- United States

- /

- Banks

- /

- NYSE:WFC

Why Wells Fargo (WFC) Is Up 7.3% After Strong Q3 Earnings and Post-Asset Cap Expansion

Reviewed by Sasha Jovanovic

- Wells Fargo recently reported third quarter results that exceeded analyst expectations, driven by higher net interest income, net income, and loan growth following the Federal Reserve’s removal of its asset cap earlier in the year.

- With management outlining ambitious profitability targets, a renewed capital return program, and a focus on digital banking and wealth management, the company’s outlook appears markedly improved compared to previous quarters.

- We'll examine how the combination of strong earnings and post-asset cap expansion is impacting Wells Fargo's medium-term investment outlook.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Wells Fargo Investment Narrative Recap

To own Wells Fargo stock today, investors need confidence in the bank’s renewed focus on profitability, capital returns, and digital transformation following the lifting of its asset cap. The recent class-action lawsuit alleging prime rate fixing introduces additional legal uncertainty, but unless new damaging details emerge, the company's immediate earnings outlook and growth catalysts remain largely unchanged. One recent announcement of interest is Wells Fargo’s leadership change, with CEO Charlie Scharf appointed Chairman of the Board. This governance shift arrives as the company faces scrutiny over legal and regulatory risks, making experienced leadership all the more relevant for its medium-term ambitions. In contrast, investors should be aware of the potential consequences if ongoing legal issues become a bigger threat to...

Read the full narrative on Wells Fargo (it's free!)

Wells Fargo's outlook anticipates $90.6 billion in revenue and $22.1 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 5.3% and a $2.6 billion increase in earnings from the current $19.5 billion.

Uncover how Wells Fargo's forecasts yield a $91.44 fair value, a 10% upside to its current price.

Exploring Other Perspectives

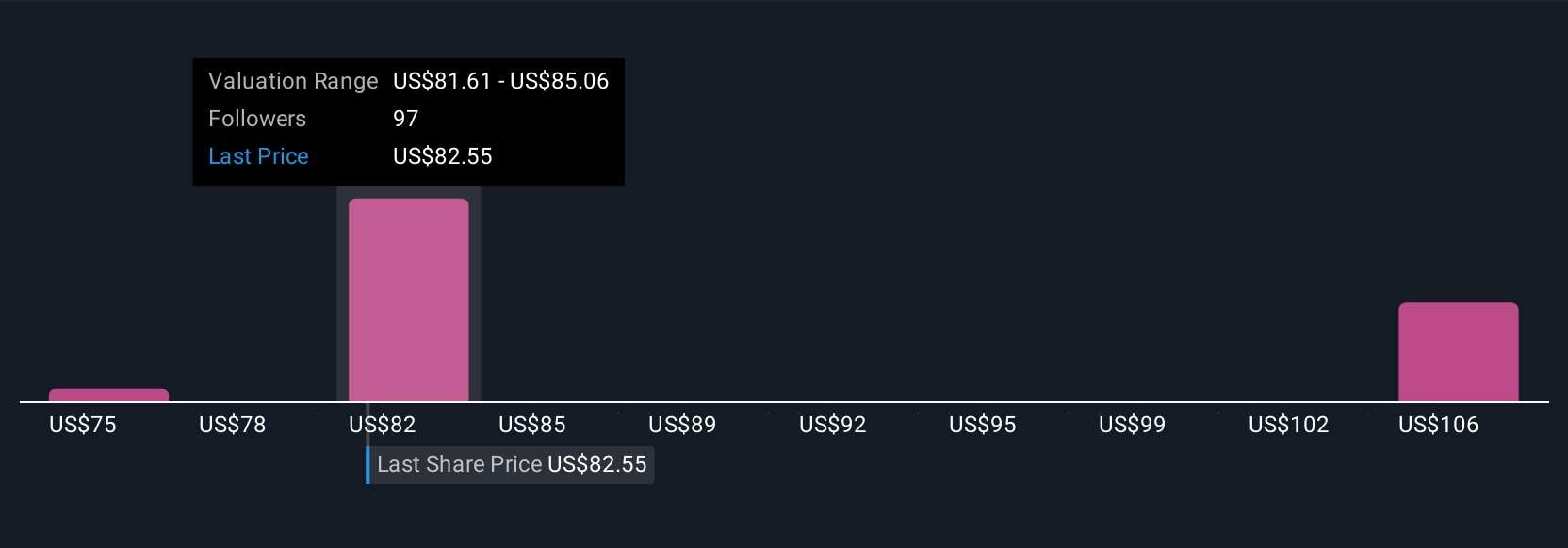

Five Simply Wall St Community fair value estimates for Wells Fargo range from US$74.70 to US$103.88 per share. As regulatory and legal risks come into focus, your outlook on these issues may meaningfully shape your own view on value.

Explore 5 other fair value estimates on Wells Fargo - why the stock might be worth 10% less than the current price!

Build Your Own Wells Fargo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wells Fargo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wells Fargo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wells Fargo's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives