- United States

- /

- Banks

- /

- NYSE:USB

Does the Recent 2.5% Drop Signal Opportunity in U.S. Bancorp Stock for 2025?

Reviewed by Bailey Pemberton

- Wondering if U.S. Bancorp stock is undervalued or due for a re-rating? You are not alone. Taking a closer look now could unlock hidden opportunity.

- Despite plenty of market attention, the stock price slid by 2.5% over the last 7 days and is down 3.0% in the past month. However, it has managed a 3.2% gain over the last year.

- U.S. Bancorp's share price has been moving alongside developments in the broader banking sector and renewed discussions about regulatory changes. Headlines around interest rates and the health of U.S. consumers have provided crucial context for these recent shifts.

- Right now, the company earns a valuation score of 5 out of 6, based on how many valuation checks point to it being undervalued. We will explore what this score means using traditional methods, and provide additional insight on a more refined way to judge value.

Find out why U.S. Bancorp's 3.2% return over the last year is lagging behind its peers.

Approach 1: U.S. Bancorp Excess Returns Analysis

The Excess Returns model estimates a company's intrinsic value by evaluating how much profit it generates above the required cost of equity, relative to its invested capital. This helps investors assess the efficiency of capital allocation and the long-run potential for value creation.

For U.S. Bancorp, the average return on equity stands at 12.90%. Analysts expect a stable earnings per share of $5.18, based on future ROE projections supplied by 15 analysts. The company’s book value per share is $36.33, with a projected stable book value of $40.17 according to 13 analysts. The cost of equity is $3.11 per share, while excess return is $2.07 per share, indicating U.S. Bancorp is generating profits greater than its risk-adjusted hurdle rate.

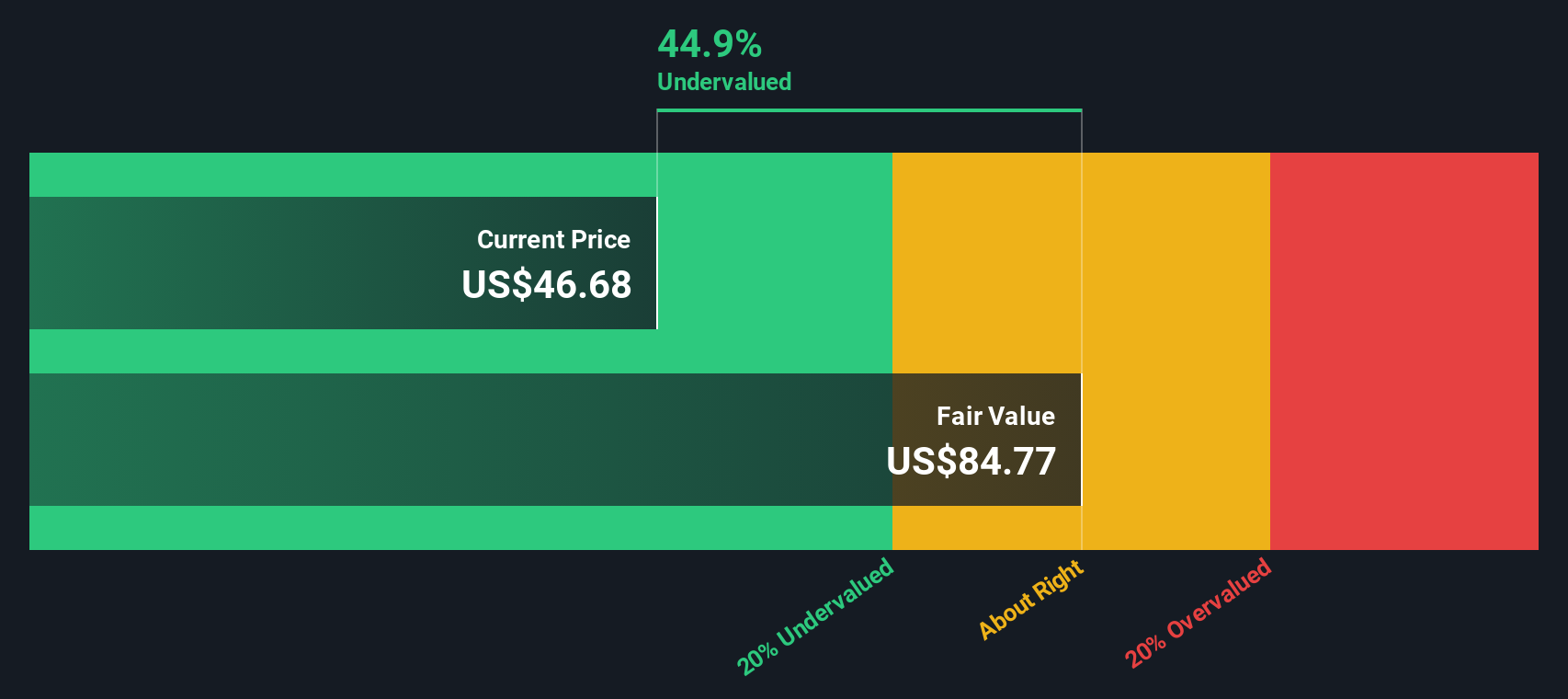

Based on these metrics, the Excess Returns Model calculates an intrinsic value that is 45.0% higher than the current share price. This substantial discount suggests that the stock is undervalued relative to its long-term value-creation potential.

Result: UNDERVALUED

Our Excess Returns analysis suggests U.S. Bancorp is undervalued by 45.0%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: U.S. Bancorp Price vs Earnings

For profitable companies like U.S. Bancorp, the price-to-earnings (PE) ratio is a widely trusted valuation metric. The PE ratio tells investors how much they are paying for each dollar of a company’s annual earnings, making it especially relevant for banks with consistent profitability.

Growth expectations and perceived risk play a large role in what constitutes a “normal” or “fair” PE ratio. Companies expecting faster earnings growth or lower risk often justify higher ratios, while slower growth or elevated risk generally warrants a lower PE.

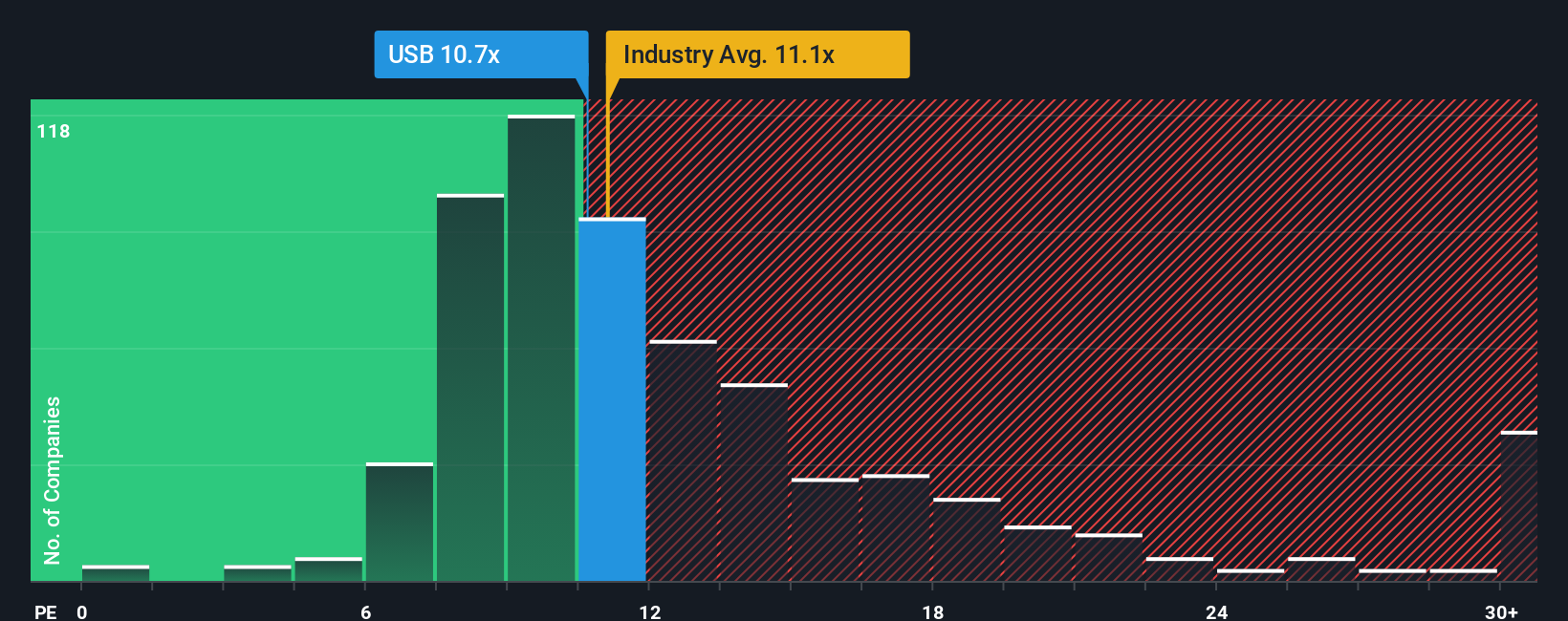

Currently, U.S. Bancorp trades at a PE of 10.7x. This compares to a banking industry average of 11.0x and a broader peer average of 17.8x. While the company’s PE is a touch below its industry, it is well under that of its peers. This may point to conservative market expectations or unique risks being priced in.

Simply Wall St introduces the “Fair Ratio,” a proprietary benchmark that factors in multiple dimensions such as the company’s growth outlook, industry segment, profit margins, market capitalization, and specific risk profile. Unlike a simple peer or industry comparison, the Fair Ratio (calculated here as 13.1x for U.S. Bancorp) aims to tell investors what multiple is realistically justified for the stock today.

When we line up U.S. Bancorp’s current PE of 10.7x alongside its Fair Ratio of 13.1x, the evidence suggests the stock is meaningfully undervalued on a fundamentals-adjusted basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your U.S. Bancorp Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative puts the numbers in context by letting you attach a story, your view of the company’s future, and key assumptions like fair value and expected revenue growth, all in one place.

Rather than just relying on static ratios, Narratives let you explain, test, and share the reasoning behind your investment thesis. This approach links U.S. Bancorp’s business story to its financial outlook and resulting fair value. This tool, available on Simply Wall St’s Community page and used by millions of investors, makes building, revising, and debating company outlooks far more intuitive and accessible for everyone.

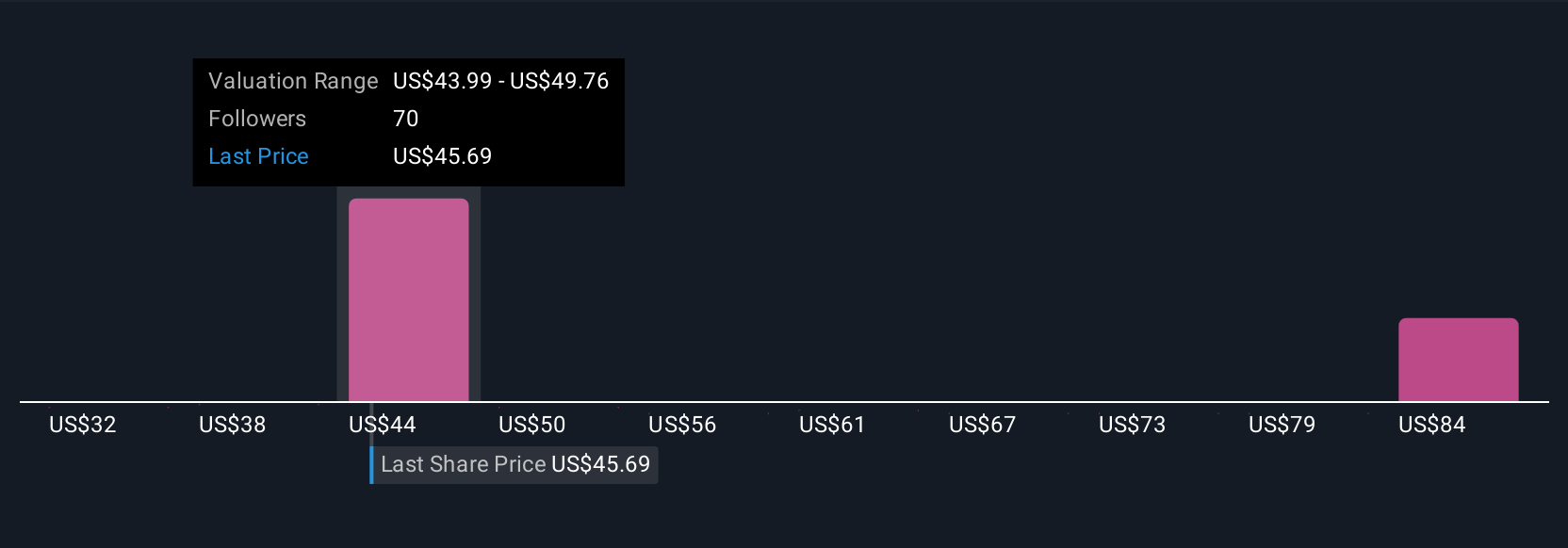

Narratives enable investors to make buy or sell decisions by comparing the Fair Value their story generates with the current market price, adapting quickly as news or earnings updates roll in. For example, looking at U.S. Bancorp, some investors expect significant earnings growth and set their Narrative’s fair value at $67, while others are more cautious with estimates around $47, based on different risk assessments and future scenarios. Using Narratives, you can quickly sense check, personalize, and upgrade every investment decision you make.

Do you think there's more to the story for U.S. Bancorp? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USB

U.S. Bancorp

A financial services holding company, provides various financial services to individuals, businesses, institutional organizations, governmental entities, and other financial institutions in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives