- United States

- /

- Banks

- /

- NYSE:NU

Nu Holdings (NYSE:NU): Examining Valuation as Shares Inch Higher on Investor Interest

Reviewed by Kshitija Bhandaru

Nu Holdings (NYSE:NU) shares inched higher today, drawing interest from investors looking for insights into the company’s recent performance. As the stock shows slight movement, traders are keeping an eye on potential catalysts and underlying fundamentals.

See our latest analysis for Nu Holdings.

After some ups and downs over the past year, Nu Holdings’ share price has ultimately posted a healthy 1-year total shareholder return of 16.2%. This momentum suggests that investors are starting to recognize the company’s growth story, with risk appetite improving as fundamentals strengthen.

If recent gains in high-growth fintech caught your attention, it could be the perfect time to broaden your scope and discover fast growing stocks with high insider ownership

With double-digit annual growth and shares still shy of analyst targets, investors are left to ponder whether Nu Holdings is flying under the radar or if the market has already priced in its future success.

Most Popular Narrative: 10.4% Undervalued

The narrative sees Nu Holdings trading just below its consensus fair value, with recent momentum in the share price narrowing the discount. Behind this headline valuation is an ambitious set of assumptions and transformative catalysts, as outlined by leading market analysts.

The rapid growth of Latin America's digitally native population, combined with expanding smartphone and internet adoption, is creating a sustained surge in demand for Nu's app-based financial services, fueling long-term customer acquisition, higher engagement, and driving topline revenue growth.

Curious what gutsy forecasts power that price target? The narrative leans on high-octane revenue expansion and profit projections that outpace most banks. Wondering which core metrics hold the key to this premium valuation? The secrets are in the details. Dare to look deeper.

Result: Fair Value of $16.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, brisk competition and riskier credit exposure could quickly challenge Nu Holdings’ robust growth assumptions. These factors could serve as potential catalysts for a shift in sentiment.

Find out about the key risks to this Nu Holdings narrative.

Another View: Are Shares Overpriced on This Key Metric?

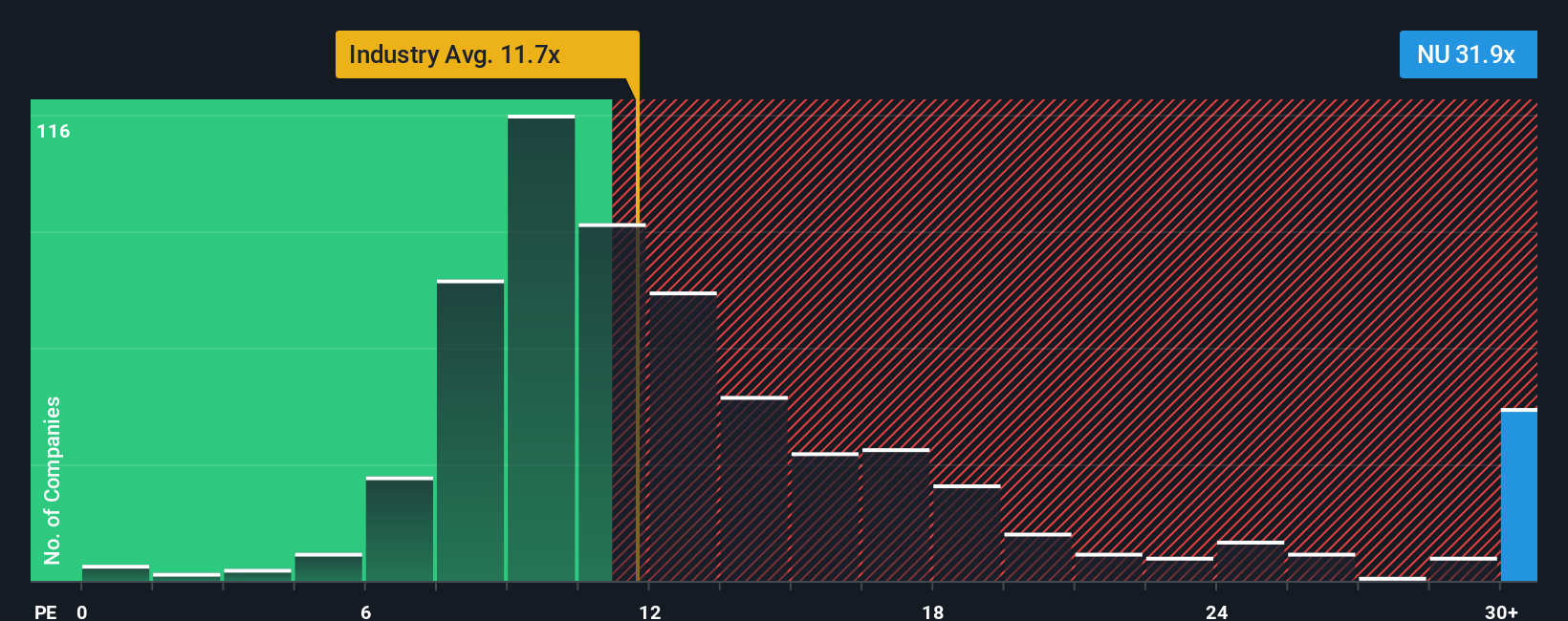

While analyst fair value highlights upside, Nu Holdings currently trades at a price-to-earnings ratio of 32x. That is noticeably higher than the US Banks industry average of 11.7x, its immediate peer average of 12.1x, and the fair ratio of 22.7x suggested by market trends. This sizable premium could expose investors to valuation risk if growth expectations stumble. Does this optimism reflect reality or set the stage for volatility?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nu Holdings Narrative

If the story above leaves you unconvinced, or you prefer to dig into the numbers for yourself, you can craft a personal thesis in just a few minutes. Do it your way.

A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep fresh opportunities on their radar. Act now and see how the right tools can point you toward the next hidden winner.

- Spot rising income with ease when you scan these 19 dividend stocks with yields > 3%. This screener features generous yields and strong fundamentals, making it well suited for building reliable cash flow.

- Capture future potential by reviewing these 31 healthcare AI stocks. Artificial intelligence is fueling breakthroughs across patient care, diagnostics, and cutting-edge biotech innovation.

- Find underappreciated gems in the market before others do by evaluating these 909 undervalued stocks based on cash flows, which reveals stocks that may be trading well below their real worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives