- United States

- /

- Auto

- /

- NYSE:WGO

Winnebago Industries (NYSE:WGO) Sees Growth with New Models Despite High P/E and Profit Challenges

Reviewed by Simply Wall St

Winnebago Industries (NYSE:WGO) is experiencing financial growth, with an impressive annual earnings projection of 33.9%, significantly surpassing the US market average. This growth is driven by strategic product innovations, such as the Lineage Series M Grand Design, and a strong market presence in the U.S. aluminum pontoon market. However, challenges like a high Price-To-Earnings Ratio and increased operating expenses, including a substantial impairment charge, pose risks to profitability. This report will explore Winnebago's financial health, growth strategies, competitive pressures, and market risks, providing a comprehensive overview of the company's current position and future prospects.

Unlock comprehensive insights into our analysis of Winnebago Industries stock here.

Key Assets Propelling Winnebago Industries Forward

Winnebago Industries showcases strong financial health, with earnings projected to grow at an impressive 33.9% annually, outpacing the US market average of 15.4%. This growth potential is bolstered by the company's strategic product innovation, as highlighted by CEO Michael Happe's remarks on the positive reception of the Lineage Series M Grand Design in the Motorhome RV segment. Furthermore, Winnebago's financial stability is evident in its satisfactory net debt to equity ratio of 28.7%, which supports its capacity to invest in growth initiatives while maintaining shareholder value through dividends and share repurchases. The company's ability to gain market share in the U.S. aluminum pontoon market further underscores its competitive strength and market adaptability.

Internal Limitations Hindering Winnebago Industries's Growth

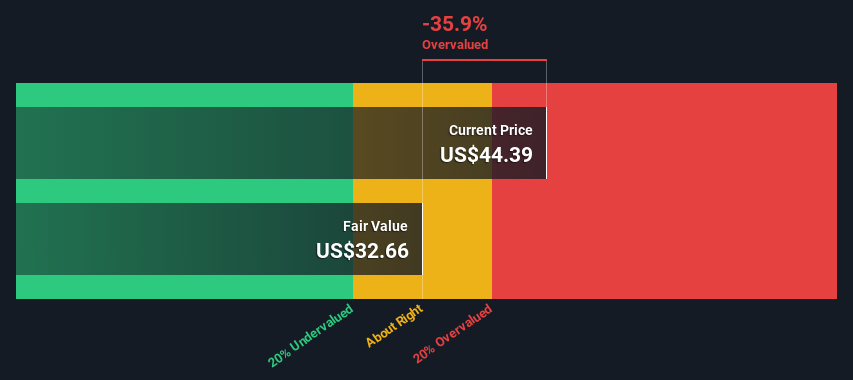

Winnebago faces challenges such as a high Price-To-Earnings Ratio of 125.9x, which significantly exceeds industry averages, indicating potential overvaluation. CFO Bryan Hughes noted increased operating expenses, including a $30.3 million impairment charge linked to the Chris-Craft reporting unit, which pressures profitability. The company's net profit margin has declined to 0.4% from 6.1% last year, reflecting operational inefficiencies and increased warranty expenses. Additionally, the high dividend payout ratio of 278.5% suggests that current earnings do not adequately cover dividend payments, posing a risk to financial sustainability.

Potential Strategies for Leveraging Growth and Competitive Advantage

Winnebago's introduction of nearly 150 new models and floor plans demonstrates its commitment to expanding its product portfolio, presenting significant growth opportunities. As Michael Happe anticipates gradual market improvement over the next 12 to 15 months, the company is well-positioned to capitalize on increased sales and market share. Strategic leadership changes in the Motorhome and Towables segments aim to address operational challenges and enhance future growth prospects. These initiatives, combined with the company's strong earnings growth forecast, could attract increased investor interest and potentially boost stock prices.

Competitive Pressures and Market Risks Facing Winnebago Industries

The current retail environment poses a substantial threat to Winnebago's sales and profitability, as highlighted by Michael Happe. Economic uncertainty and aggressive competition further challenge the company's market position, potentially impacting pricing and margins. Additionally, significant insider selling over the past three months may indicate a lack of confidence from company executives, which could affect investor perceptions. The forecasted revenue growth below the US market average suggests potential limitations in overall growth potential, necessitating strategic adjustments to maintain competitive advantage.

Conclusion

Winnebago Industries is poised for significant growth with a projected annual earnings increase of 33.9%, driven by strategic product innovations and a strong market presence in the U.S. aluminum pontoon sector. However, the company's high Price-To-Earnings Ratio of 125.9x, far exceeding industry norms, suggests that investors may be pricing in these growth prospects too optimistically. This, coupled with operational challenges like increased expenses and a declining profit margin, raises concerns about sustainable profitability. While the introduction of new models and leadership changes could enhance future market share and investor interest, the company must navigate economic uncertainties and competitive pressures to align its valuation with its financial performance and growth potential.

Make It Happen

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winnebago Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WGO

Winnebago Industries

Manufactures and sells recreation vehicles and marine products primarily for use in leisure travel and outdoor recreation activities.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives