- United States

- /

- Banks

- /

- NYSEAM:PRK

Park National (PRK) Margin Expansion Reinforces Profitable, Defensive Narrative

Reviewed by Simply Wall St

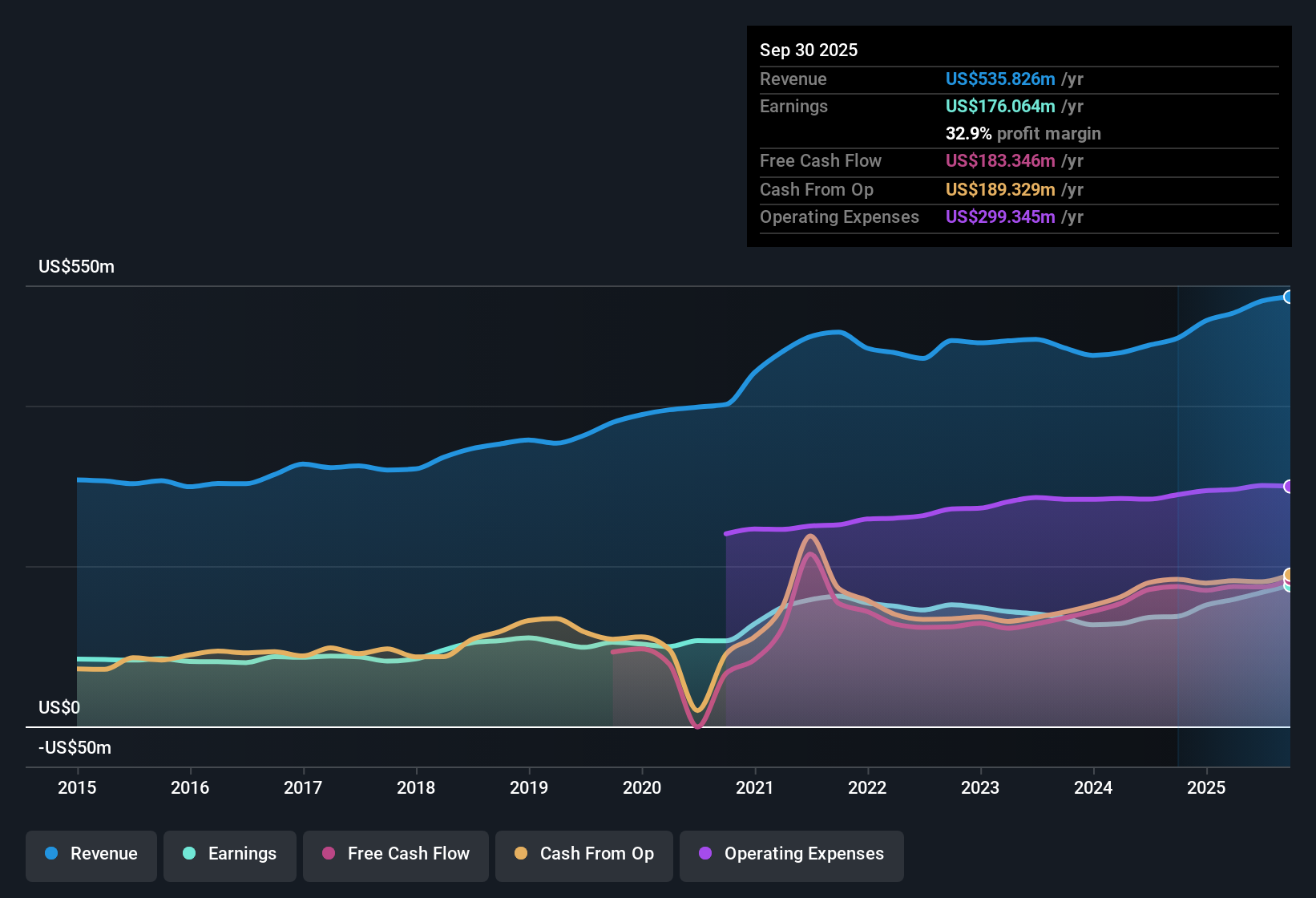

Park National (PRK) posted robust earnings momentum, with profit rising by 28.2% in the most recent period. This marks a significant jump over the company’s steady 2.3% annual earnings growth rate over the past five years. Net profit margins expanded to 32.9% from last year’s 28.3%, giving investors a tangible boost in efficiency and profitability. With forecasts pointing to 5.6% annual earnings growth and a revenue growth outlook of 10.5% per year, Park National’s results position it as a bank with improving earnings quality and competitive margins, even as the future pace of growth is expected to trail the wider US market.

See our full analysis for Park National.Next, we will see how these results line up with the core narratives circulating among investors and analysts, where consensus holds, and where this latest earnings report pushes back against expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Outpace Industry Peers

- Net profit margins reached 32.9%, rising from 28.3% last year. Most US banks hovered closer to industry averages near 28%, highlighting Park National’s standout efficiency gains.

- Margin expansion here strongly supports the view that Park National’s disciplined approach is delivering real-world benefits for profitability, even as sector peers face tougher cost and revenue trade-offs.

- Efficiency gains in rising margins exceed those seen at most similarly sized banks. This demonstrates management's ability to drive performance beyond simply following sector trends.

- With profit outpacing previous averages, Park National's margin story presents a tangible advantage for those focused on stable returns, especially at a time when regional banks are under scrutiny.

Growth Trajectory Lags US Market

- Earnings are forecast to grow 5.6% per year, trailing the wider US market’s expected pace. This could influence longer-term investor enthusiasm even after this year’s acceleration.

- Prevailing market analysis notes that while Park National’s growth is reliable, investors seeking outperformance might hesitate since future expansion is expected to be measured rather than breakaway.

- With annual revenue forecast at 10.5% growth, Park National is in line with the broad US market but does not outpace it. Its story is more about defense and consistency than rapid expansion.

- Most observers view the bank as a solid, conservative operator rather than an aggressive growth play, setting clear market expectations for those considering its shares for the long term.

Valuation Below DCF Fair Value, P/E Above Peers

- Park National’s stock trades at $151.73, below its DCF fair value estimate of $232.03. Its 13.9x P/E ratio is higher than the US Banks average (11x) and peer average (12.2x), suggesting investors pay a quality premium.

- For value-minded investors, it is notable that despite trading below DCF fair value, the share price still commands a higher multiple relative to peers, pointing to confidence in the bank’s earnings quality and defensive stance.

- High-quality profit and sustainable dividends help justify the premium compared to lower-rated banks, even if this means less upside versus faster-growing financial names.

- For those seeking a margin of safety, the valuation gap to intrinsic value may outweigh concerns about the premium P/E ratio, especially in an industry where stability is valued.

See our latest analysis for Park National.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Park National's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Park National’s growth outlook is reliable, it lags behind higher-growth peers and may not satisfy investors seeking market-beating expansion.

If you want to keep your portfolio on a faster growth track, see how companies with stronger three-year earnings projections stack up using our high growth potential stocks screener (50 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:PRK

Park National

Operates as the bank holding company for Park National Bank that provides commercial banking and trust services in small and medium population areas in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives