- United States

- /

- Diversified Financial

- /

- NYSE:WD

Here's Why Shareholders May Want To Be Cautious With Increasing Walker & Dunlop, Inc.'s (NYSE:WD) CEO Pay Packet

CEO Willy Walker has done a decent job of delivering relatively good performance at Walker & Dunlop, Inc. (NYSE:WD) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 06 May 2021. However, some shareholders will still be cautious of paying the CEO excessively.

See our latest analysis for Walker & Dunlop

How Does Total Compensation For Willy Walker Compare With Other Companies In The Industry?

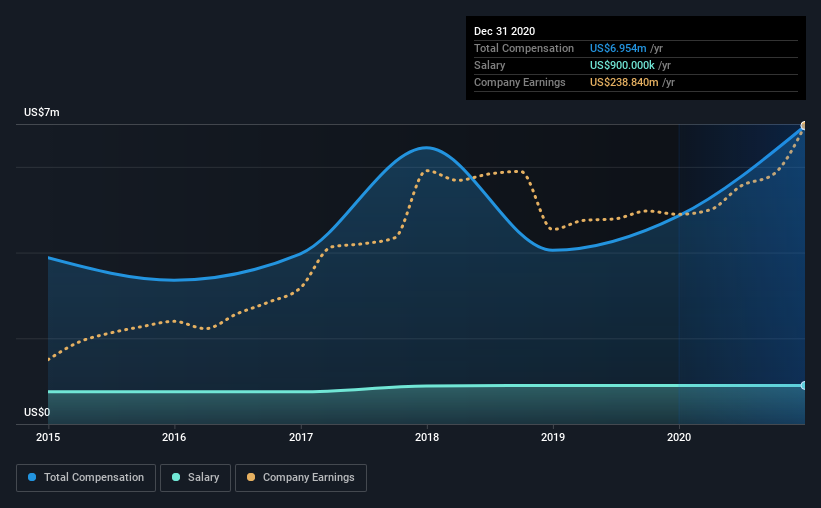

According to our data, Walker & Dunlop, Inc. has a market capitalization of US$3.4b, and paid its CEO total annual compensation worth US$7.0m over the year to December 2020. That's a notable increase of 43% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$900k.

On comparing similar companies from the same industry with market caps ranging from US$2.0b to US$6.4b, we found that the median CEO total compensation was US$5.2m. This suggests that Willy Walker is paid more than the median for the industry. Moreover, Willy Walker also holds US$181m worth of Walker & Dunlop stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$900k | US$900k | 13% |

| Other | US$6.1m | US$4.0m | 87% |

| Total Compensation | US$7.0m | US$4.9m | 100% |

Speaking on an industry level, salary and non-salary portions, both make up 50% each of the total remuneration. Walker & Dunlop pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Walker & Dunlop, Inc.'s Growth Numbers

Walker & Dunlop, Inc.'s earnings per share (EPS) grew 5.3% per year over the last three years. Its revenue is up 30% over the last year.

It's great to see that revenue growth is strong. And in that context, the modest EPS improvement certainly isn't shabby. We wouldn't say this is necessarily top notch growth, but it is certainly promising. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Walker & Dunlop, Inc. Been A Good Investment?

Boasting a total shareholder return of 116% over three years, Walker & Dunlop, Inc. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 4 warning signs for Walker & Dunlop you should be aware of, and 1 of them doesn't sit too well with us.

Important note: Walker & Dunlop is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Walker & Dunlop, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Walker & Dunlop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:WD

Walker & Dunlop

Through its subsidiaries, originates, sells, and services a range of multifamily and other commercial real estate financing products and services for owners and developers of real estate in the United States.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)