- United States

- /

- Banks

- /

- NYSE:OFG

Will Rising Charge-Offs and Earnings Miss Shift OFG Bancorp's (OFG) Long-Term Investment Narrative?

Reviewed by Sasha Jovanovic

- OFG Bancorp recently reported its third quarter 2025 results, showing net interest income of US$154.72 million and net income of US$51.84 million, both higher than the prior year, but missing analyst expectations due to higher provision for credit losses and increased net charge-offs.

- An important element from the quarter was the rise in net charge-offs to US$20.2 million, signaling growing credit quality concerns despite ongoing investment in digital transformation and share buybacks.

- We’ll explore how increased charge-offs and weaker core banking metrics may affect OFG Bancorp’s investment narrative and long-term earnings outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

OFG Bancorp Investment Narrative Recap

To own OFG Bancorp stock, an investor needs confidence that growth in Puerto Rico’s economy and digital innovation will continue to offset increasing competition and regional risks. The recent rise in net charge-offs and a miss on earnings estimates introduces fresh uncertainty around credit quality, which could weigh on the company’s ability to expand profitably in the near term; this does impact the most pressing short-term risk, but not the core digital banking catalyst, which remains intact.

The company’s completion of a US$20.4 million share buyback during the third quarter is noteworthy as it illustrates a commitment to returning capital even in the face of rising credit costs. While buybacks can signal conviction in future prospects, the effect on shareholder value will depend on how well OFG can navigate heightened credit risks and maintain its funding base, both of which are under more scrutiny following these earnings.

Yet, despite ongoing digital investments and steady loan demand, investors should keep a close eye on OFG’s exposure to Puerto Rico’s economic volatility…

Read the full narrative on OFG Bancorp (it's free!)

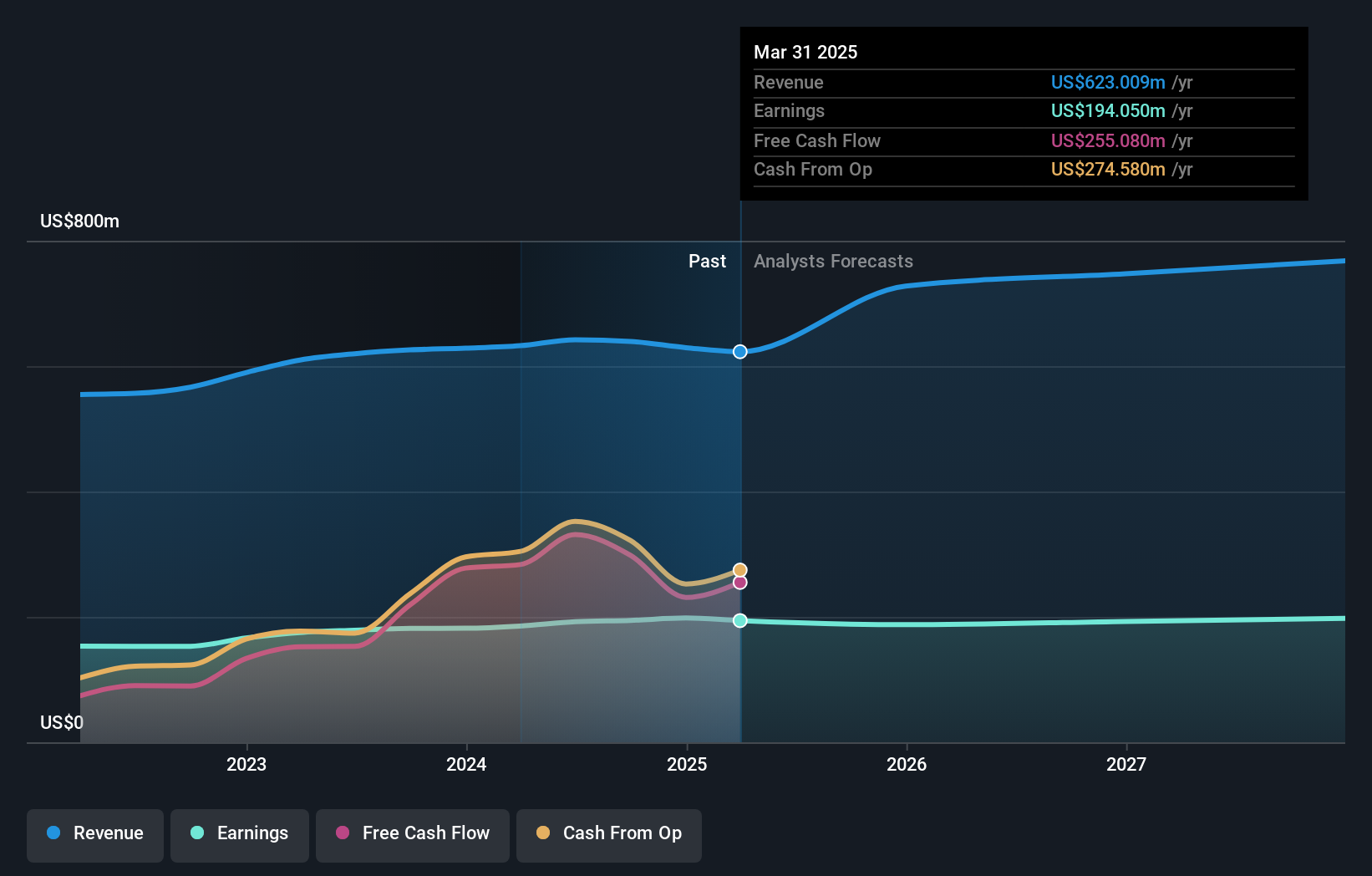

OFG Bancorp's outlook anticipates $828.3 million in revenue and $204.3 million in earnings by 2028. This projection is based on a 10.2% annual revenue growth rate and a $9.6 million increase in earnings from the current level of $194.7 million.

Uncover how OFG Bancorp's forecasts yield a $50.00 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members all set their fair value for OFG Bancorp at US$50, based on one distinct analysis. While consensus exists here, recent credit quality worries highlight the importance of comparing different viewpoints on the bank's long-term outlook.

Explore another fair value estimate on OFG Bancorp - why the stock might be worth just $50.00!

Build Your Own OFG Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OFG Bancorp research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free OFG Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OFG Bancorp's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OFG

OFG Bancorp

A financial holding company, provides a range of banking and financial services in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives