- United States

- /

- Banks

- /

- OTCPK:CBCY

Assessing Central Bancompany (CBCY) Valuation After Strong Earnings and Rising Investor Optimism

Reviewed by Simply Wall St

Central Bancompany (CBCY) has just released its latest earnings, reporting stronger net interest income and net income for the nine months ending September 30, 2025, compared to the same period last year. Investors are taking note of this growth.

See our latest analysis for Central Bancompany.

Central Bancompany’s upbeat financials appear to be fueling fresh momentum in its share price. The stock climbed 8% over the past 30 days and has delivered a robust 59% share price return so far this year. Looking longer term, investors who held on for five years have enjoyed an impressive 106% total shareholder return, emphasizing consistent performance and rising optimism around the bank’s growth prospects.

If you’re watching how financial stocks are reacting to strong earnings trends, it might be time to broaden your search and discover fast growing stocks with high insider ownership

But with shares already up 59% this year and outpacing the broader market, is Central Bancompany’s rally just getting started or are expectations for future growth already fully reflected in today’s price? Could this be a buying opportunity, or is the upside already built in?

Price-to-Earnings of 13.6x: Is it justified?

Central Bancompany is currently trading at a price-to-earnings (P/E) ratio of 13.6x, compared to a peer average of 15.9x. At the last close of $21.25, this suggests investors are paying less for each dollar of earnings than for similar companies.

The price-to-earnings ratio is a well-known tool for gauging whether a company's stock is fairly priced based on its historical and expected profits. For banks, it often reflects relative market positioning, profitability, and future growth expectations. A lower P/E than the peer group can indicate undervaluation, stable fundamentals, or market skepticism about growth.

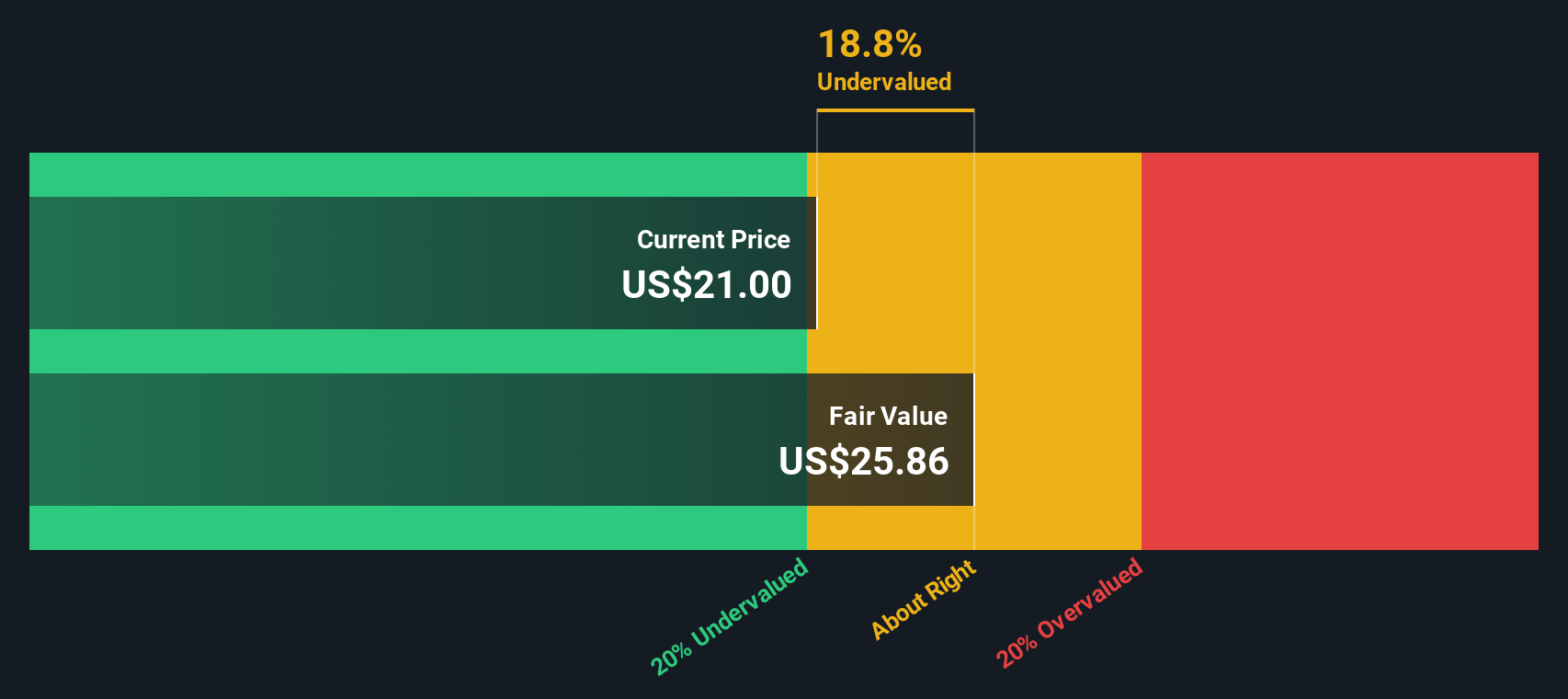

In Central Bancompany’s case, not only does the stock trade below its peer average, but it is also valued at 20% below the SWS DCF model’s fair value estimate. This supports a view that the market may be discounting the company’s solid track record of earnings growth and quality margins more than necessary.

However, while the P/E looks attractive relative to peers, it is important to note that the figure is higher than the broader US banks industry average, which sits at 11x. This contrast shows a nuanced market view. The company earns a valuation premium among some peers but not across the entire sector.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 13.6x (UNDERVALUED)

However, rising competition among regional banks and uncertainty around future interest rates could quickly reshape the outlook for Central Bancompany’s shares.

Find out about the key risks to this Central Bancompany narrative.

Another Angle: What About Discounted Cash Flow?

While the price-to-earnings ratio suggests Central Bancompany might be undervalued compared to its peers, our SWS DCF model paints a similar picture. The share price is nearly 20% below its estimated fair value of $26.56. Does this mean the market is missing something here, or is there more risk than meets the eye?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Central Bancompany for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 836 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Central Bancompany Narrative

If you have your own perspective or want to dig deeper into the numbers, you can build your own narrative in just a few minutes, Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Central Bancompany.

Looking for more investment ideas?

The best opportunities rarely wait around. Right now, successful investors are searching for hidden value, industry breakthroughs, and market-beating returns with these unique screens on Simply Wall Street.

- Harvest stable, above-average income potential from these 20 dividend stocks with yields > 3%, which boasts yields greater than 3% and stands out in any portfolio.

- Spot high-growth trends before they hit the mainstream with these 26 AI penny stocks, transforming industries through innovative artificial intelligence applications.

- Capture early-mover advantages as digital assets gain traction by finding these 81 cryptocurrency and blockchain stocks, which powers the future of finance and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:CBCY

Central Bancompany

Operates as the bank holding company for The Central Trust Bank that provides consumer, commercial and wealth management products and services.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives