- United States

- /

- Banks

- /

- OTCPK:OAKC

Oakworth Capital (OAKC): Earnings Grow 165%, Margin Expansion Reinforces Bullish Community Narrative

Reviewed by Simply Wall St

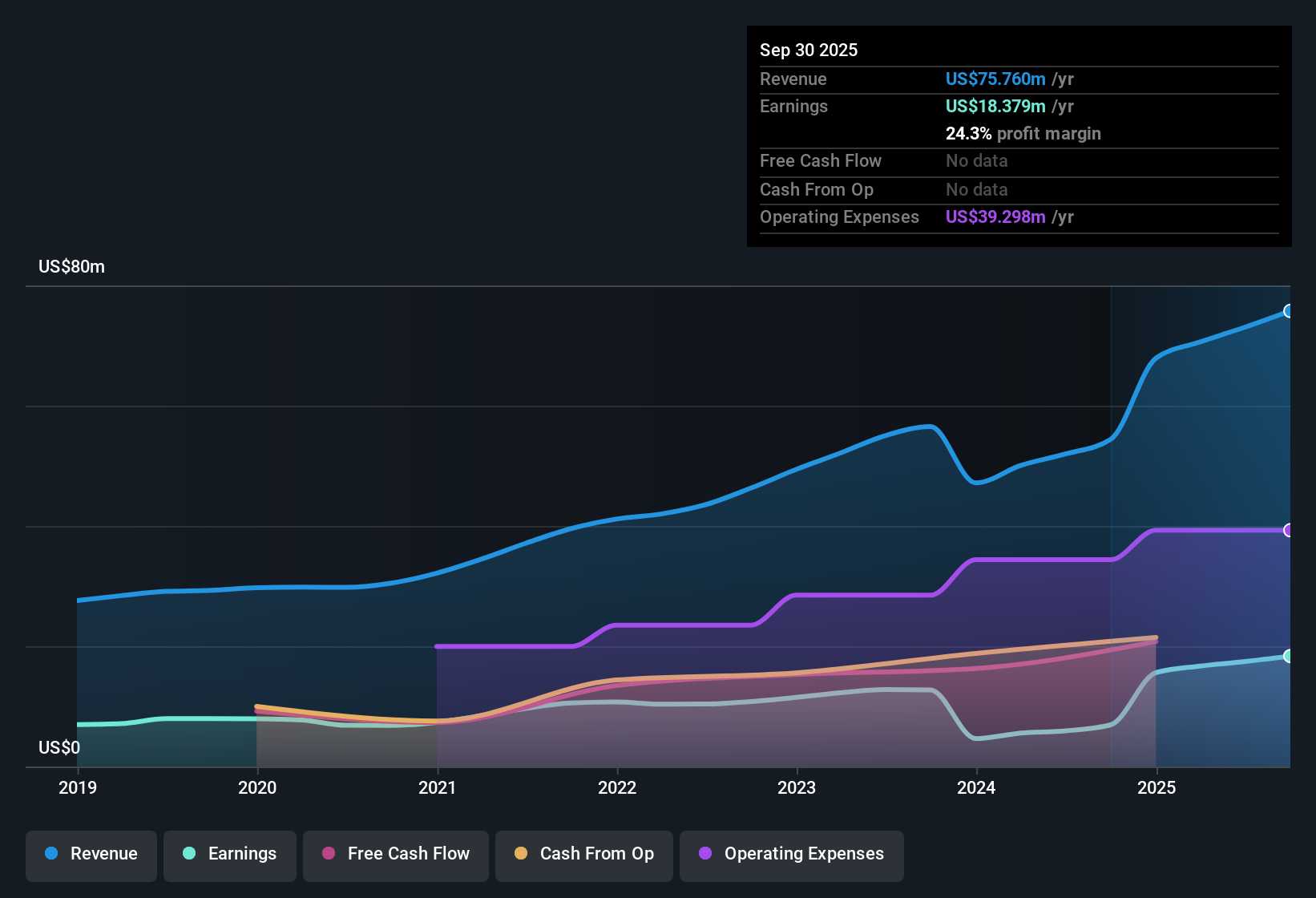

Oakworth Capital (OAKC) delivered robust results with net income jumping 165% over the past year. This outpaces its five-year average annual growth of 11.5%. The company’s net profit margin expanded to 24.3%, up from 12.8% a year earlier. Shares are trading at $32.5, notably below the estimated fair value of $48.18. With a price-to-earnings ratio of 8.8x compared to peer and industry averages, the combination of margin improvement, consistent earnings quality, and a discounted valuation adds meaningful weight to the current equity story for investors.

See our full analysis for Oakworth Capital.Next up, we’ll weigh these numbers against the broader market narratives and see whether the latest results support or complicate the consensus at Simply Wall St.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Surpasses Recent Years

- Net profit margin increased to 24.3% from 12.8% last year, more than doubling Oakworth Capital’s efficiency in turning sales into profits compared to its own recent history.

- Viewed through the prevailing market lens, this kind of margin jump is seen as definitive proof that management’s disciplined approach is paying off, especially when compared to banks where margin pressure is the norm.

- Such a standout margin is rare among regional banks contending with sector-wide cost concerns.

- Sustained, high-quality earnings growth of 11.5% per year over five years further underpins confidence in Oakworth’s business fundamentals.

Discounted Valuation Relative to Peers

- Oakworth’s price-to-earnings ratio of 8.8x is meaningfully lower than the US Banks industry average of 11.2x and peers at 18.6x, and shares trade at $32.50 versus a DCF fair value of $48.18, highlighting a notable valuation gap.

- Analysts focusing on prevailing market data note the deep discount has increased the appeal, as investors have generally awarded premiums to banks with consistent earnings quality and risk control.

- The $15.68 valuation gap per share draws attention for those seeking value that does not rely on turnaround speculation.

- In a sector rewarded for conservatism lately, Oakworth’s combination of steady performance and below-average multiples has become a positive talking point.

Reliably Compounding Profits

- Earnings rose 165% in the past year, far ahead of Oakworth’s already strong 5-year earnings growth average of 11.5% per year, confirming remarkable compounding momentum.

- Prevailing market perspective views this upside as heavily supporting the case for continued shareholder value.

- Such a rapid increase rarely happens in mature, conservative-focused banks and hints at operational discipline well above the pack.

- Importantly, the positive earnings trend has occurred even as many regional peers struggle with net interest margin contraction and cost inflation.

See our latest analysis for Oakworth Capital.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Oakworth Capital's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Oakworth Capital's impressive earnings surge and margin expansion, its overall growth pace has lagged larger high-growth peers in the sector.

If you're seeking established companies forecast to deliver even stronger earnings growth in the years ahead, check out high growth potential stocks screener (59 results) and see which opportunities might outpace the rest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:OAKC

Oakworth Capital

Operates as a bank holding company for Oakworth Capital Bank that provides range of banking services in the United States.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives