- United States

- /

- Banks

- /

- NYSE:SFBS

ServisFirst Bancshares (SFBS): Assessing Valuation Following a Recent Share Price Move

Reviewed by Simply Wall St

See our latest analysis for ServisFirst Bancshares.

ServisFirst Bancshares' recent bump in share price this week offers a small relief after an extended period of weaker momentum. Despite today’s slight uptick, the stock is still working to recover from its 1-year total shareholder return of -26%, signaling that long-term performance has lagged even as new investors watch for signs of renewed strength.

If you’re open to spotting new opportunities beyond banks, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

The question now is whether ServisFirst Bancshares is trading below its intrinsic value and offering investors a bargain, or if the recent price already reflects expectations for the company’s future growth potential and recovery.

Most Popular Narrative: 17.2% Undervalued

ServisFirst Bancshares’ most followed narrative points to a fair value substantially above the last close of $71.76, suggesting upside potential. With market sentiment still hesitant, all eyes are on the drivers behind such a sizable fair value gap.

Expansion of commercial lending teams and ongoing hiring in key Southeastern markets positions the company to capitalize on robust population and business growth in the Sun Belt. This supports above-average organic loan and deposit growth, which is likely to drive top-line revenue and long-term earnings growth.

Do you want to know what’s fueling this optimistic valuation? The secret sauce is a bold prediction of record loan and revenue expansion, matched with ambitious margin and growth assumptions not typically seen in regional banks. Find out what quantitative leaps back up this narrative, and why consensus might be betting on a strong turnaround in underlying performance.

Result: Fair Value of $86.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in commercial real estate and ongoing deposit growth pressures may undermine the optimistic outlook for ServisFirst’s recovery narrative.

Find out about the key risks to this ServisFirst Bancshares narrative.

Another View: What Do the Ratios Say?

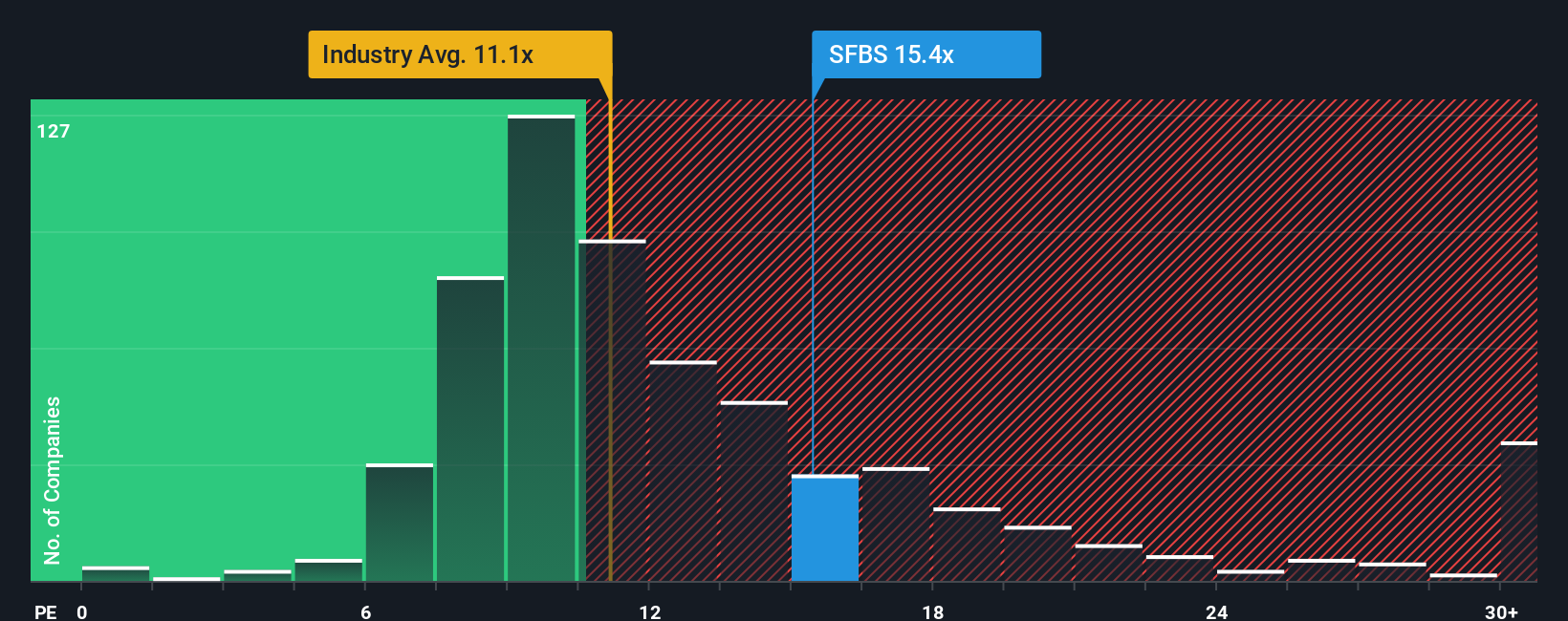

Looking at price-to-earnings, ServisFirst trades at 15.4x, which is higher than both the US Banks industry average of 11.1x and its own fair ratio of 13.3x. This suggests shares might be on the expensive side compared to peers and market expectations, adding a note of caution. Does this higher multiple signal confidence in a turnaround, or could it mean limited room for upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ServisFirst Bancshares Narrative

If you have a different perspective or want to analyze the numbers firsthand, dive into the data and craft your own story. It takes just a few minutes. Do it your way

A great starting point for your ServisFirst Bancshares research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Ready to unlock the full potential of your portfolio? Stay ahead of the curve and jump on emerging trends before the crowd by checking out these hand-picked opportunities:

- Spot new income streams by selecting these 16 dividend stocks with yields > 3% with attractive yields above 3% to help fortify your investments against volatility.

- Capture the momentum of cutting-edge innovation using these 25 AI penny stocks, which are accelerating real change and showing promise in tomorrow’s markets.

- Boost your returns with these 883 undervalued stocks based on cash flows, identified by smart algorithms as offering compelling value and providing growth opportunities that others might overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SFBS

ServisFirst Bancshares

Operates as the bank holding company for ServisFirst Bank that provides various banking services to individual and corporate customers.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives