- United States

- /

- Banks

- /

- NYSE:TFIN

Triumph Financial (TFIN): Assessing Valuation After Analyst Upgrade and FreightTech Recognition

Reviewed by Simply Wall St

Triumph Financial (NYSE:TFIN) has seen its stock get a boost following a recent upgrade from B. Riley Securities. The company’s momentum is also being driven by its recognition on the FreightWaves 2026 FreightTech 25 list, which highlights its technology-driven progress.

See our latest analysis for Triumph Financial.

This renewed optimism comes after a stretch of volatility for Triumph Financial, where the share price slid by nearly a third year-to-date but recently rebounded with a strong 16.2% gain over the past month. Short-term momentum is building, with the stock rallying sharply off recent lows. However, its one-year total shareholder return of -32.4% keeps the bigger picture in focus for investors weighing both the risks and the potential for a turnaround.

If Triumph’s recent momentum has you thinking bigger, now could be the perfect time to discover fast growing stocks with high insider ownership.

With shares rebounding but long-term returns still lagging, the key question for investors now is whether Triumph Financial is trading at a bargain or if the recent optimism has already been fully reflected in the stock price.

Most Popular Narrative: 1.3% Undervalued

While Triumph Financial’s last close price is nearly in line with the narrative’s fair value, there is a slight edge in favor of the current valuation. This suggests analysts believe recent fundamentals have caught up with expectations, setting the stage for potential catalysts that could tip the balance in either direction.

Integration of Greenscreens into Triumph's platform, with its $40B in proprietary audit and payment data, is significantly improving product accuracy and penetration within the top freight brokers. This is accelerating adoption, elevating average contract value, and positioning the intelligence business as Triumph's fastest-growing segment. These factors are supporting higher fee-based revenue and improved earnings growth.

Want to know which strategic bets are fueling that fair value? The secret sauce may be how cutting-edge data, new digital products, and upgraded margins all combine behind the scenes. The boldest assumptions are just a click away. Are you ready to see what’s driving analyst enthusiasm?

Result: Fair Value of $60.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Triumph’s concentration in freight and the challenge of integrating new platforms could pressure margins if industry conditions weaken or if scaling efforts do not succeed.

Find out about the key risks to this Triumph Financial narrative.

Another View: What Do Market Ratios Suggest?

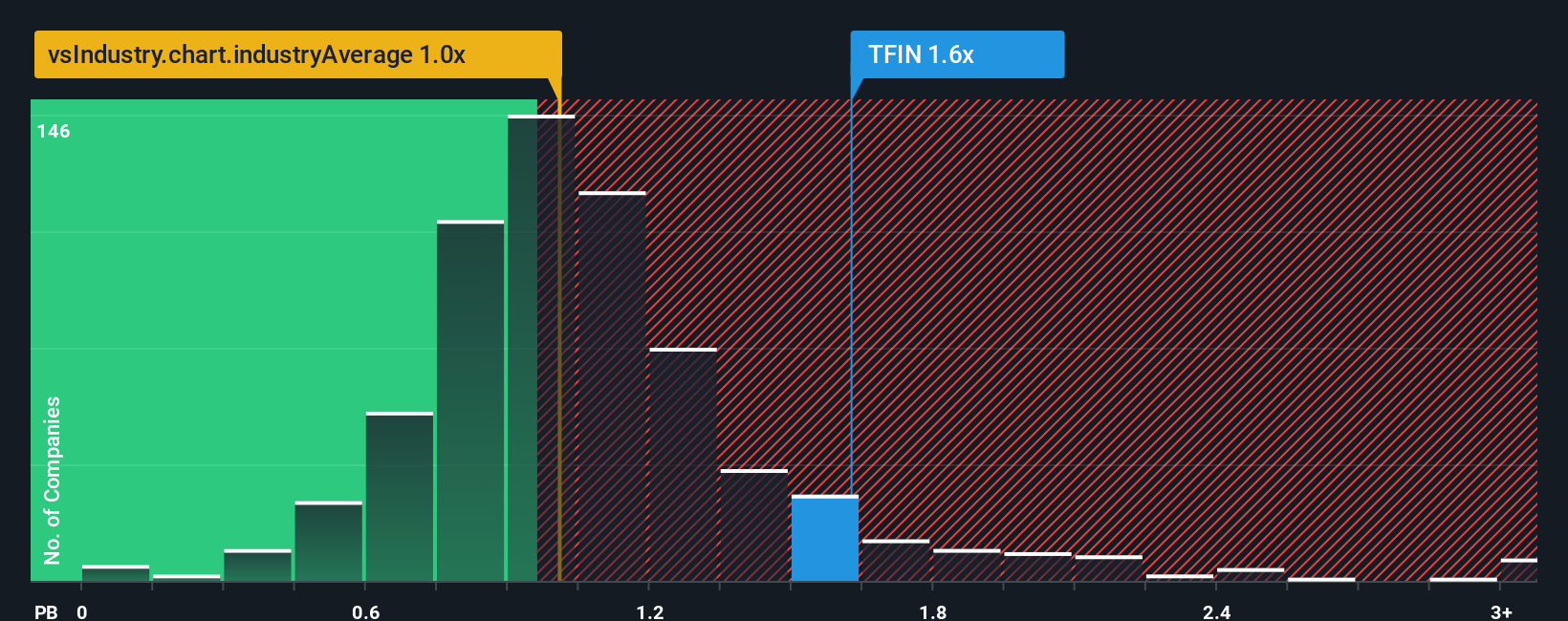

Looking from a market ratio perspective, Triumph Financial’s price-to-book ratio stands at 1.6x, which is above both the industry and peer average of 1x. This means the stock is considered expensive compared to similar banks, suggesting less room for upside unless earnings accelerate or the premium is justified. Is paying more really worth it, or is the market missing something?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Triumph Financial Narrative

Keep in mind, if you see things differently or want to dig into the numbers yourself, you can shape your own view in just a few minutes by using the following link: Do it your way.

A great starting point for your Triumph Financial research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Start your next smart move by checking out exciting stocks that could be tomorrow’s winners. Don’t let unique opportunities pass you by while others take action.

- Tap into the energy of artificial intelligence with these 27 AI penny stocks, featuring companies that are innovating faster than the competition and unlocking new ways to grow your portfolio.

- Consider the chance for reliable cash flow by exploring these 17 dividend stocks with yields > 3% for steady yields and companies that reward their shareholders.

- Ride the wave of secure, digital finance by examining these 80 cryptocurrency and blockchain stocks, which is making headlines in blockchain technology and future-ready payment systems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triumph Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFIN

Triumph Financial

A financial holding company, provides banking, factoring, payments, and intelligence services in the United States.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives