- United States

- /

- Banks

- /

- NYSE:WFC

Wells Fargo (WFC): Exploring Valuation After Earnings Beat and Fed Asset Cap Removal

Reviewed by Simply Wall St

Wells Fargo (WFC) stock jumped after the company reported third-quarter earnings and revenues that came in ahead of expectations. The bank’s growth outlook shifted meaningfully after the Federal Reserve lifted its long-standing asset cap.

See our latest analysis for Wells Fargo.

Momentum has clearly shifted for Wells Fargo, with its share price up 22.6% year-to-date and the latest earnings beat fueling renewed optimism after years of regulatory constraints. Recent news, including several senior note offerings, a fresh leadership appointment, and the Fed’s decision to lift the asset cap, has investors focusing on the bank’s growth story. Over the past year, shareholders have enjoyed a robust 35.7% total return, and the three- and five-year total shareholder returns of 105% and 342% respectively show just how much sentiment has improved both short and long term.

If this rally in banking stocks has you rethinking your strategy, expand your search with fast growing stocks with high insider ownership.

With Wells Fargo surging past key barriers and analyst targets climbing, is the recent upside fully justified by fundamentals, or is there still value to be unlocked as the bank enters its post-cap era?

Most Popular Narrative: 5.9% Undervalued

Relative to the last close price of $86.02, the most widely followed narrative sees Wells Fargo with a fair value of $91.44, suggesting that its recent rally may still have some room to run. The market’s attention now turns to how forward-looking projections stack up against this target.

The removal of the asset cap and resolution of multiple regulatory orders unlocks Wells Fargo's ability to aggressively grow its balance sheet, including deposits, loans, and trading assets, after years of constraint. This could result in higher revenue and earnings growth over the coming quarters and years.

Want to find out what’s powering this higher fair value? The narrative spotlights rapid revenue growth, strong digital momentum, and a financial reset that could change the profit playbook. Get the inside track and see if these optimistic projections hold up under scrutiny.

Result: Fair Value of $91.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Wells Fargo still faces potential hurdles. These include competitive pressure from digital challengers and regulatory obligations that could slow cost reductions and margin expansion.

Find out about the key risks to this Wells Fargo narrative.

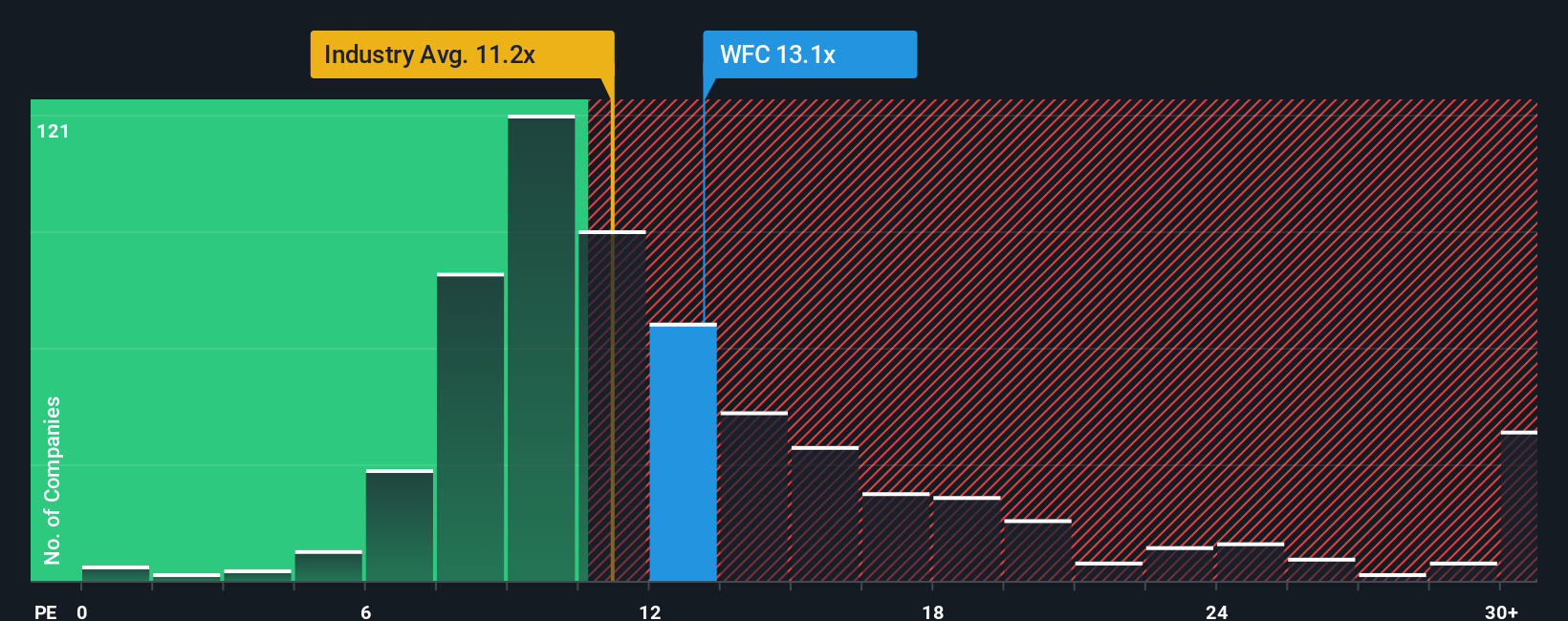

Another View: The Multiples Perspective

While the most followed fair value estimate sees Wells Fargo as undervalued, the market's standard price-to-earnings ratio paints a different picture. Currently, Wells Fargo trades at 13.6 times earnings, which is higher than the US Banks industry average of 11.3 and its peer average of 13.2. However, it remains below its fair ratio of 15.5, which is where the market could drift in the future. This gap signals both risk if expectations falter and opportunity if the company outperforms. Which side of the line will the market ultimately settle on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wells Fargo Narrative

If you see the story differently or want to dig into the numbers yourself, you can put together your own narrative in just a few minutes. Do it your way.

A great starting point for your Wells Fargo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Extend your edge by checking out stocks handpicked for growth, value, and innovation. Uncover potential you might otherwise overlook with these targeted approaches:

- Secure steady income streams as you pursue opportunities among these 17 dividend stocks with yields > 3%. These stocks offer impressive yields and solid fundamentals for long-term confidence.

- Ride the artificial intelligence wave by reviewing these 24 AI penny stocks. These options have game-changing potential in automation, machine learning, and industry disruption.

- Tap into hidden bargains in the market with these 875 undervalued stocks based on cash flows, which spotlights companies trading below their intrinsic value for those seeking strong upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives