- United States

- /

- Electrical

- /

- NasdaqCM:ADSE

ADS-TEC Energy PLC (NASDAQ:ADSE) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

ADS-TEC Energy PLC (NASDAQ:ADSE) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. The last month tops off a massive increase of 116% in the last year.

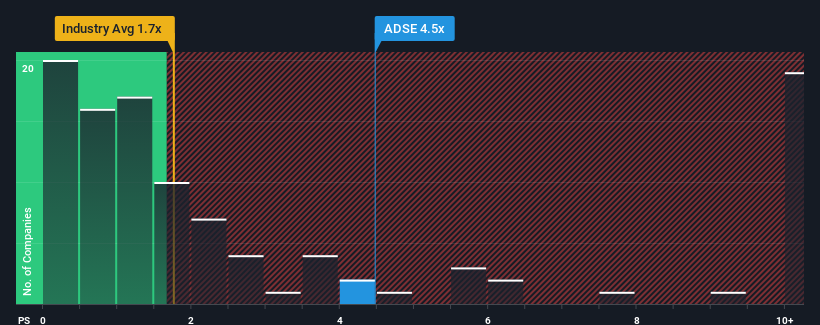

Following the firm bounce in price, given around half the companies in the United States' Electrical industry have price-to-sales ratios (or "P/S") below 1.7x, you may consider ADS-TEC Energy as a stock to avoid entirely with its 4.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for ADS-TEC Energy

How Has ADS-TEC Energy Performed Recently?

Recent times have been advantageous for ADS-TEC Energy as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think ADS-TEC Energy's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like ADS-TEC Energy's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 168% last year. Pleasingly, revenue has also lifted 124% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 60% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 13%, which is noticeably less attractive.

With this in mind, it's not hard to understand why ADS-TEC Energy's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On ADS-TEC Energy's P/S

The strong share price surge has lead to ADS-TEC Energy's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that ADS-TEC Energy maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electrical industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with ADS-TEC Energy (including 1 which makes us a bit uncomfortable).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ADSE

ADS-TEC Energy

Engages in the provision of intelligent and decentralized energy storage systems in Europe and North America.

High growth potential with imperfect balance sheet.

Market Insights

Community Narratives