- United States

- /

- Banks

- /

- NYSE:WBS

What Webster Financial (WBS)'s HSA Expansion Deal With Marathon Means For Shareholders

Reviewed by Sasha Jovanovic

- Webster Financial Corporation recently announced a partnership with Marathon to expand its Health Savings Account (HSA) business, leveraging favorable legislative changes and aiming to open new business channels and revenue streams.

- This move highlights Webster’s emphasis on growth areas that generate recurring non-interest income, especially as clients remain optimistic about commercial loan activity despite broader market uncertainty.

- With the company deepening its focus on HSAs through the Marathon collaboration, let's explore how this development may shape Webster's investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Webster Financial Investment Narrative Recap

To be a shareholder in Webster Financial, you need confidence in the company’s ability to generate sustained non-interest income, especially via new health savings offerings, and manage its credit risks amid a complex lending environment. The recent Marathon partnership affirms management’s commitment to diversifying revenue channels, but it does not materially alter the near-term importance of maintaining resilient loan growth and navigating ongoing margin pressures, which remain the leading catalyst and risk, respectively.

Of Webster’s latest announcements, the report of rising net charge-offs in Q3 2025 is most relevant here. While fee-based initiatives like the HSA expansion aim to diversify revenue, increasing credit costs highlight continuing exposure to commercial real estate and margin compression, both of which could weigh on earnings in the short term.

Yet, in contrast to new growth initiatives, investors should also consider the increasing credit losses and what those may signal about longer-term risks to Webster’s capital...

Read the full narrative on Webster Financial (it's free!)

Webster Financial's narrative projects $3.4 billion revenue and $1.2 billion earnings by 2028. This requires 10.8% yearly revenue growth and a $369 million earnings increase from the current $830.6 million.

Uncover how Webster Financial's forecasts yield a $71.59 fair value, a 29% upside to its current price.

Exploring Other Perspectives

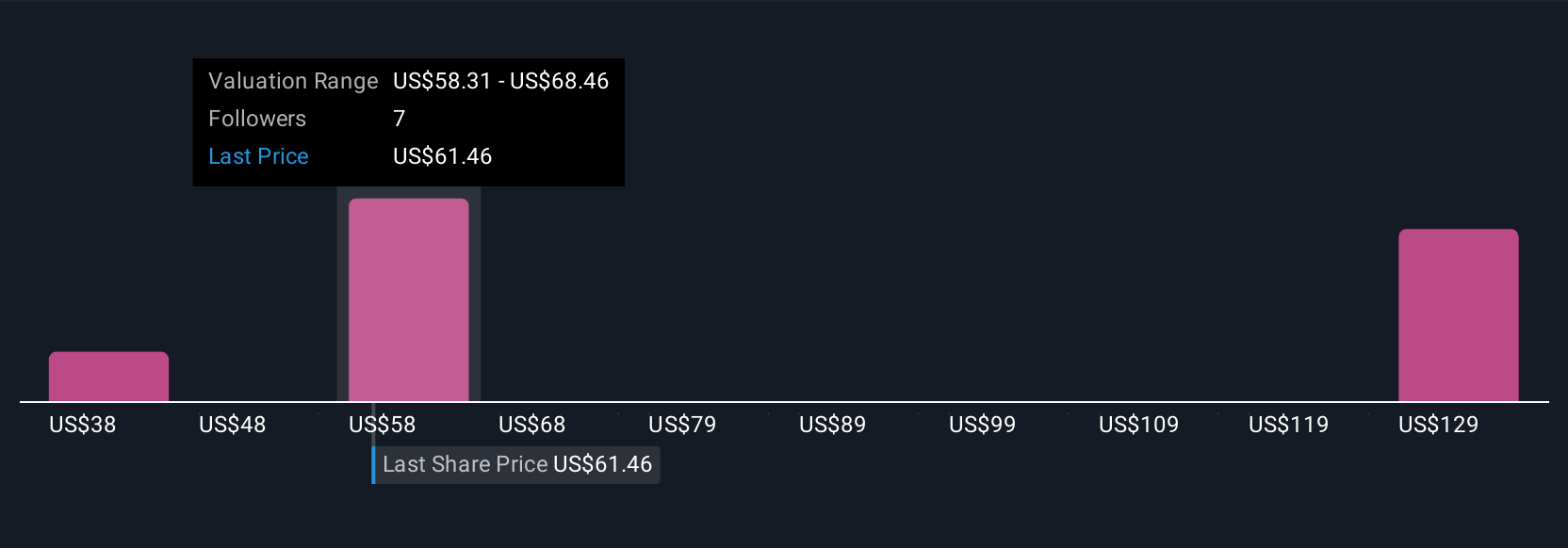

Simply Wall St Community fair value estimates for Webster Financial range from US$38 to US$96.68 across three analyses, suggesting wide differences in investor optimism. Margin compression and persistent loan competition remain key variables that could shape whether expectations align with results, so explore several viewpoints before making decisions.

Explore 3 other fair value estimates on Webster Financial - why the stock might be worth 31% less than the current price!

Build Your Own Webster Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Webster Financial research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Webster Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Webster Financial's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Webster Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WBS

Webster Financial

Operates as the bank holding company for Webster Bank, National Association that provides various financial products and services to businesses, individuals, and families in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives