- United States

- /

- Banks

- /

- OTCPK:DIMC

Dimeco (DIMC) Net Profit Margin Surge Reinforces Bullish Value Narrative

Reviewed by Simply Wall St

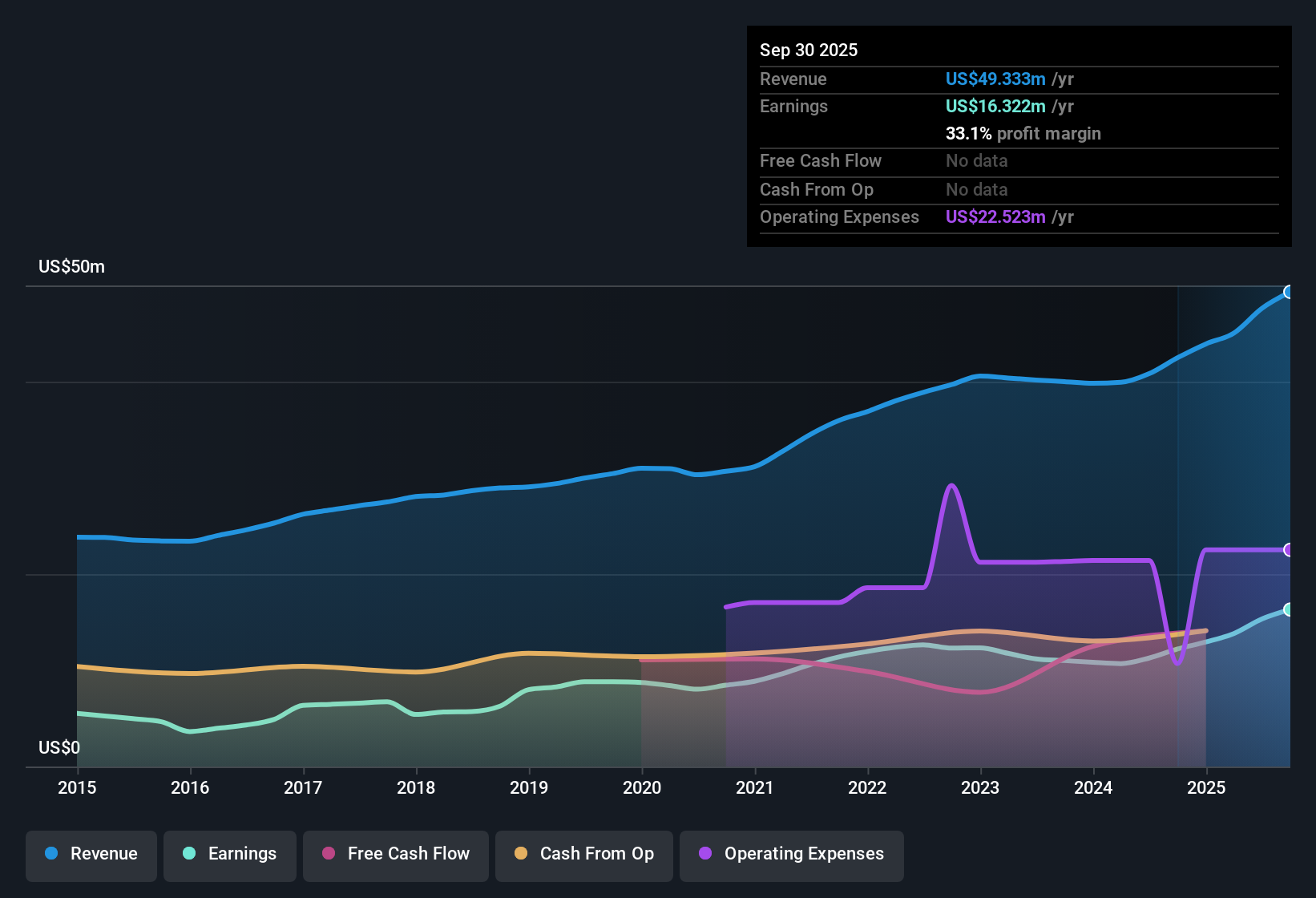

Dimeco (DIMC) posted a robust set of earnings, as its net profit margin climbed to 32.2% from last year’s 27.6%. Earnings growth accelerated to 36.1% year-over-year, far outpacing the 6.7% average annual growth of the past five years. Shares are trading at $41.25, which is well below the estimated fair value of $93.21. The company’s 6.8x Price-To-Earnings ratio is significantly lower than both peer and industry averages. With no major risks reported and a backdrop of attractive dividends and solid profit growth, investors may focus on Dimeco’s quality and valuation as key positives from this release.

See our full analysis for Dimeco.Up next, we’ll see how these headline numbers compare to the major narratives tracked by Simply Wall St. This will highlight where consensus might be shifting or being put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Rises Alongside Earnings Acceleration

- Dimeco’s net profit margin increased to 32.2% this year, up from 27.6% last year. This represents a significant boost in the company’s earnings efficiency beyond its typical 6.7% five-year growth pace.

- Bulls highlight that the sharp margin expansion comes on top of a 36.1% year-over-year acceleration in profits. This is a notable surge compared to the long-term trend.

- Bulls argue that pairing improved margins with higher profits strongly supports the view that Dimeco has established a stronger earnings foundation than its banking peers.

- What is surprising is that such margin gains occurred without any major new risks flagged in this period, directly addressing previous concerns about sustainability.

P/E Ratio Signals Deep Value vs Peers

- Dimeco’s Price-To-Earnings ratio is just 6.8x, well below both its peer group average of 9.4x and the US Banks industry average of 11.2x. This highlights a steep valuation discount despite robust profit gains.

- The prevailing market view draws attention to this wide P/E gap, suggesting that investors have yet to fully price in the improved profitability and may be overly cautious.

- This low multiple, paired with a rising profit margin, strongly supports the idea that Dimeco could offer compelling value for those seeking undervalued financial stocks.

- However, the current share price of $41.25, set against a DCF fair value of $93.21, raises questions about whether the disconnect will close given the lack of risk events in recent disclosures.

Dividends and Profit Quality Steady the Case

- Alongside growth and valuation, the period’s filing reiterates Dimeco’s reputation for high quality earnings with recognition for attractive dividend payouts in the sector.

- According to the prevailing market view, Dimeco’s steady five-year profit growth rate of 6.7% per year continues to anchor the stock’s defensive appeal.

- The consistency of both dividends and profit growth speaks to the company’s resilience, which helps explain why risk disclosures remain minimal even as margins and earnings surge.

- For investors favoring durability and stability, these trends strongly differentiate Dimeco among smaller US banks.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Dimeco's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Dimeco’s attractive valuation and profit growth, the persistent gap between its share price and intrinsic value signals caution, suggesting that the market remains unconvinced.

If you want to uncover financial stocks that may be more readily recognized for their value, check out these 872 undervalued stocks based on cash flows for opportunities where upside could be realized sooner.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:DIMC

Dimeco

Operates as the bank holding company for The Dime Bank that provides banking products and services to individuals and businesses in Pennsylvania.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion