- United States

- /

- Banks

- /

- NYSE:TFIN

Will NFI’s Adoption of Payment and Intelligence Solutions Change Triumph Financial’s (TFIN) Digital Freight Ambitions?

Reviewed by Sasha Jovanovic

- On November 12, 2025, Triumph Financial announced that NFI has expanded its relationship to include Triumph's Payment, Audit, and Intelligence solutions across its carrier network to boost payment speed, automate invoice auditing, and provide advanced operational insights.

- This development highlights growing industry adoption of Triumph’s integrated technology platform, which aims to transform freight transactions through real-time automation, data-driven decisions, and improved transparency for logistics partners.

- We’ll now explore how NFI's broader adoption of Triumph’s technology tools influences the company’s investment narrative and digital freight ecosystem ambitions.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Triumph Financial Investment Narrative Recap

For Triumph Financial shareholders, the core belief is that technology-driven solutions in freight payments, audit, and intelligence can drive meaningful efficiency and growth, even amid sector volatility and digital competition. The expanded NFI partnership underscores Triumph’s relevance with top logistics players, but does not fundamentally shift the biggest near-term catalyst, which remains broader network adoption of its platform, or the principal risk: exposure to cyclical freight downturns and rising competition among freight fintechs. Triumph’s September launch of its integrated Pricing and Performance Intelligence solution is especially relevant, as it complements the NFI deal by extending Triumph’s reach into predictive analytics for brokers and carriers. This addition is vital in supporting the company’s ambition to build sticky, high-value platform relationships as it seeks to offset freight sector headwinds. However, investors should be aware that, in contrast, heightened competition and customer diversification remain an ever-present risk for...

Read the full narrative on Triumph Financial (it's free!)

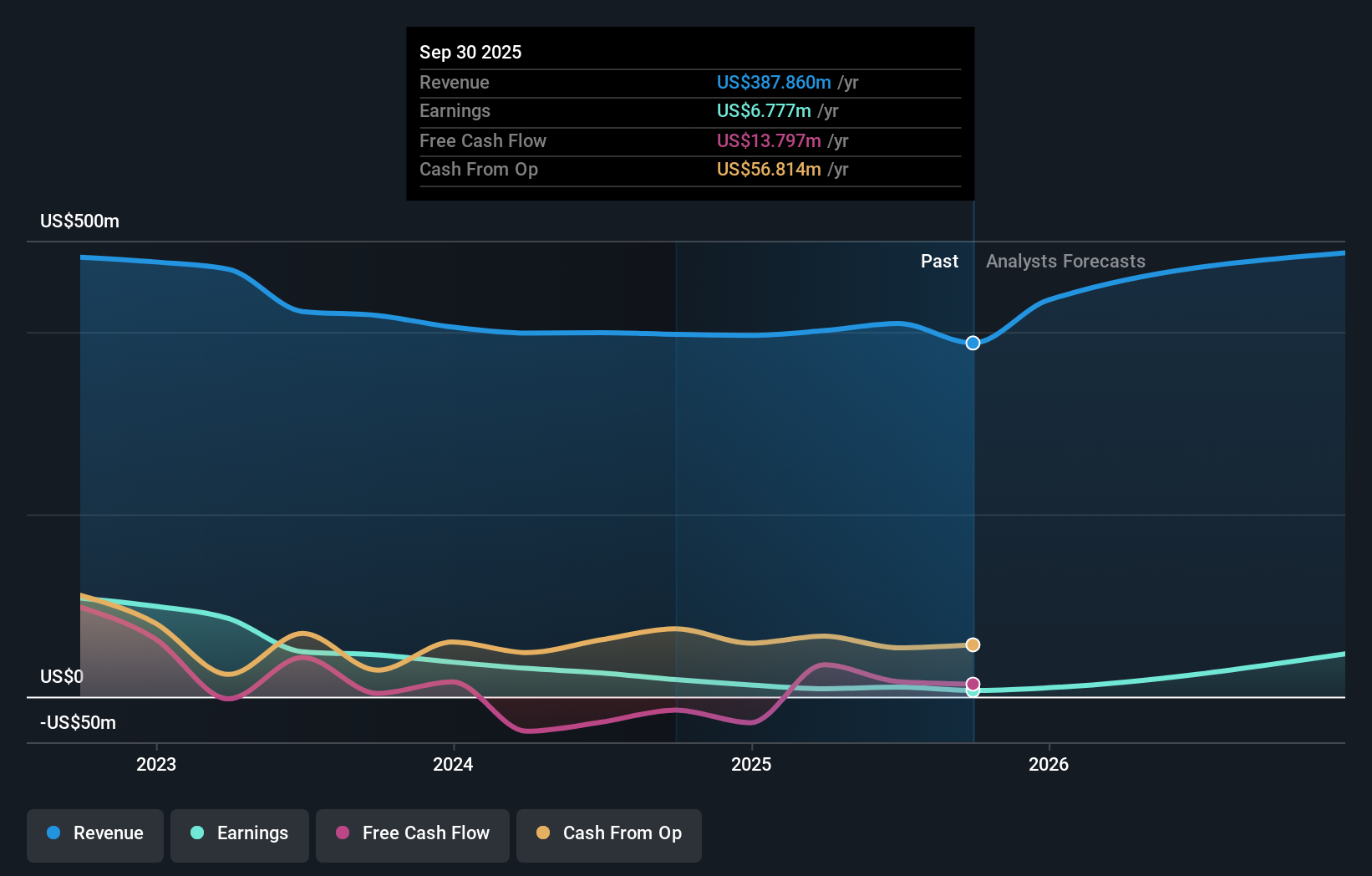

Triumph Financial's narrative projects $602.4 million in revenue and $131.3 million in earnings by 2028. This requires 13.8% yearly revenue growth and a $120.9 million increase in earnings from $10.4 million today.

Uncover how Triumph Financial's forecasts yield a $60.50 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community provided fair value ranges for Triumph Financial from US$11.83 to US$60.50 per share. While community estimates vary widely, freight sector volatility is a recurring risk that could impact Triumph's ability to sustain revenue growth. Consider these different viewpoints when forming your own outlook.

Explore 2 other fair value estimates on Triumph Financial - why the stock might be worth as much as 13% more than the current price!

Build Your Own Triumph Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Triumph Financial research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Triumph Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Triumph Financial's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triumph Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFIN

Triumph Financial

A financial holding company, provides banking, factoring, payments, and intelligence services in the United States.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives