- United States

- /

- Banks

- /

- NYSE:TFC

Truist Financial (TFC): Valuation Perspective Following Q3 Earnings Growth and Analyst Upgrades

Reviewed by Simply Wall St

Truist Financial (NYSE:TFC) recently posted its fiscal Q3 2025 results, showing a 4% increase in total revenues and a broader uptick in average loan balances. This performance has captured attention across the banking sector.

See our latest analysis for Truist Financial.

Truist Financial’s fiscal Q3 update appears to have reinvigorated sentiment, fueling a seven percent share price return over the past month as analysts grew more positive following the results. With a total shareholder return of just under one percent over the past year and a 13.8% three-year gain, long-term momentum is building. Investors are watching closely to see if this recent lift develops into a broader trend.

If Truist’s recent uptick has you curious, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The question now facing investors is whether Truist’s recent growth and analyst upgrades signal an undervalued opportunity or if the market’s optimism already reflects future growth potential. Could this be a buying moment, or is everything priced in?

Most Popular Narrative: 10% Undervalued

Truist Financial’s fair value, according to the most widely followed narrative, stands at $50.50, about 10% above the recent close. This positions the shares as attractively priced, drawing new attention to the quantitative drivers behind the narrative’s fair value estimate.

Accelerating digital adoption among Truist's client base, including a 17% year-over-year increase in digital account production and deeper client engagement with digital financial management tools, positions the company to expand margin through lower operational costs and to drive new client acquisition, positively impacting both future net margins and top-line revenue growth.

Want to understand why the narrative projects more upside from here? This valuation hinges on a bold shift in operational efficiency and an ambitious take on future growth and profitability. Find out exactly which financial levers analysts believe will turbocharge earnings and what assumptions could surprise even seasoned investors. Dive in for the full story behind this valuation call.

Result: Fair Value of $50.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing challenges such as Truist’s exposure to commercial real estate and questions about the pace of digital transformation could still stall progress ahead.

Find out about the key risks to this Truist Financial narrative.

Another View: What Do Market Ratios Suggest?

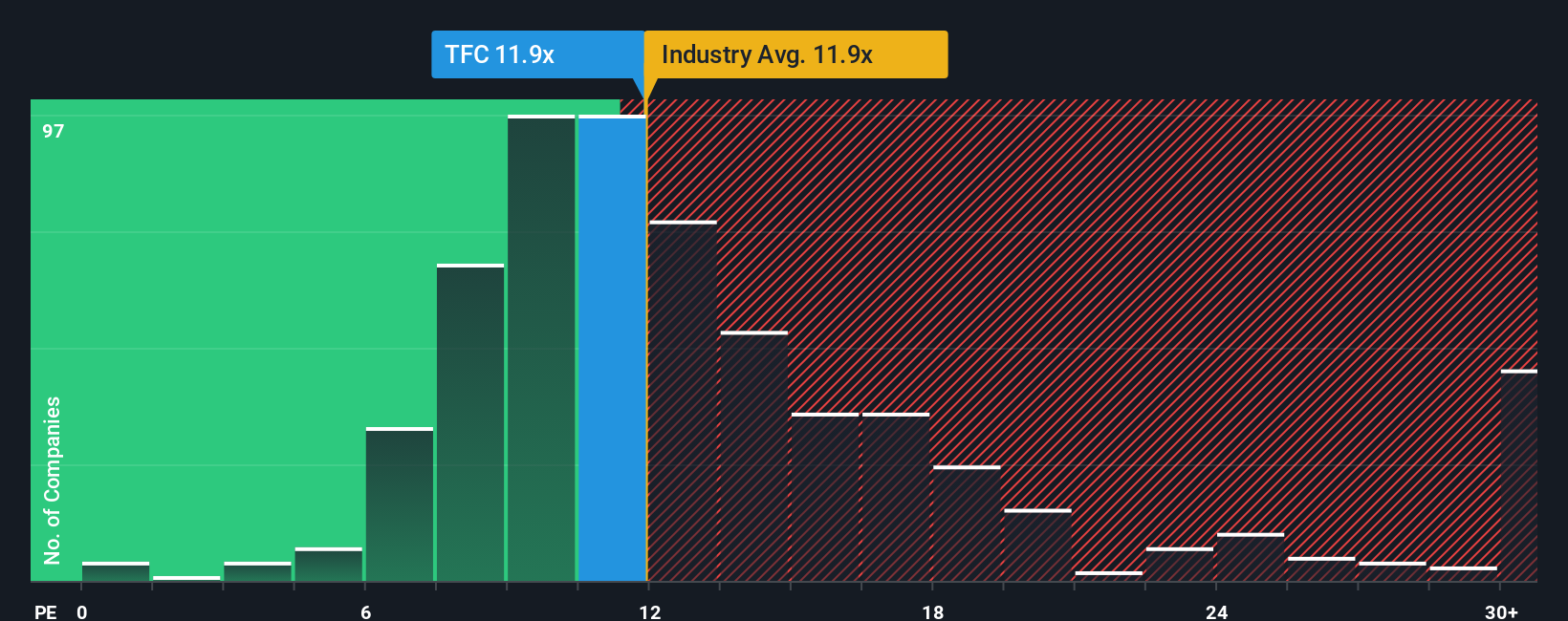

While the most followed narrative points to Truist’s shares being about 10% undervalued, a look at the price-to-earnings ratio gives a different take. Truist trades at 11.8 times earnings, which is slightly above the US Banks industry average of 11.1, but below its fair ratio of 13. That gap could signal limited upside if the market does not re-rate Truist closer to its fair ratio, or it may reveal lingering caution versus peers. Is the real opportunity hiding in plain sight, or are expectations already baked in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Truist Financial Narrative

If you see things differently or want to put your own analysis to the test, building your own Truist Financial narrative is quick and insightful. The process often takes less than three minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Truist Financial.

Looking for More Investment Ideas?

Smart investors know that the market is full of fresh opportunities beyond a single stock. Use the Simply Wall Street Screener to find tomorrow’s potential standouts, today.

- Tap into the hottest trends powering artificial intelligence by checking out these 25 AI penny stocks, which are at the forefront of machine learning and intelligent automation.

- Level up your dividend income by exploring these 15 dividend stocks with yields > 3%, which offers reliable yields and solid balance sheets for consistent returns.

- Unlock potential hidden gems trading below their real worth by targeting these 854 undervalued stocks based on cash flows, and position yourself ahead of market moves.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truist Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFC

Truist Financial

A financial services company, provides banking and trust services in the Southeastern and Mid-Atlantic United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives