- United States

- /

- Banks

- /

- NYSE:WFC

Is Wells Fargo’s Credit Card Expansion a Sign of Further Stock Gains in 2025?

Reviewed by Bailey Pemberton

If you have been watching Wells Fargo lately, you are not alone. With the stock closing at $83.28 and rallying by 7.3% in the last week, many investors are wondering if now is the right time to buy, hold, or consider taking some gains off the table. The one-month gain of 1.0% may look modest, but zoom out and you will see that shares have climbed 18.6% since the start of the year and soared a remarkable 32.3% over the past twelve months. For anyone with a longer-term perspective, that three-year increase of 101.2% and a five-year gain of 301.1% are hard to ignore.

Much of the recent buzz centers on Wells Fargo's increased focus on credit cards and its connection to major financial events, such as the competition among banks for massive IPOs like Fannie Mae and Freddie Mac. These strategic moves have injected a sense of growth potential, even as headline risk around regulation or data access fees hovers in the background. With every major bank vying for a piece of high-profile deals and looking for new revenue streams, it is no surprise that investors' perceptions of risk and opportunity are shifting.

Of course, a hot stock always sparks a debate over its true value. Wells Fargo scores a 2 out of 6 on our value checklist, meaning it looks undervalued on just two of the six core checks we use. But before you make any decisions, let's dive deeper into the value approaches analysts use and see how Wells stacks up. At the end of this article, I will share a more insightful way to cut through the noise and judge the stock's valuation for yourself.

Wells Fargo scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Wells Fargo Excess Returns Analysis

The Excess Returns valuation model measures how effectively a company generates returns above its cost of capital from each dollar of equity. In Wells Fargo’s case, this approach is especially useful for banks, where the focus is on how much profit is generated relative to what shareholders have invested over time.

For Wells Fargo, the current Book Value sits at $52.25 per share, with a projected Stable Book Value of $55.40 per share based on estimates from 14 analysts. The Stable EPS is estimated at $7.04 per share, according to weighted future Return on Equity figures provided by 17 analysts. The Cost of Equity, which is essentially the minimum return necessary to compensate shareholders for their risk, comes in at $4.55 per share. This results in an Excess Return of $2.49 per share. The average Return on Equity (ROE) is a sturdy 12.71%.

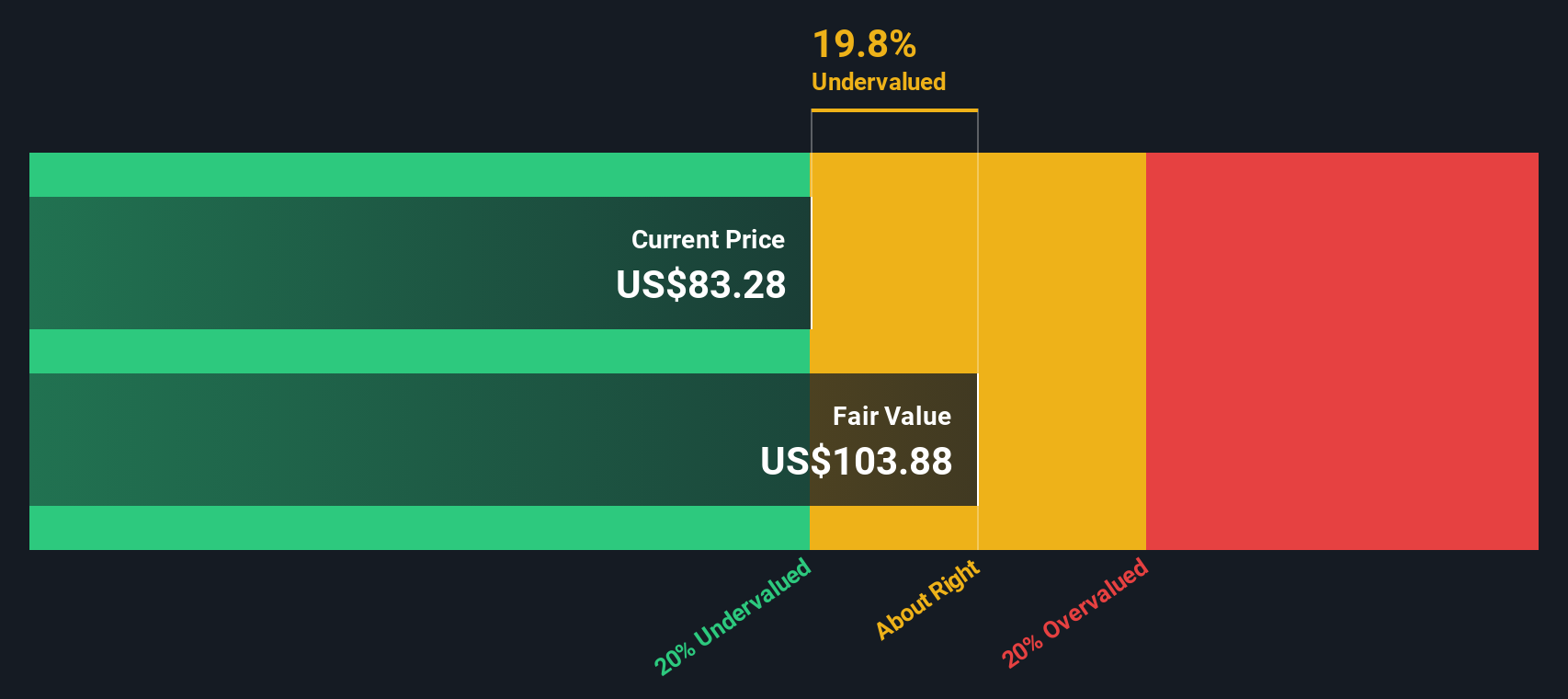

Using these factors, the Excess Returns model calculates an intrinsic value of $103.88 per share. Compared to the recent stock price of $83.28, this indicates Wells Fargo may be around 19.8% undervalued according to this methodology.

Result: UNDERVALUED

Our Excess Returns analysis suggests Wells Fargo is undervalued by 19.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Wells Fargo Price vs Earnings

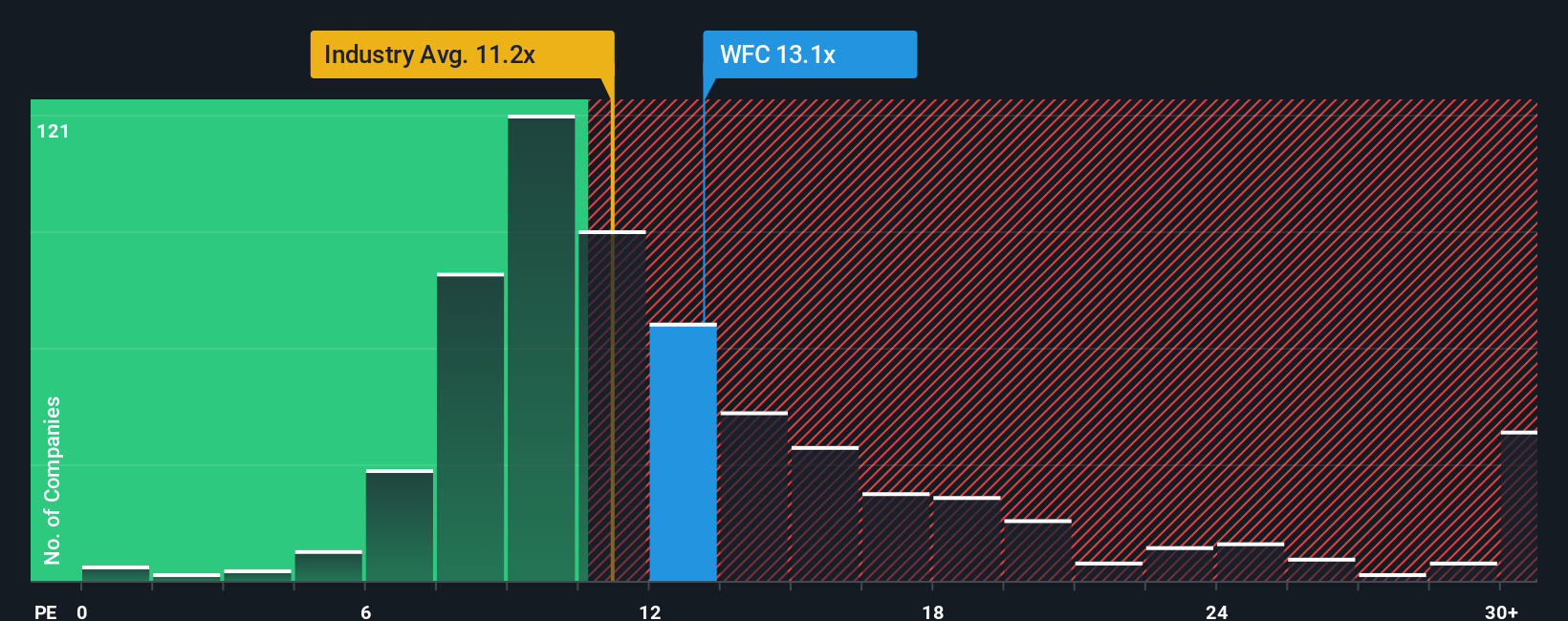

The Price-to-Earnings (PE) ratio is widely considered the go-to measure for valuing profitable companies like Wells Fargo, as it directly connects a company’s share price to its bottom-line profitability. It offers a quick glimpse at how much investors are willing to pay for each dollar of earnings, helping to spot bargains or identify overpriced stocks within the same industry.

However, what counts as a "fair" PE ratio is not set in stone. It is influenced by factors such as expected earnings growth, the risks the company faces, and even the wider industry conditions. A company expected to grow faster and with less risk might justifiably trade at a higher multiple.

Wells Fargo currently trades at a PE ratio of 13.13x. When you compare this to the banking industry average of 11.25x and its peer group, which averages 12.02x, Wells Fargo looks slightly more expensive than its closest competitors. However, Simply Wall St’s proprietary Fair Ratio for Wells Fargo stands at 15.36x. This figure is more refined because it weighs not just industry trends or peers but also factors in specific elements like Wells Fargo’s profit margin, market cap, growth prospects, and unique risks. As a result, the Fair Ratio gives a more tailored and reliable benchmark to measure true value.

Given that Wells Fargo’s current PE of 13.13x is meaningfully below its Fair Ratio of 15.36x, the numbers suggest that the stock may be undervalued based on its earnings potential and company-specific strengths.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Wells Fargo Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a feature designed to help investors look beyond the raw numbers and consider the full story behind a company.

A Narrative is an easy-to-use tool for giving your unique perspective on a stock’s future, linking your assumptions about Wells Fargo’s earnings, margins, and growth to a fair value estimate.

By crafting a Narrative, you connect a company’s real-world story, including what you believe about its opportunities and risks, all the way through to a financial forecast and what you think shares are truly worth.

This approach puts you in control and is available to anyone on Simply Wall St’s Community page, where millions of investors share, compare, and update their views as new news or earnings are released.

Narratives make it straightforward and dynamic. When major events or fresh financials come in, each Narrative is automatically updated, allowing you to clearly see if your investment case still stacks up or needs rethinking.

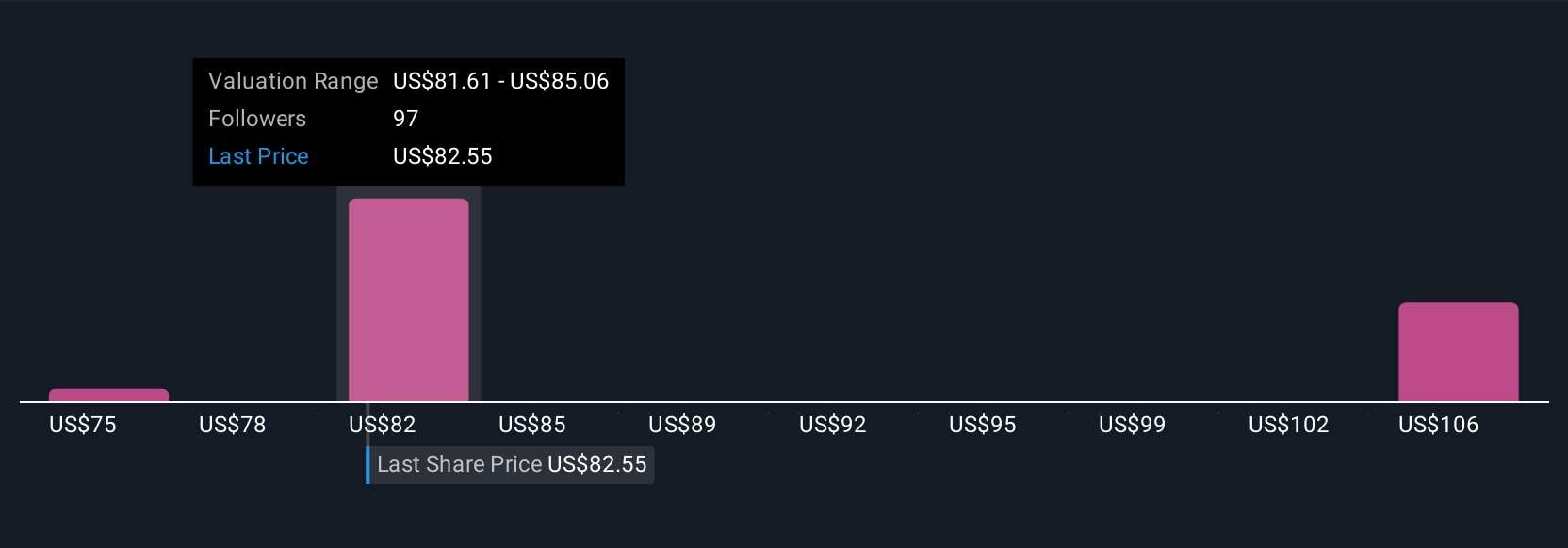

For Wells Fargo, you’ll find Narratives that span a wide range. Some investors see fair value as low as $74.70, while others place it much higher at $89.13. This means you can compare your view with the community and decide whether it is time to buy, hold, or sell based on your own conviction.

For Wells Fargo, we’ll make it really easy for you with previews of two leading Wells Fargo Narratives:

🐂 Wells Fargo Bull CaseFair Value: $89.13

Undervalued by 6.6%

Forecast Revenue Growth: 5.4%

- Regulatory restrictions have been lifted, which allows Wells Fargo to aggressively grow its balance sheet and expand in key segments such as deposits, lending, and wealth management. This supports robust revenue and earnings growth.

- Digital initiatives and disciplined expense management are driving scalable growth, higher margins, and improved customer satisfaction. These factors strengthen the bank’s long-term competitiveness.

- Analysts project annual revenue growth of 5.4%, with consensus expecting fair value to be slightly higher than the current share price. However, competition, regulatory pressures, and execution risks remain important watchpoints.

Fair Value: $74.70

Overvalued by 11.5%

Forecast Revenue Growth: 3.0%

- Wells Fargo’s forward P/E ratio is lower than the market average, but projected revenue and earnings growth are only moderate over the next year or two.

- While the bank enjoys a wide economic moat due to its large customer base and low funding costs, uncertainty in economic conditions, especially in housing and manufacturing, may limit near-term upside.

- Some analysts see the current stock price running ahead of fair value, despite long-term fundamentals. They point to only a modest revenue growth outlook and the need for further regulatory clarity before meaningful revaluation.

Do you think there's more to the story for Wells Fargo? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives