- United States

- /

- Banks

- /

- NYSE:STEL

Stellar Bancorp (STEL): Assessing Valuation as Dividend Rises and Rate Cut Hopes Lift Shares

Reviewed by Simply Wall St

Stellar Bancorp has announced a quarterly dividend hike to $0.15 per share, as optimism around possible interest rate cuts has sparked gains for regional bank stocks. This signals a shareholder focus amid shifting market sentiment.

See our latest analysis for Stellar Bancorp.

The share price of Stellar Bancorp has been on an upward trend lately, gaining 13.1% year-to-date and rising 4.3% on the day after market optimism over potential interest rate cuts. While its one-year total shareholder return is a modest 3.3%, the longer-term five-year total return stands at 50.7%, showing that patience has paid off for long-term holders and that recent momentum is building around improving prospects.

If you’re inspired by recent moves in the banking space, this could be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With the stock up sharply and new optimism swirling around the sector, the real question for investors is whether Stellar Bancorp remains undervalued, or if the market has already priced in its future growth potential.

Most Popular Narrative: Fairly Valued

With Stellar Bancorp’s latest close at $31.42 and the most followed narrative setting fair value at $31.60, the gap is minimal, drawing focus to the detailed story beneath the surface.

The current valuation seems to assume continued organic loan growth and sustained market share gains, banking on robust Texas/Southwest economic trends and small business expansion, while underestimating risk from geographic concentration and potential regional economic downturns that could pressure loan growth and future earnings.

What is the secret ingredient analysts see in Stellar’s path? There is a financial forecast here that breaks the mold for regional banks and it hinges on one future-shaping number you may not expect. Are you curious to discover which bold assumption underpins the price target and why this valuation stands apart? Read on to find out what is driving the consensus and whether it stands up to scrutiny.

Result: Fair Value of $31.60 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong capital reserves and strategic digital investments could help Stellar Bancorp outperform expectations if market or regulatory risks turn out to be less disruptive than forecast.

Find out about the key risks to this Stellar Bancorp narrative.

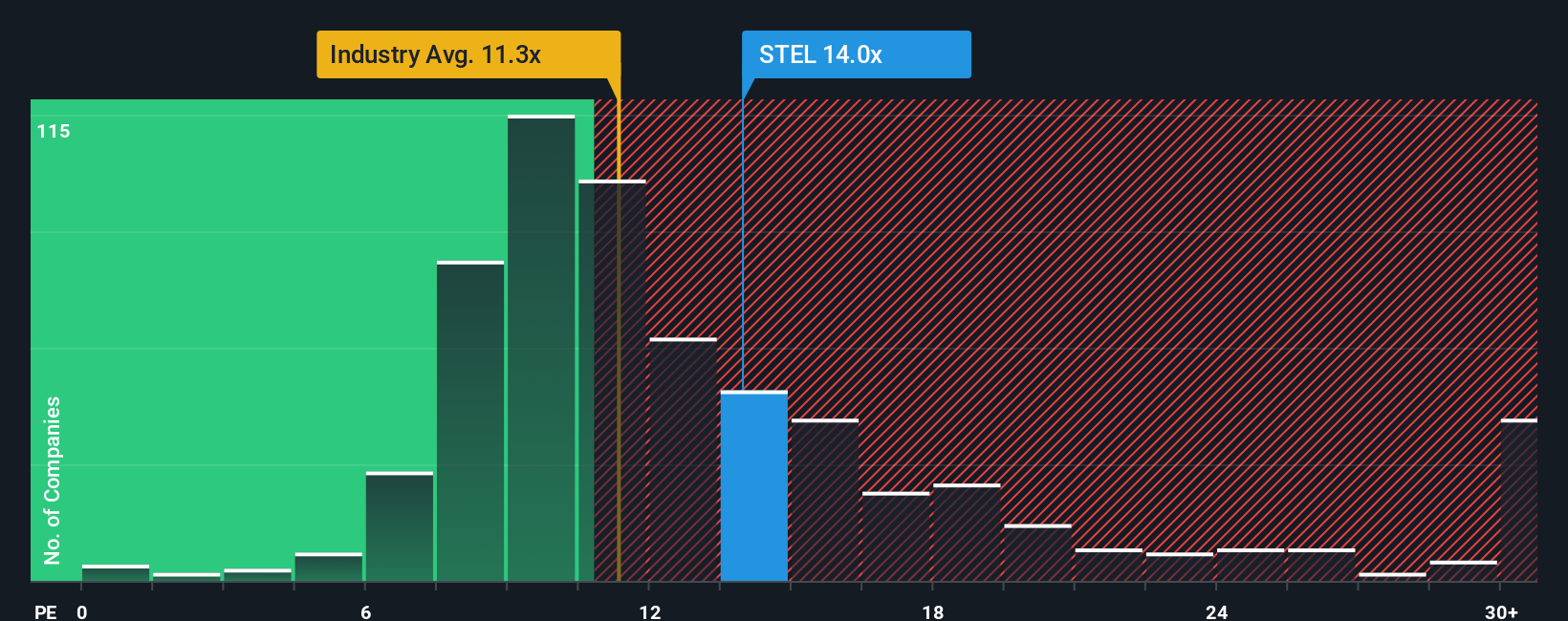

Another View: Valuation Through Multiples

Looking at valuation through market ratios, Stellar Bancorp trades at 15.8 times earnings, which is above the US Banks industry average of 11.2 and higher than its estimated fair ratio of 9.7. While this signals that investors are optimistic, it also suggests the market expects greater profitability ahead or has already priced in much of the upside. This raises the question of whether there is room for disappointment if growth falls short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stellar Bancorp Narrative

If you want to put your own perspective to the test and see if the numbers tell a different story, it takes just a few minutes to build your own assessment. So why not Do it your way

A great starting point for your Stellar Bancorp research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your next opportunity, broaden your watchlist, and see what others are missing by checking out unique stock ideas tailored to your interests.

- Capture gains from emerging tech by checking out these 26 quantum computing stocks, which features companies at the forefront of transformative computing innovations.

- Boost your long-term income strategy by tapping into these 16 dividend stocks with yields > 3%, featuring top picks with attractive yields and robust payout histories.

- Fuel your portfolio’s growth potential and get an edge with these 925 undervalued stocks based on cash flows, highlighting stocks that the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STEL

Stellar Bancorp

Operates as the bank holding company that provides a range of commercial banking products and services primarily to small and medium-sized businesses, professionals, and individual customers.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives