- United States

- /

- Building

- /

- NasdaqGS:AAON

How Investors Are Reacting To AAON (AAON) As Short Interest Eases Amid Shifting Market Sentiment

Reviewed by Sasha Jovanovic

- In recent days, AAON Inc. has experienced a 6.33% decline in short interest, with shorted shares still significantly above the peer average at 12.72% of float.

- This shift, coupled with strong near-term sentiment identified by AI-driven trading models, suggests changing market expectations despite lingering mid- and long-term caution.

- We’ll explore how easing bearish sentiment, as reflected in falling short interest, may influence AAON’s investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

AAON Investment Narrative Recap

To be a long-term shareholder in AAON, you need to believe in the company’s ability to translate major investments in capacity, technology, and product innovation into profitable growth, particularly as demand for advanced HVAC and data center cooling solutions expands. The recent drop in short interest sends a positive short-term signal, but it does not meaningfully change the most important current catalyst, ongoing progress in operational recovery from its ERP rollout, or reduce the primary risk of further disruptions or margin pressure from this implementation.

Among recent company announcements, AAON’s Q3 earnings and raised full-year sales growth guidance stand out. While operational hurdles have impacted profitability, management’s commitment to improving efficiencies and ramping new facilities addresses a key near-term catalyst: boosting margins as production constraints ease and new capacity is utilized more fully.

However, set against stabilization in sentiment, the risk of continuing ERP-related inefficiencies across multiple sites remains a point investors should be aware of…

Read the full narrative on AAON (it's free!)

AAON's narrative projects $1.9 billion revenue and $283.0 million earnings by 2028. This requires 15.3% yearly revenue growth and a $160.9 million earnings increase from $122.1 million today.

Uncover how AAON's forecasts yield a $115.25 fair value, a 23% upside to its current price.

Exploring Other Perspectives

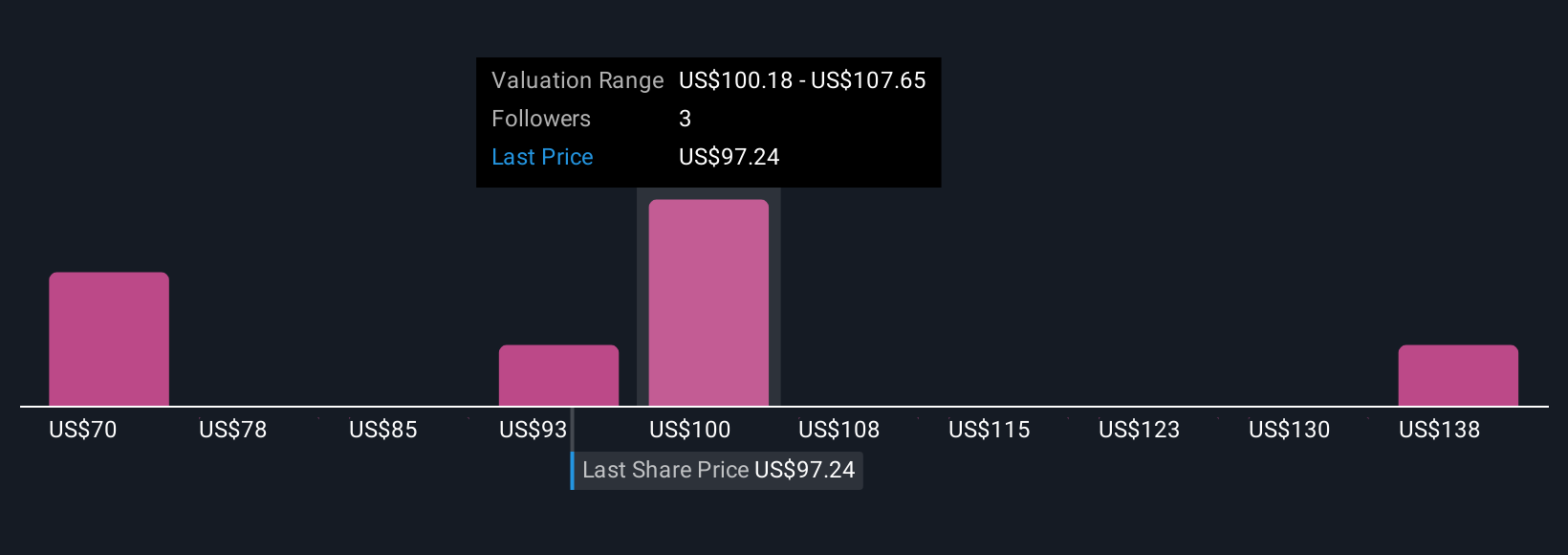

Simply Wall St Community members set AAON fair value estimates between US$95.67 and US$145 across four distinct opinions. This wide range underscores how investor views can diverge, especially as ongoing operational recovery remains a focal point for the business.

Explore 4 other fair value estimates on AAON - why the stock might be worth as much as 55% more than the current price!

Build Your Own AAON Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AAON research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AAON research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AAON's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAON

AAON

Engages in engineering, manufacturing, marketing, and selling air conditioning and heating equipment in the United States and Canada.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.