- United States

- /

- Banks

- /

- OTCPK:SBKO

Summit Bank Group (SBKO): Margin Surge to 26.1% Reinforces Bullish Profitability Narrative

Reviewed by Simply Wall St

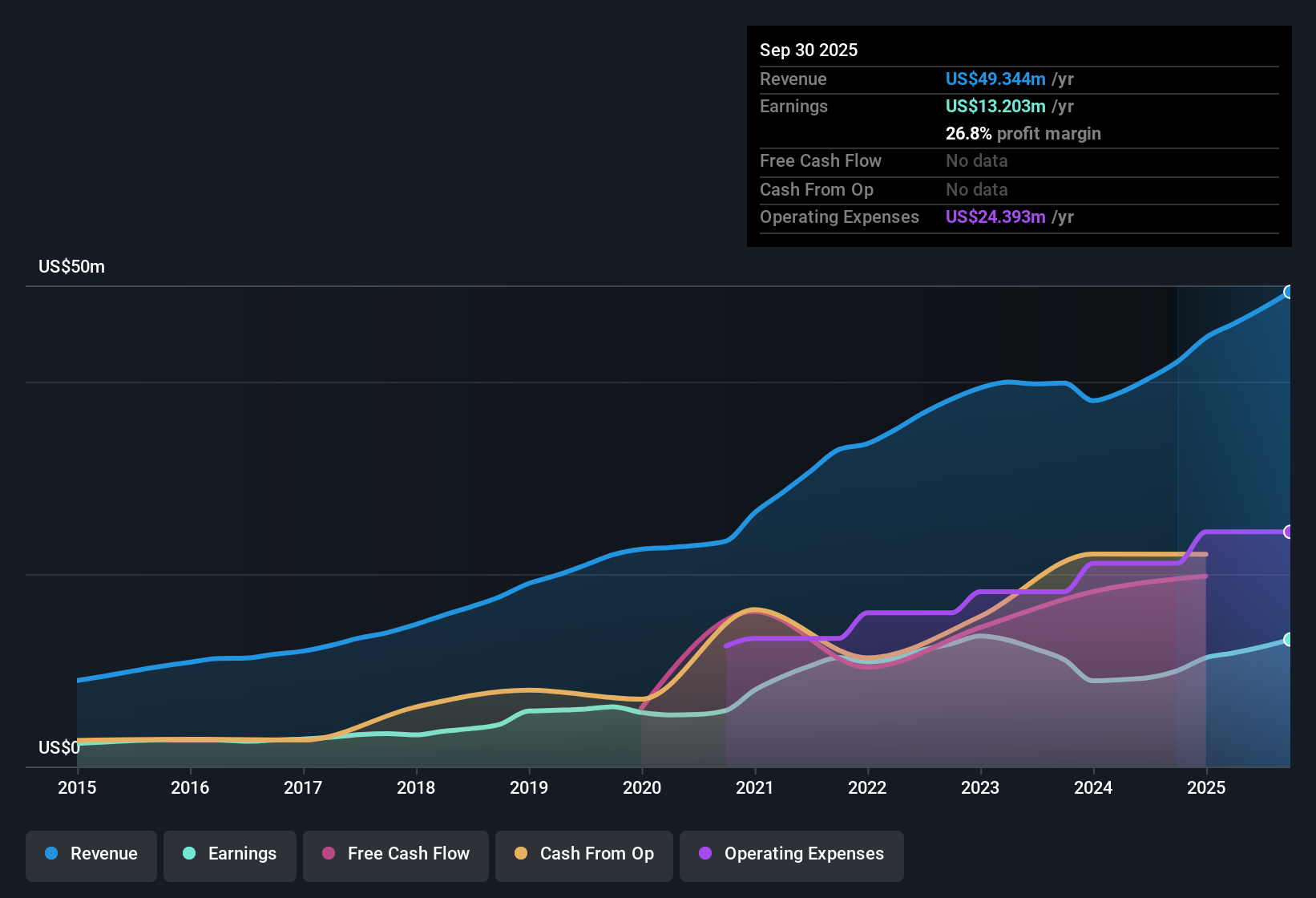

Summit Bank Group (SBKO) reported net profit margins of 26.1%, up from 22.9% a year earlier, with EPS growth accelerating to 34.5% in the latest year, well above its five-year average of 4.3%. The stock trades at a Price-To-Earnings Ratio of 10.4x, which is notably below the peer average of 15.8x and the broader US Banks industry average of 11.2x. Shares recently traded at $16.64 and remain well below the estimated fair value of $29.95. With no material risks flagged and high-quality earnings supporting recent performance, investors are likely to focus on both the strong growth and the company's attractive relative valuation.

See our full analysis for Summit Bank Group.Next, we will see how these headline numbers line up with the most widely-followed narratives in the market, and which stories they will put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Move Above 26%

- Net profit margin increased to 26.1% from 22.9% a year ago, adding more than three percentage points to the bottom line.

- With high quality earnings delivering a margin expansion, the prevailing market view points out that such improvement reinforces Summit Bank Group’s reputation for prudent management and operational consistency.

- This margin trend aligns with the view that regional banks are being rewarded for stability, rather than aggressive expansion.

- What is notable is that increases in profitability have occurred without any flagged risks or volatility in the underlying business.

Recent Growth Beats Long-Term Trend

- Earnings grew by 34.5% last year, dramatically outpacing the five-year average annual growth rate of just 4.3%.

- The prevailing market view notes that such a sharp acceleration, especially when compared to the bank's historical pace, puts the spotlight on the durability of this surge.

- This uptick suggests that, while the company has a long track record of steady results, recent operational momentum is genuinely distinct and not just a return to trend.

- Critics would expect above-average growth to invite concerns about sustainability, but the lack of flagged risks points to a strong fundamental base.

P/E Discount and Fair Value Gap Stand Out

- Summit Bank Group trades at a Price-To-Earnings Ratio of 10.4x, compared to a peer average of 15.8x. The share price ($16.64) sits well below the DCF fair value of $29.95.

- The prevailing market view finds this dual discount reinforces the case for value-focused investors, without forcing a trade-off on quality.

- Unlike some “cheap” banks that come with baggage, Summit’s above-average profit margins and growth suggest the valuation gap is not due to risk.

- Investors looking for a margin of safety might see this as an opportunity that is typically rare for a bank with earnings growth and no material risks flagged.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Summit Bank Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Summit Bank Group’s recent growth momentum is impressive, its longer-term track record reveals that consistent, above-average earnings expansion has not always been sustained.

If you’re searching for companies with a proven history of steady results across changing conditions, check out stable growth stocks screener (2095 results) to focus on others delivering consistent growth from cycle to cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:SBKO

Summit Bank Group

Summit Bank Group, Inc., together with its subsidiaries, commercial banking, financing, real estate lending, and other services in Lane, Deschutes, Multnomah, and Washington counties in Oregon.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives