- United States

- /

- Banks

- /

- NYSE:WFC

Wells Fargo (WFC) Valuation After Fed Lifts Asset Cap and Growth Prospects Improve

Reviewed by Simply Wall St

The big story around Wells Fargo (WFC) right now is the Federal Reserve finally lifting its $1.95 trillion asset cap, a shift that gives the bank fresh room to expand and rework its growth playbook.

See our latest analysis for Wells Fargo.

Investors seem to be warming to that new regulatory freedom, with the share price at $89.83 and a roughly 28% year to date share price return sitting alongside a powerful 5 year total shareholder return of about 247%. This suggests momentum has been building rather than fading.

If this kind of bank led rally has your attention, it might be a good moment to also explore aerospace and defense stocks as another way to spot resilient compounders in today’s market.

With the cap gone, earnings forecast to climb, and the stock still trading at a discount to peers, is Wells Fargo genuinely undervalued or has the market already priced in the next leg of growth?

Most Popular Narrative: 4.1% Undervalued

With Wells Fargo last closing at $89.83 against a narrative fair value of $93.71, the current setup leans toward modest upside driven by fundamental improvements.

Management reiterated a continued commitment to expense discipline and scalable technology investments, including early stage AI initiatives. These efforts are expected to offset investment for growth and enable structurally lower efficiency ratios, positively impacting net margins and long term earnings power.

Curious how steady, mid single digit growth, slight margin compression, and a richer future earnings multiple still point to upside? Discover the full valuation playbook behind this narrative.

Result: Fair Value of $93.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks around digital transformation and any renewed regulatory setbacks could quickly undermine margin gains and temper the current valuation upside.

Find out about the key risks to this Wells Fargo narrative.

Another Angle on Value

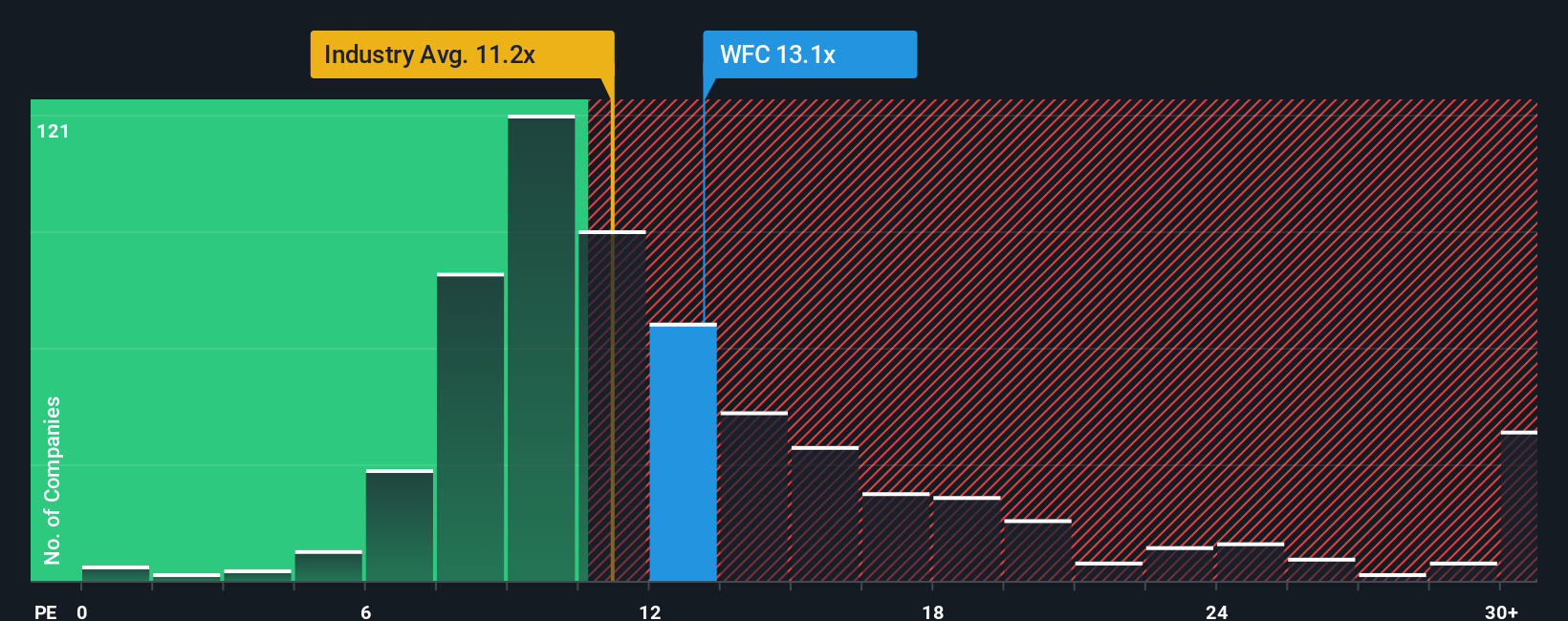

On earnings, Wells Fargo looks less straightforward. Its 14.1x price to earnings ratio sits above both the US Banks industry at 11.6x and peer average at 13.2x, yet below a fair ratio of 15.6x. That mix of premium and headroom raises a simple question: how much rerating is really left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wells Fargo Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Wells Fargo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one bank, you could miss stronger opportunities. Let Simply Wall Street’s powerful Screener uncover fresh, data backed stock ideas for you.

- Capitalize on mispriced businesses by reviewing these 906 undervalued stocks based on cash flows that show strong cash flow potential the market has yet to fully recognize.

- Ride the next wave of innovation by targeting these 26 AI penny stocks positioned at the heart of transformative artificial intelligence trends.

- Lock in reliable income streams by scanning these 15 dividend stocks with yields > 3% that combine solid yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026