- United States

- /

- Banks

- /

- NYSE:WFC

Wells Fargo (NYSE:WFC) Enhances Growth with Expedia Partnership and Dividend Increase

Reviewed by Simply Wall St

Wells Fargo (NYSE:WFC) has announced a new fixed-income offering, featuring 5% and 5.15% senior unsecured notes due in 2031 and 2034, respectively, as part of its strategy to bolster financial stability amidst economic uncertainties. The bank continues to demonstrate strong earnings growth and strategic investments in diversified revenue streams. The following discussion will explore Wells Fargo's innovative growth strategies, internal limitations, future prospects, and external threats impacting its market position.

Get an in-depth perspective on Wells Fargo's performance by reading our analysis here.

Innovative Factors Supporting Wells Fargo

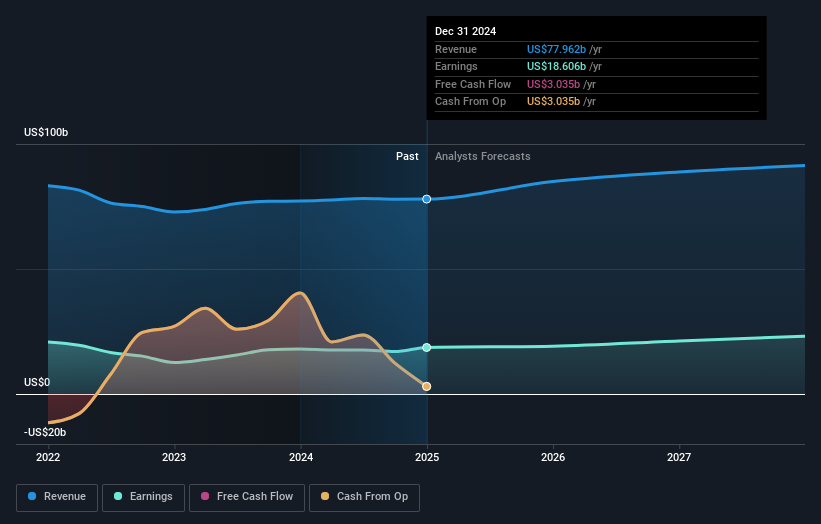

Wells Fargo has demonstrated a strong earnings growth of 10.2% annually over the past five years, highlighting its financial health. The company's strategic investments have diversified its revenue streams, with a notable 16% increase in fee-based income, as emphasized by CEO Charles Scharf. This shift reduces reliance on interest income and strengthens its earnings quality. Additionally, the bank's commitment to shareholder returns is evident through significant stock repurchases and a 14% increase in dividends, reinforcing its solid capital management. With a trading value 27.9% below its estimated fair value, Wells Fargo presents an attractive proposition for investors seeking undervalued opportunities.

Internal Limitations Hindering Wells Fargo's Growth

Wells Fargo faces challenges such as a low return on equity at 9.8%, which is below industry expectations. The bank has also experienced a 7.3% decline in net profit margins, reflecting difficulties in maintaining profitability. CFO Michael Santomassimo noted a $233 million decrease in net interest income, highlighting pressures from interest rate fluctuations and deposit costs. Furthermore, a weak demand for commercial loans underscores the impact of economic uncertainties on growth prospects. These factors, coupled with an unstable dividend track record, pose significant hurdles for the bank.

Future Prospects for Wells Fargo in the Market

Wells Fargo's expansion in the credit card sector, including new co-branded cards with Expedia, offers promising growth avenues. Such initiatives enhance customer engagement through unique rewards programs. Strategic alliances, such as the partnership with Volkswagen Financial Services, position Wells Fargo as a preferred financing provider, potentially boosting market share. Investments in technology and leadership, particularly with Bridget Engle's appointment, are expected to enhance operational efficiency and customer experience, aligning with future growth strategies.

External Factors Threatening Wells Fargo

Regulatory scrutiny remains a significant threat, with ongoing compliance challenges potentially increasing operational costs. Economic uncertainties, as highlighted by Charles Scharf, CEO, affect loan demand and financial performance, with commercial real estate market risks posing additional threats to asset quality. The recent fixed-income offerings, including senior unsecured notes, reflect Wells Fargo's efforts to strengthen its financial position amidst these challenges. However, insider selling over the past three months raises concerns about investor confidence and the bank's long-term stability.

Conclusion

Wells Fargo's strategic diversification into fee-based income and its commitment to shareholder returns through stock repurchases and dividend increases underscore its potential for sustained financial health, despite the challenges of low return on equity and declining profit margins. While the bank's trading price is considered high relative to the broader US banking industry, it remains a compelling investment given its trading value below estimated fair value and relative attractiveness compared to peers. Future growth prospects are bolstered by initiatives in the credit card sector and strategic partnerships, yet regulatory scrutiny and economic uncertainties pose ongoing risks. Ultimately, Wells Fargo's ability to navigate these internal and external challenges will be crucial in determining its long-term market performance and investor confidence.

Seize The Opportunity

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

```Valuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet, good value and pays a dividend.