconductor

Provides megawatt-scale power resiliency solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives