- United States

- /

- Banks

- /

- NYSE:PNC

Is There Opportunity for PNC After Recent 9.1% Drop and Valuation Signals in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your PNC Financial Services Group stock? You’re not alone. Decisions around PNC aren’t just about what’s happened in the past month; they’re about weighing near-term volatility against the bigger picture, especially as fresh headlines and shifting market sentiment keep investors on their toes.

Over the past week, PNC shares ticked up 1.5%, a welcome rebound for holders after a tougher 30 days where the stock declined 9.1%. That pullback has caught the attention of investors looking for value. Looking at a broader timeframe, PNC is still up 1.0% over the past year and a sizeable 28.9% over the last three years, with an impressive 93.5% gain over five. This bank has demonstrated some resilience through different cycles, even as the financial sector has faced plenty of change.

In recent weeks, PNC has remained in the spotlight following sector-wide updates about regional banking stability and ongoing shifts in consumer financial habits. Discussion has centered on how well-positioned banks like PNC are to navigate changes in the economy, and the market’s reaction has been a mix of caution and curiosity, especially as appetite for bank stocks has fluctuated this year.

But amid swings in sentiment and prices, what does value really look like for PNC right now? Our valuation score, which is 4 out of a possible 6, reflects clear signals that there may be room for upside. Next, let’s dig into the valuation methods themselves and see how PNC shapes up. We’ll also explore a more holistic view of valuation you won’t want to miss.

Why PNC Financial Services Group is lagging behind its peers

Approach 1: PNC Financial Services Group Excess Returns Analysis

The Excess Returns valuation model helps investors understand how much value a company is creating over and above its cost of equity capital. By focusing on returns on invested capital, this model reveals whether a business is generating profits in excess of what shareholders require for their investment risk. For PNC Financial Services Group, this analysis highlights key financial strengths.

Based on current projections, PNC’s Book Value stands at $150.48 per share, while the company’s Stable EPS is estimated at $18.14 per share. These figures are drawn from weighted future Return on Equity (ROE) estimates provided by 13 analysts. The average ROE for PNC is a robust 12.28%, suggesting the bank is making efficient use of its equity base. With a Cost of Equity at $10.99 per share, the resulting Excess Return per share comes in at $7.15, underlining strong value creation. Additionally, the Stable Book Value is projected to be $147.70 per share, based on input from 11 analysts.

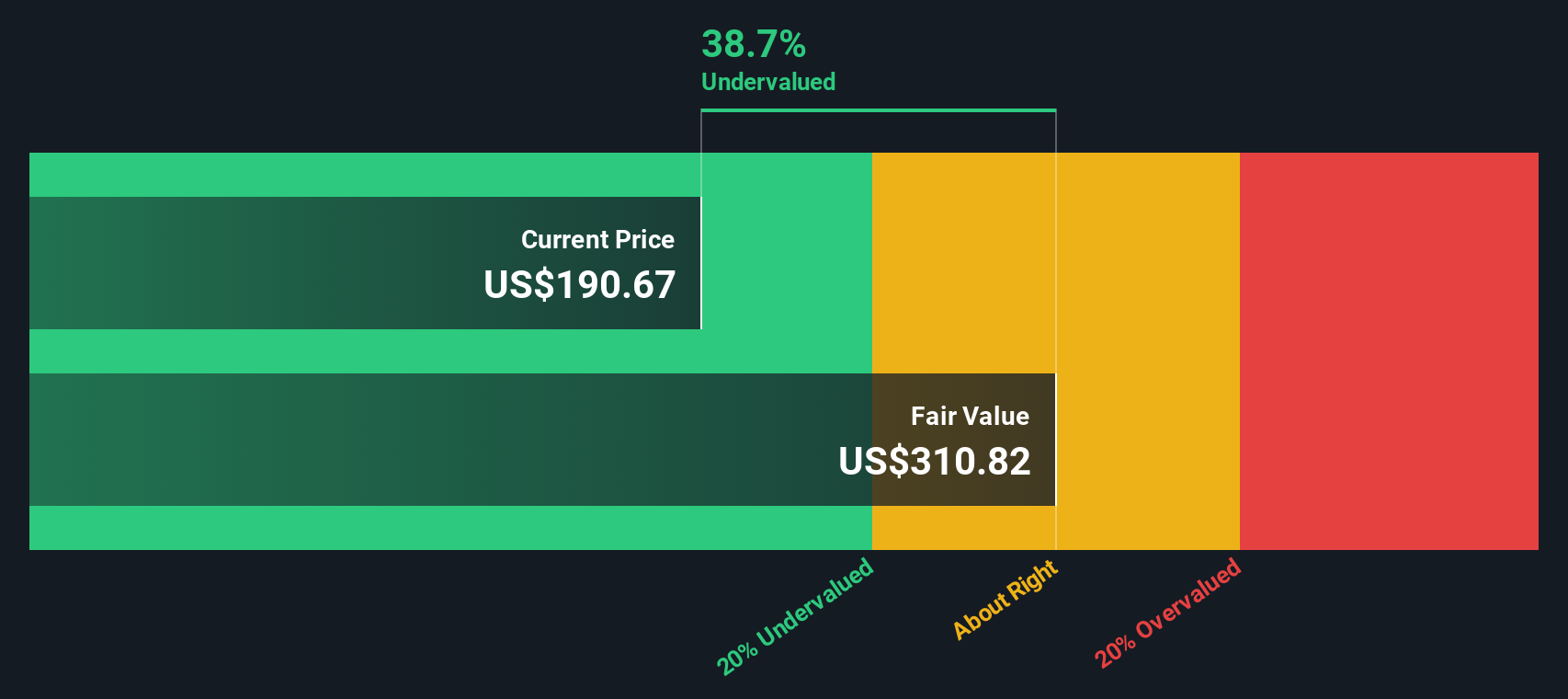

Using the Excess Returns model, the estimated intrinsic value for PNC stock is $311.83 per share. Compared to the current market price, this implies the stock is trading at a 40.7% discount. That suggests a significant undervaluation, pointing to meaningful upside potential for investors willing to look past recent volatility.

Result: UNDERVALUED

Our Excess Returns analysis suggests PNC Financial Services Group is undervalued by 40.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: PNC Financial Services Group Price vs Earnings

The price-to-earnings ratio, or PE, is a classic tool for valuing profitable companies like PNC Financial Services Group. Since it directly relates the price of a company’s stock to its earnings power, it serves as a quick litmus test for assessing how much investors are willing to pay for each dollar of profit. For established, consistently profitable banks, the PE multiple is especially relevant because it provides insight into how the market values predictable earnings streams relative to peers and historical standards.

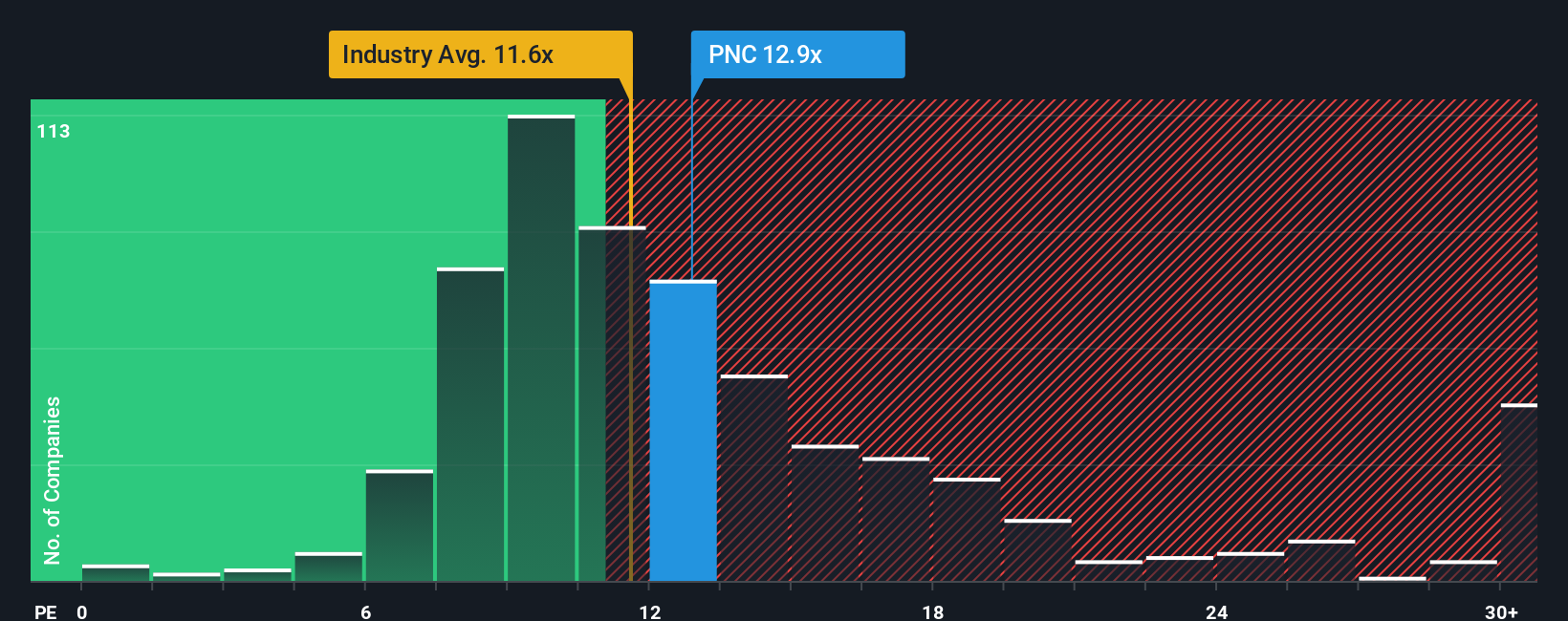

It’s important to note that a “normal” or “fair” PE ratio is not universal. Higher growth expectations or lower perceived risk generally justify a higher PE multiple, while lower growth or higher uncertainty often lead to a lower multiple. At present, PNC trades at a PE of 11.76x. This sits above the banking sector’s 11.25x average but below its closest peer average of 17.60x, suggesting the market sees PNC as more robust than the average bank but still somewhat less attractive than top comparables.

While peer and industry comparisons are useful, the Fair Ratio, Simply Wall St’s proprietary benchmark for the expected PE multiple, offers a more tailored perspective. This metric incorporates growth prospects, profitability, market cap, industry trends, and risk factors, making it more comprehensive than a straight peer comparison. PNC’s Fair Ratio stands at 14.22x, just above its actual PE of 11.76x. This suggests the stock is trading below what would be expected given its overall fundamentals and risk profile, potentially pointing to an undervaluation at current levels.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PNC Financial Services Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, intuitive way to explain your viewpoint about a company, connecting the reasoning behind your numbers with a clear story about its future. Instead of just plugging numbers and forecasts into a model, Narratives allow you to share why you believe PNC Financial Services Group is set to grow, face challenges, or trade at a certain value. This approach puts your assumptions, confidence in management, and predictions about revenue or margins front and center.

Narratives turn investing into more than just math. They link your view of PNC's business, such as branch expansion or expense discipline, to an explicit financial forecast and then to a fair value for the stock. This process is easy to update and compare with others. On Simply Wall St's Community page, millions of investors use Narratives as an interactive tool to track and discuss investment cases. This helps you quickly judge if PNC looks undervalued or overvalued relative to the current price, and when news or earnings come out, Narratives update automatically to reflect the latest information.

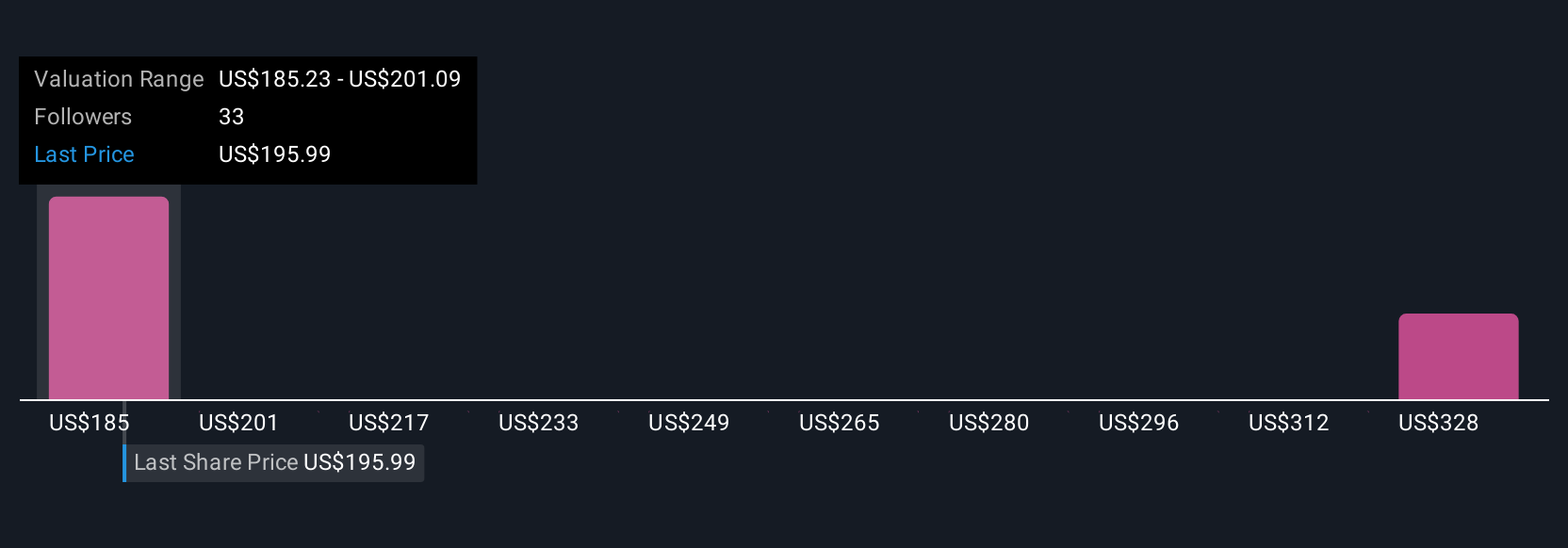

Since investors come at PNC from different angles, you might see one Narrative highlighting strong loan growth and strategic acquisitions, resulting in a high fair value of $238. Another, more cautious Narrative citing expense pressures or market uncertainties, puts fair value closer to $186. This shows the real power of Narratives to capture those different perspectives in one place.

Do you think there's more to the story for PNC Financial Services Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNC

PNC Financial Services Group

Operates as a diversified financial services company in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives