- United States

- /

- Building

- /

- NasdaqGS:AAON

Will New Institutional Investment and Analyst Upgrades Transform AAON's (AAON) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, AAON attracted attention as institutional investors such as RIVERBRIDGE PARTNERS LLC initiated a new US$20.9 million position, and Wall Street analysts expressed renewed confidence through positive ratings and target revisions.

- This surge in institutional activity and consistently favorable analyst perspectives highlights growing momentum for AAON, particularly as its positioning benefits from sector trends tied to artificial intelligence infrastructure investments.

- With increased institutional investment reflecting broader analyst optimism, we will now explore how this could reshape AAON's investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

AAON Investment Narrative Recap

To be an AAON shareholder today, you need to believe in the company’s ability to capitalize on surging demand for advanced HVAC solutions tied to artificial intelligence infrastructure, while continuing to resolve near-term operational inefficiencies. The recent influx of institutional investments and upbeat analyst ratings underscores positive sentiment, yet these developments do not materially alter the short-term catalyst, restoring production momentum post-ERP rollout, nor do they mitigate the ongoing risk of operational setbacks from further system implementations across AAON’s manufacturing sites.

One of the most relevant recent announcements is AAON’s updated full-year guidance, which was trimmed in August to reflect ongoing inefficiencies at its Longview facility and adjusted production in Tulsa. This update aligns directly with the short-term catalyst for the business: demonstrating consistent improvements in operational efficiency and margin recovery through the remainder of the year.

However, behind the recent institutional optimism, investors should be keenly aware that any recurring ERP-related disruptions could...

Read the full narrative on AAON (it's free!)

AAON's outlook anticipates $1.9 billion in revenue and $283.0 million in earnings by 2028. This is based on a projected annual revenue growth rate of 15.3% and represents a $160.9 million increase in earnings from the current level of $122.1 million.

Uncover how AAON's forecasts yield a $103.25 fair value, a 3% upside to its current price.

Exploring Other Perspectives

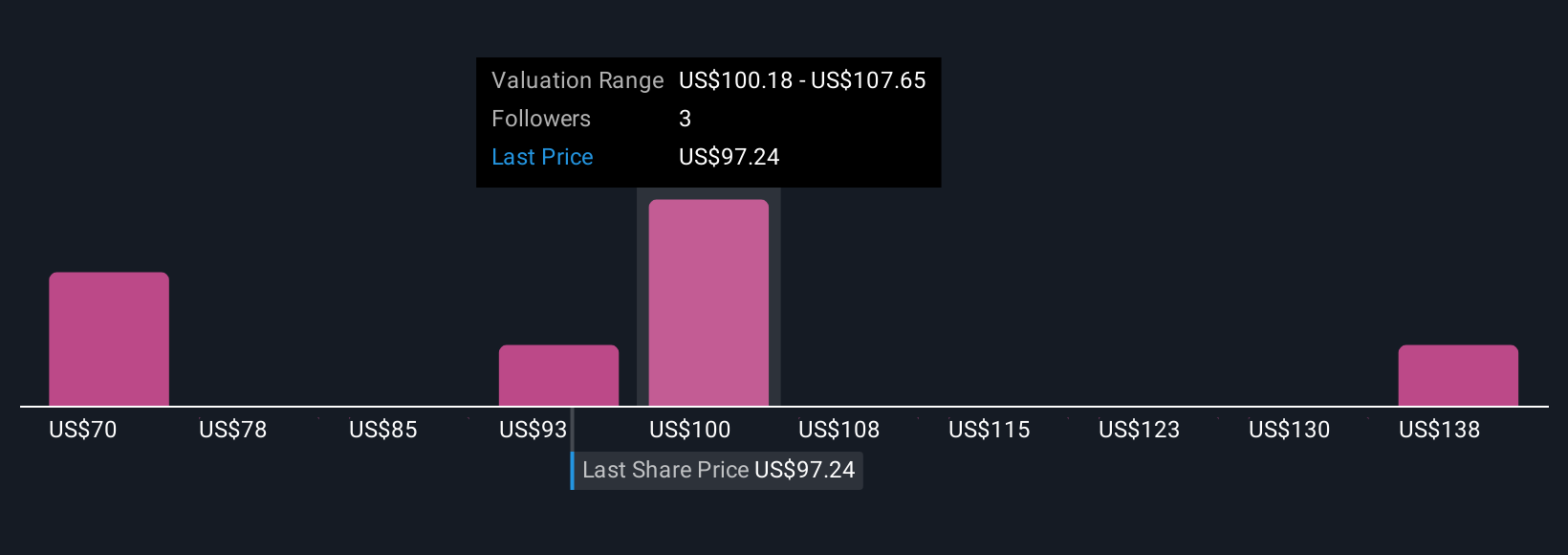

Simply Wall St Community members provided four fair value estimates for AAON, spanning from US$70.32 to US$145 per share. While many see upside tied to operational recovery and data center growth, your view should reflect on the persistent risks from ongoing ERP rollouts that could impact earnings and margins, see how others in the community are weighing these factors.

Explore 4 other fair value estimates on AAON - why the stock might be worth as much as 45% more than the current price!

Build Your Own AAON Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AAON research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free AAON research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AAON's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAON

AAON

Engages in engineering, manufacturing, marketing, and selling air conditioning and heating equipment in the United States and Canada.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives