- United States

- /

- Banks

- /

- NYSE:WFC

Should Wells Fargo's (WFC) New Debt Issuance and Wealth Push Reflect a Shift in Funding Priorities?

Reviewed by Simply Wall St

- Earlier this week, Aequum Capital Financial, LLC announced it had closed a new US$250 million debt facility led by Wells Fargo & Company, and Wells Fargo also completed multiple fixed-income offerings totaling US$4 billion in senior unsecured notes with variable rates and maturities extending to 2036.

- These capital market activities, combined with Wells Fargo's enhanced partnership to offer alternative investments through InvestCloud, highlight an ongoing evolution in both the company's funding strategy and its approach to wealth management innovation.

- We'll examine how Wells Fargo's robust debt issuance signals proactive liquidity management and its implications for the company's investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Wells Fargo Investment Narrative Recap

To invest in Wells Fargo, you need to believe in its ability to grow earnings and revenue by managing loan demand, digital transformation, and regulatory costs, while delivering efficiency gains and balance sheet expansion unlocked by the asset cap removal. The recent fixed-income offerings and the Aequum Capital debt facility reinforce confidence in Wells Fargo’s liquidity management, but do not have a material impact on the near-term catalyst of loan growth or the primary risk of net interest margin pressure due to competitive and rate headwinds.

Of the recent announcements, the partnership with InvestCloud to offer alternative investments stands out. By allowing clients to consolidate both traditional and alternative assets, Wells Fargo is taking another step toward more diversified, fee-based income streams, which could help balance the risk of compressed margins and strengthen its wealth management franchise in today's evolving financial sector.

In contrast, one key factor investors should watch closely is how competition from non-banks and narrow lending spreads could squeeze Wells Fargo’s core profitability if...

Read the full narrative on Wells Fargo (it's free!)

Wells Fargo's narrative projects $90.6 billion in revenue and $22.1 billion in earnings by 2028. This requires 5.3% yearly revenue growth and a $2.6 billion earnings increase from the current $19.5 billion.

Uncover how Wells Fargo's forecasts yield a $87.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

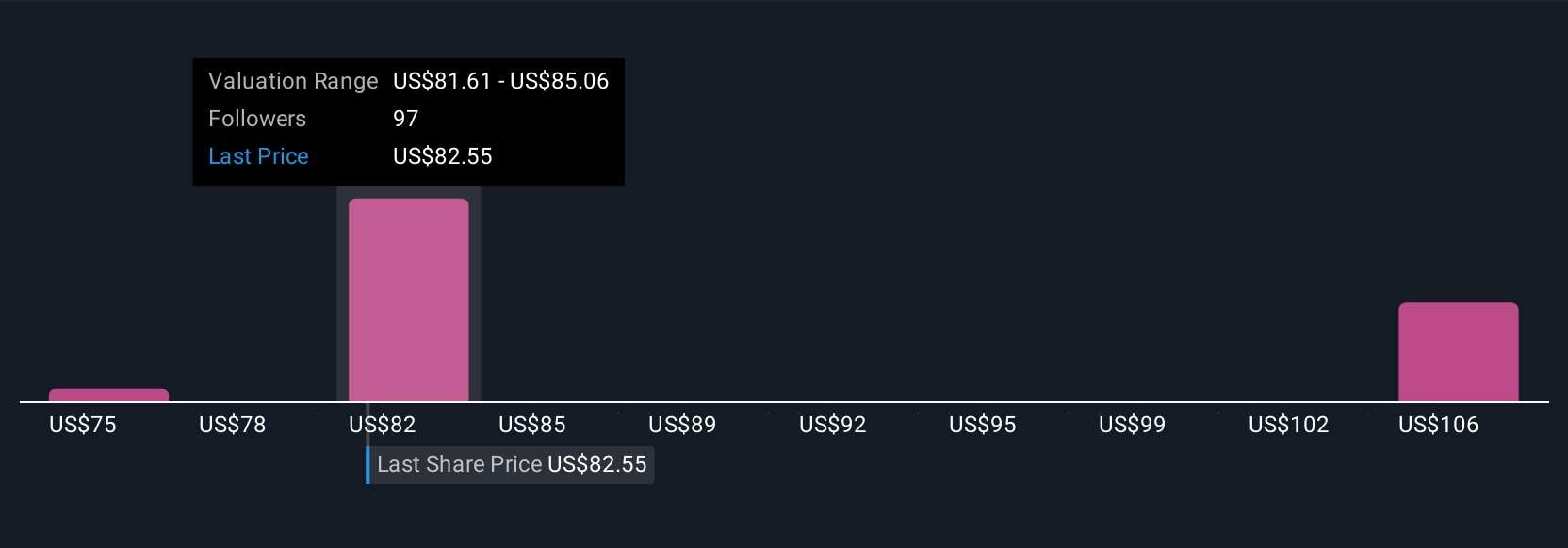

Five recent fair value estimates from the Simply Wall St Community for Wells Fargo range from US$74.70 to US$98.23 per share. As expectations for net interest margin pressure grow, these varied opinions remind you that market participants often see different potential in the same business, so it’s smart to review multiple viewpoints.

Explore 5 other fair value estimates on Wells Fargo - why the stock might be worth as much as 22% more than the current price!

Build Your Own Wells Fargo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wells Fargo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wells Fargo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wells Fargo's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 29 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives