- United States

- /

- Electrical

- /

- NasdaqGM:ALNT

If You Had Bought Allied Motion Technologies (NASDAQ:AMOT) Stock Five Years Ago, You Could Pocket A 112% Gain Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

While Allied Motion Technologies Inc. (NASDAQ:AMOT) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 15% in the last quarter. But that doesn't change the fact that shareholders have received really good returns over the last five years. We think most investors would be happy with the 112% return, over that period. To some, the recent pullback wouldn't be surprising after such a fast rise. Of course, that doesn't necessarily mean it's cheap now.

View our latest analysis for Allied Motion Technologies

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

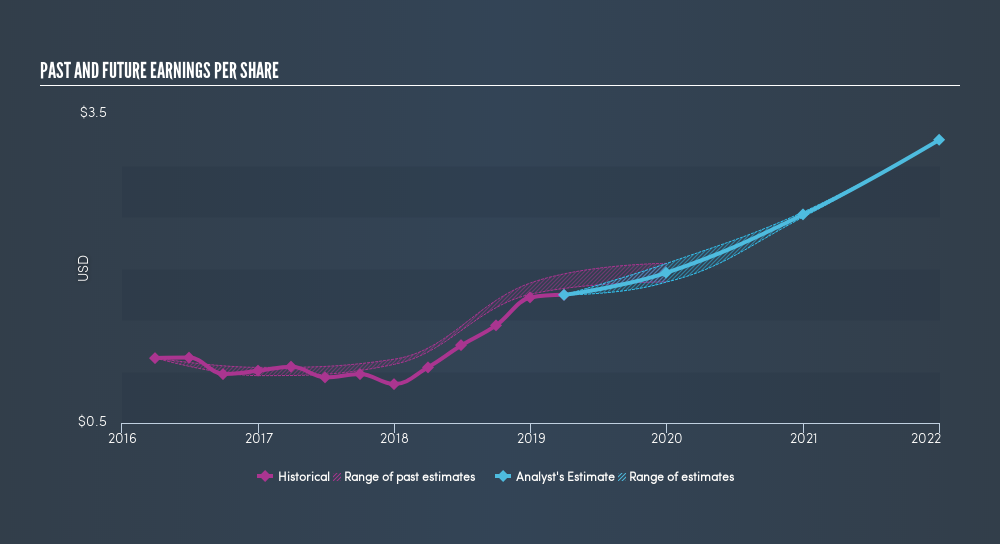

Over half a decade, Allied Motion Technologies managed to grow its earnings per share at 25% a year. The EPS growth is more impressive than the yearly share price gain of 16% over the same period. Therefore, it seems the market has become relatively pessimistic about the company.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Allied Motion Technologies has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Allied Motion Technologies, it has a TSR of 116% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Investors in Allied Motion Technologies had a tough year, with a total loss of 27% (including dividends), against a market gain of about 2.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 17%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before spending more time on Allied Motion Technologies it might be wise to click here to see if insiders have been buying or selling shares.

Of course Allied Motion Technologies may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:ALNT

Allient

Designs, manufactures, and sells precision and specialty-controlled motion components and systems for various industries in the United States, Canada, South America, Europe, and the Asia-Pacific.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives