- United States

- /

- Banks

- /

- NYSE:TFIN

Triumph Financial (TFIN): How Freight Tech Expansion with NFI Shapes the Latest Valuation Narrative

Reviewed by Simply Wall St

Triumph Financial (TFIN) just shared news of a deeper integration with NFI, expanding their partnership to roll out Triumph's Payment, Audit, and Intelligence solutions across NFI’s carrier network. This move highlights Triumph’s ongoing focus on freight technology and promises increased efficiency and transparency for clients.

See our latest analysis for Triumph Financial.

Triumph Financial’s recent tech-focused partnership news comes after a tumultuous stretch for the stock. While the share price has rebounded 15% over the past month, longer-term momentum is still lagging, with a one-year total shareholder return of -47%. Several recent events, including a $40 million shelf registration and a high-profile industry conference appearance, indicate Triumph is working to reassert its relevance and growth story, but risk perception remains elevated among investors.

If you’re open to uncovering other promising names beyond financials, consider expanding your search and discover fast growing stocks with high insider ownership

With shares still trading well below last year’s levels despite a recent rebound and new tech partnerships in place, investors are left to wonder whether Triumph is undervalued at current prices or if the market is already factoring in a turnaround story.

Most Popular Narrative: 10.3% Undervalued

Triumph Financial's fair value, according to the most followed narrative, stands at $60.50, which is notably above the recent close of $54.29. The difference suggests increasing optimism around the company's future trajectory amid its ongoing innovation push.

Integration of Greenscreens into Triumph's platform, with its $40B in proprietary audit and payment data, is significantly improving product accuracy and penetration within the top freight brokers. This is accelerating adoption, elevating average contract value, and positioning the intelligence business as Triumph's fastest-growing segment. These developments are supporting higher fee-based revenue and improved earnings growth.

Curious what kind of ambitious earnings and profit margin leaps are needed for this price target? There’s one core growth assumption driving this outlook and it could change your view on Triumph’s valuation story. Uncover the specific growth targets and see what makes this narrative so compelling. Read to discover the numbers behind the buzz.

Result: Fair Value of $60.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Triumph's heavy dependence on the freight sector, as well as execution risks from rapid tech investments, could derail these positive projections if challenges intensify.

Find out about the key risks to this Triumph Financial narrative.

Another View: Multiples Tell a Different Story

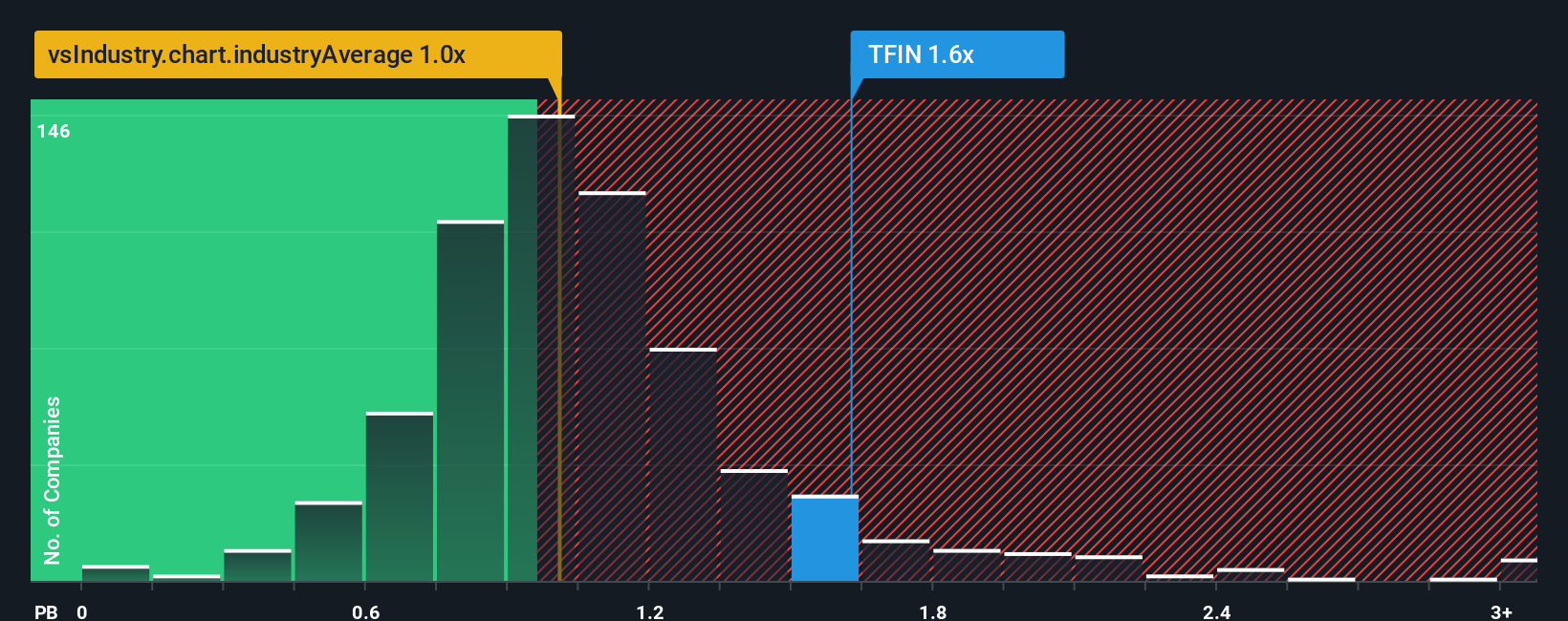

Looking beyond fair value models, Triumph Financial’s price-to-book ratio is currently 1.5. This stands out as more expensive compared to both the US Banks industry average and peer average of 1.0. This gap suggests valuation risk if the market turns cautious. Could peers’ lower multiples signal where Triumph’s price might settle?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Triumph Financial Narrative

If the prevailing stories or market views don’t line up with your own research, you can easily take the data and build your own perspective in just a few minutes. Do it your way

A great starting point for your Triumph Financial research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Smart investors never limit themselves to just one story. You could miss out on the next breakout trend if you don't check what's driving results in other corners of the market.

- Tap into rapid growth by checking out these 25 AI penny stocks, which target breakthroughs in artificial intelligence across industries.

- Strengthen your income strategy with these 14 dividend stocks with yields > 3%, offering yields above 3% and the potential for stable returns.

- Position yourself at the forefront of technology by finding these 27 quantum computing stocks, paving the way with quantum computing potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triumph Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFIN

Triumph Financial

A financial holding company, provides banking, factoring, payments, and intelligence services in the United States.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives