- United States

- /

- Banks

- /

- NYSEAM:TMP

Does Tompkins Financial’s (TMP) Dividend Hike Reveal Management’s Strategy for Long-Term Shareholder Value?

Reviewed by Sasha Jovanovic

- Director Rahilly Ita M of Tompkins Financial Corporation recently purchased 1,462.762 shares of common stock for US$99,999, and the company approved a 4.6% increase in its quarterly dividend to US$0.65 per share, with the next payout scheduled for November 14, 2025.

- These combined actions signal management's confidence in the company's outlook and a focus on delivering value directly to shareholders.

- We'll explore how the dividend increase strengthens Tompkins Financial's investment narrative and its approach to rewarding shareholders.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Tompkins Financial's Investment Narrative?

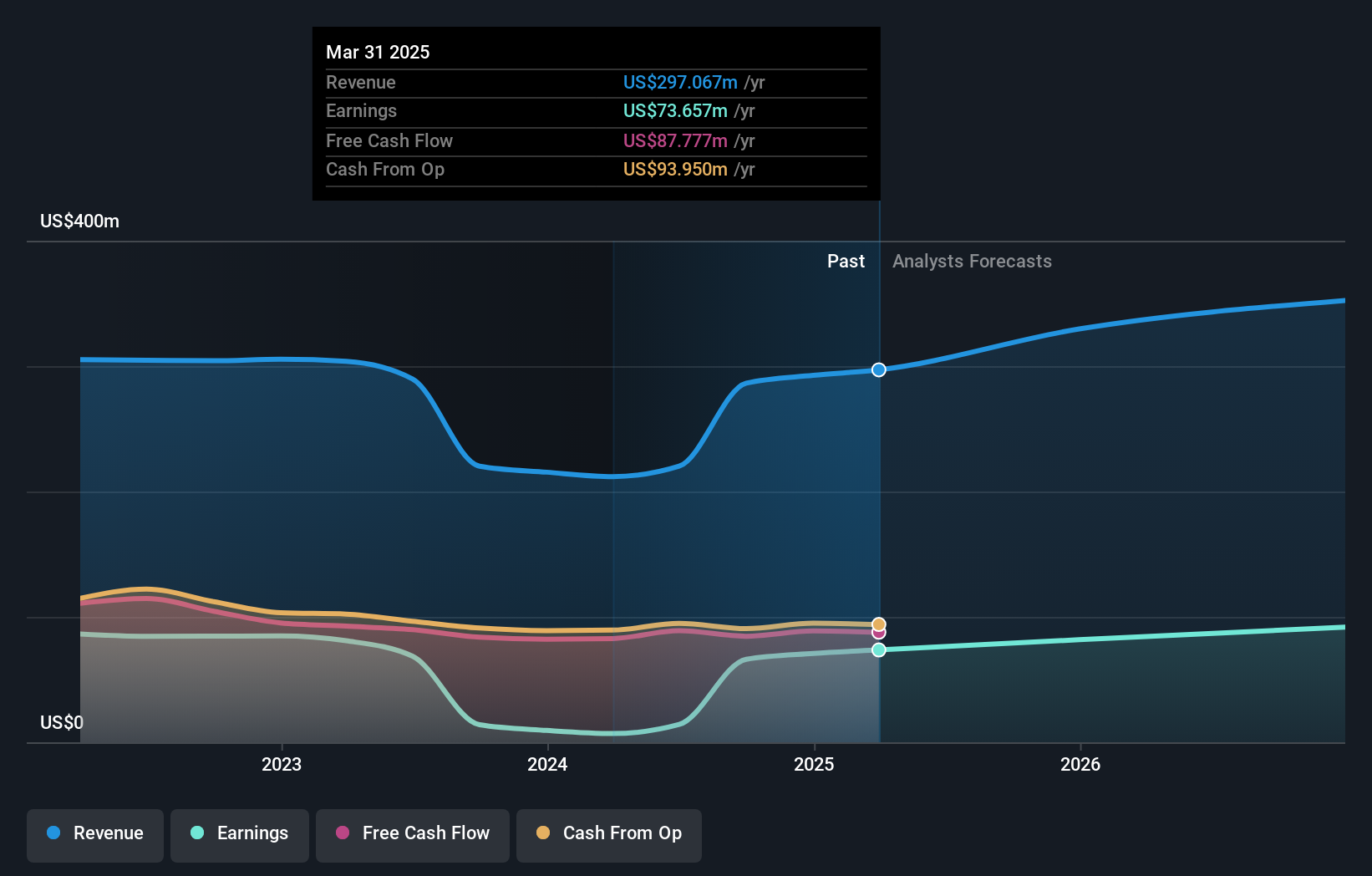

For investors considering Tompkins Financial, the case rests on believing that steady fundamentals and management’s commitment to shareholder value can counterbalance slower anticipated growth ahead. The recent insider share purchase and the 4.6% dividend raise both point to management’s confidence, which could help support investor sentiment in the short term. However, with analyst forecasts calling for a gradual decline in earnings over the next few years and revenue growth expected to trail the broader market, these supportive signals are unlikely to alter the core catalysts or the principal risks. The buyback program, while unused, exists as a latent tool, but board turnover and limited growth visibility remain key factors to watch. Recent positive price moves suggest some optimism, yet continued underperformance versus peers is an important caution.

But turning optimism into sustainable returns could face headwinds from leadership changes and slowing profit forecasts. Tompkins Financial's shares have been on the rise but are still potentially undervalued by 21%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on Tompkins Financial - why the stock might be worth as much as 27% more than the current price!

Build Your Own Tompkins Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tompkins Financial research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tompkins Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tompkins Financial's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tompkins Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:TMP

Tompkins Financial

A financial holding company, provides commercial and consumer banking, leasing, trust and investment management, financial planning and wealth management, and insurance services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success