- United States

- /

- Banks

- /

- OTCPK:TRUX

Truxton (TRUX) Margin Dip Challenges Views on Stability Despite Strong Earnings Growth

Reviewed by Simply Wall St

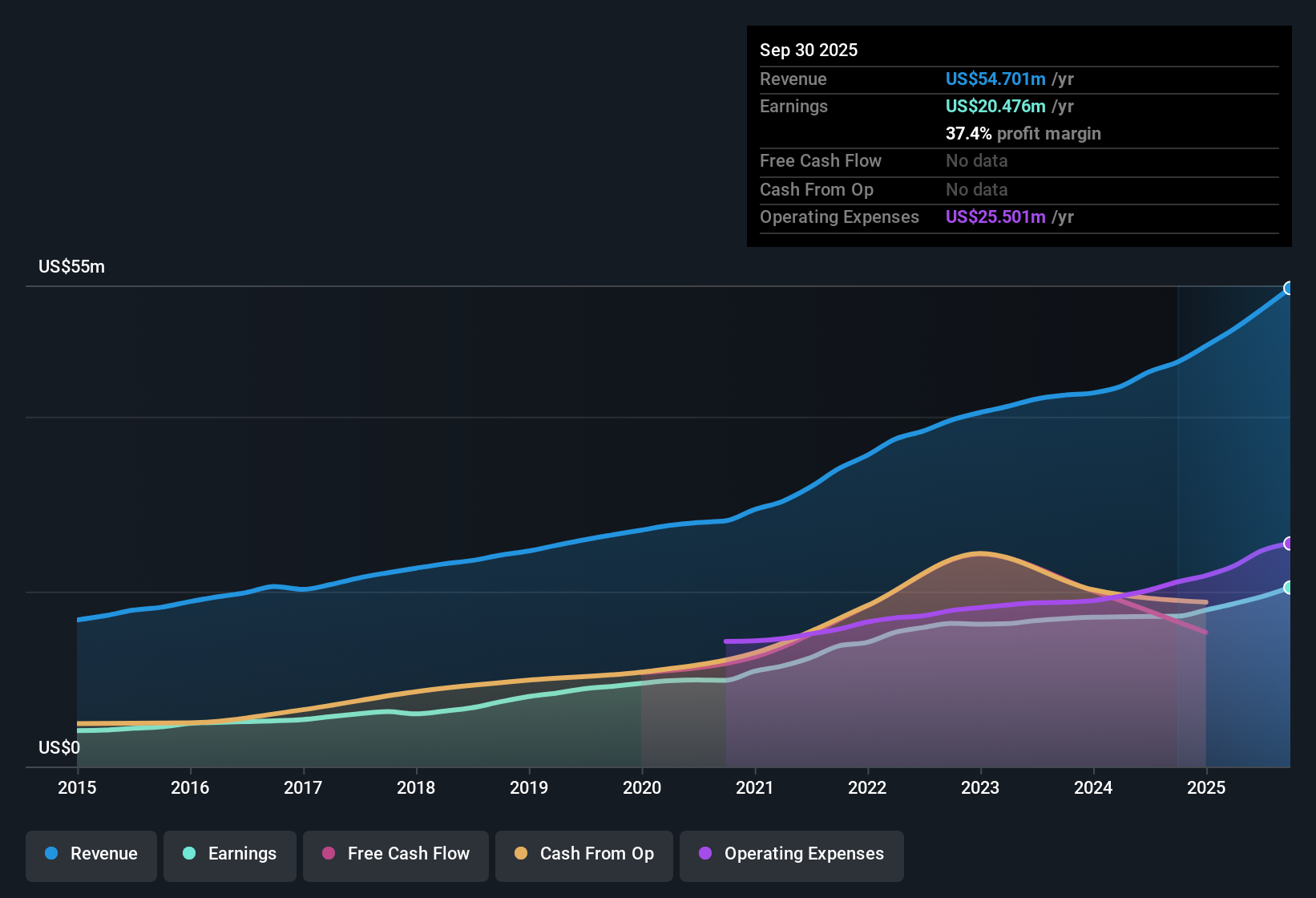

Truxton (TRUX) posted a 13.1% jump in annual earnings, outpacing its five-year growth average of 10.7%. The company’s net profit margin edged down to 37.1% from last year’s 38.1%, while its EPS translated to a Price-to-Earnings Ratio of 12.6x, sitting above both the industry and peer averages. Shares closed at $84.9, noticeably under the estimated fair value of $136.04, with investors weighing attractive dividends, steady profit growth, and overall value against the minor dip in margins.

See our full analysis for Truxton.Now, let’s see how these earnings results compare when set against the latest market narratives. Some expectations may be confirmed, while others could be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Slippage Raises Eyebrows

- Truxton’s net profit margin dipped from 38.1% last year to 37.1%, suggesting a modest pullback in efficiency, even as annual earnings growth accelerated.

- What is surprising is that this slimmer margin has not eroded Truxton’s reputation for high-quality, consistent profits, a point heavily emphasized by the prevailing market perspective:

- Despite the drop, sustained profit growth over five years at 10.7% per year still signals solid operational control.

- Investors are likely to weigh whether this margin dip is a temporary trade-off for ongoing earnings expansion or the start of a new cost trend.

Premium Price, Discounted Shares

- The Price-to-Earnings Ratio sits at 12.6x, putting Truxton at a premium to both the US Banks industry average of 11.3x and peer average of 11.9x. However, the share price of $84.9 remains well below its DCF fair value of $136.04.

- This valuation spread shapes investment narratives, creating tension between perceived market caution and tangible value:

- Bulls highlight the gap to DCF fair value as a sign the market could be overlooking Truxton’s strong underlying fundamentals.

- Bears, meanwhile, may focus on the premium P/E as a warning that future upside depends on ongoing delivery of growth and profitability.

Dividend and Growth Combo Stands Out

- Attractive dividends, combined with a five-year annual earnings growth rate of 10.7%, set Truxton apart when investors seek both income and expansion potential.

- The prevailing market view points out that this blend of steady payouts and reliable growth outweighs short-term margin fluctuations for many long-term holders:

- The company’s ability to keep growing while paying dividends suggests resilience not always found among peers.

- Absent significant flagged risks, the market may assign added value to this consistency as economic conditions shift.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Truxton's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Truxton’s declining net profit margin and premium valuation raise concerns about whether its growth and dividends can be as reliable in the future.

If you’re searching for more consistent performers, our stable growth stocks screener (2090 results) will help you discover companies with a track record of steady earnings and revenue growth through changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Truxton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:TRUX

Truxton

Through its subsidiaries, provides various banking, investment management, and trust administration services to individuals, businesses, and charitable institutions in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion