- United States

- /

- Banks

- /

- NYSE:NU

Is Nu Stock’s 51.6% Jump Justified After Expansion Highlights?

Reviewed by Bailey Pemberton

- Ever wondered if Nu Holdings is a hidden gem or just another growth story? If you’re curious about whether now is the right time to buy in, you’re not alone.

- The stock has climbed 51.6% year-to-date and is up 6.1% over the past month, signaling renewed excitement and a possible shift in how investors see its future potential and risks.

- Recent headlines have spotlighted Nu’s strategic expansion across new Latin American markets and ongoing product launches. This has sparked optimism about its ability to deepen its customer base even as competition intensifies. These developments are fueling speculation that Nu could keep outpacing rivals and capture fresh growth opportunities.

- Looking at the numbers, Nu Holdings currently scores 0 out of 6 on our valuation checks for being undervalued, which might surprise some after its run-up. Next, we’ll dig into what this score means, compare common approaches to analyzing valuation, and introduce a smarter way to evaluate whether the stock truly offers value at today’s price.

Nu Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Nu Holdings Excess Returns Analysis

The Excess Returns valuation model measures how effectively a company creates value above the basic cost of capital by comparing the return on invested equity to the required rate of return. Unlike models that focus only on cash flows, this approach centers on the company’s ability to generate “excess” profits from its equity base.

For Nu Holdings, the data tells a clear story. The company’s average return on equity is an impressive 29.42%, while its stable book value is estimated at $3.04 per share by six analysts. The stable earnings per share, based on weighted future Return on Equity from nine analysts, stands at $0.90. The cost of equity is $0.36 per share, so the excess return currently generated is $0.53 per share.

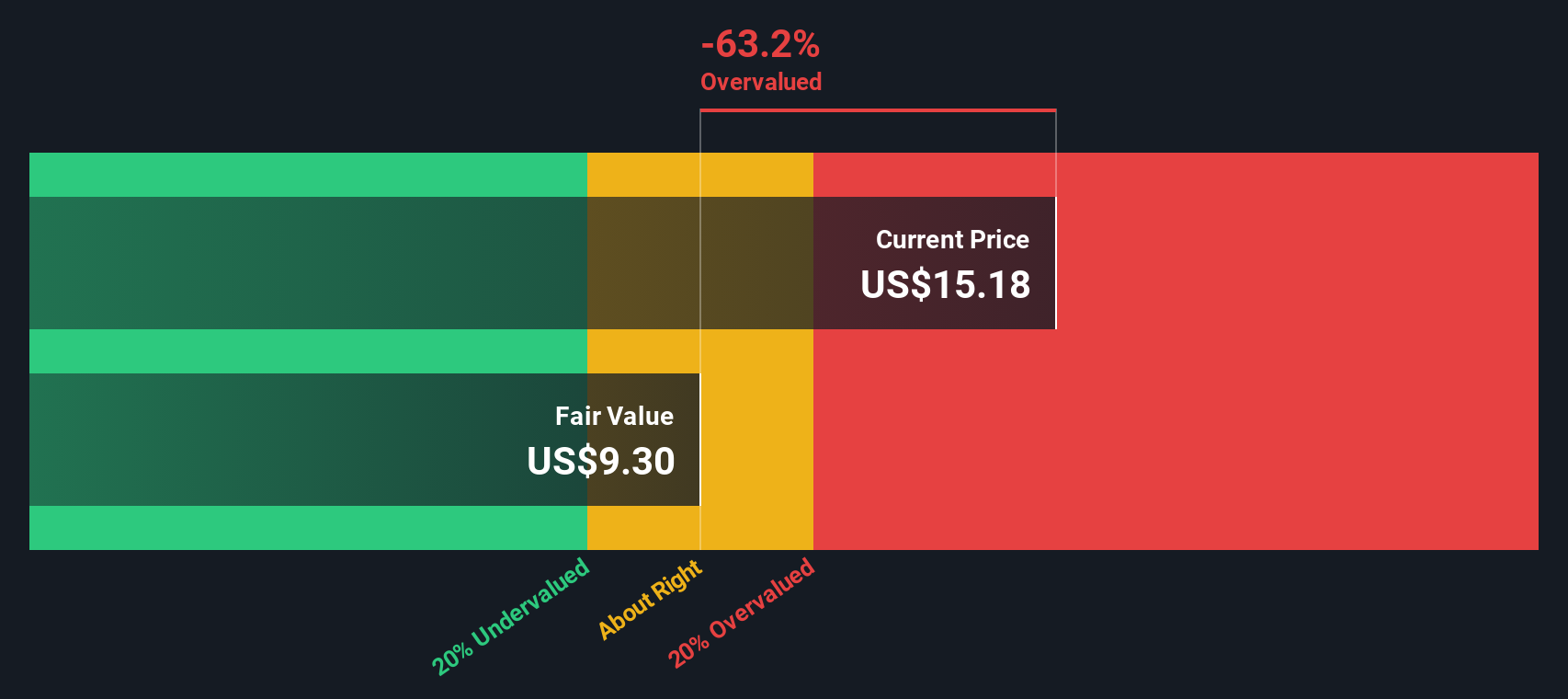

While strong returns on capital may be a positive sign, the model estimates an intrinsic value that is much lower than today’s price. The Excess Returns analysis suggests Nu Holdings is trading at a 76.9% premium to its fair value, which may indicate that the stock is significantly overvalued at present.

Result: OVERVALUED

Our Excess Returns analysis suggests Nu Holdings may be overvalued by 76.9%. Discover 834 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Nu Holdings Price vs Earnings

For profitable companies, the Price-to-Earnings (PE) ratio is often viewed as one of the best ways to quickly assess value. The PE multiple captures how much investors are willing to pay for each dollar of a company's earnings and is especially useful when profits are stable and growing. Higher growth prospects and lower risks typically justify a higher "normal" PE ratio. More volatile earnings or higher uncertainties mean investors may expect a lower multiple.

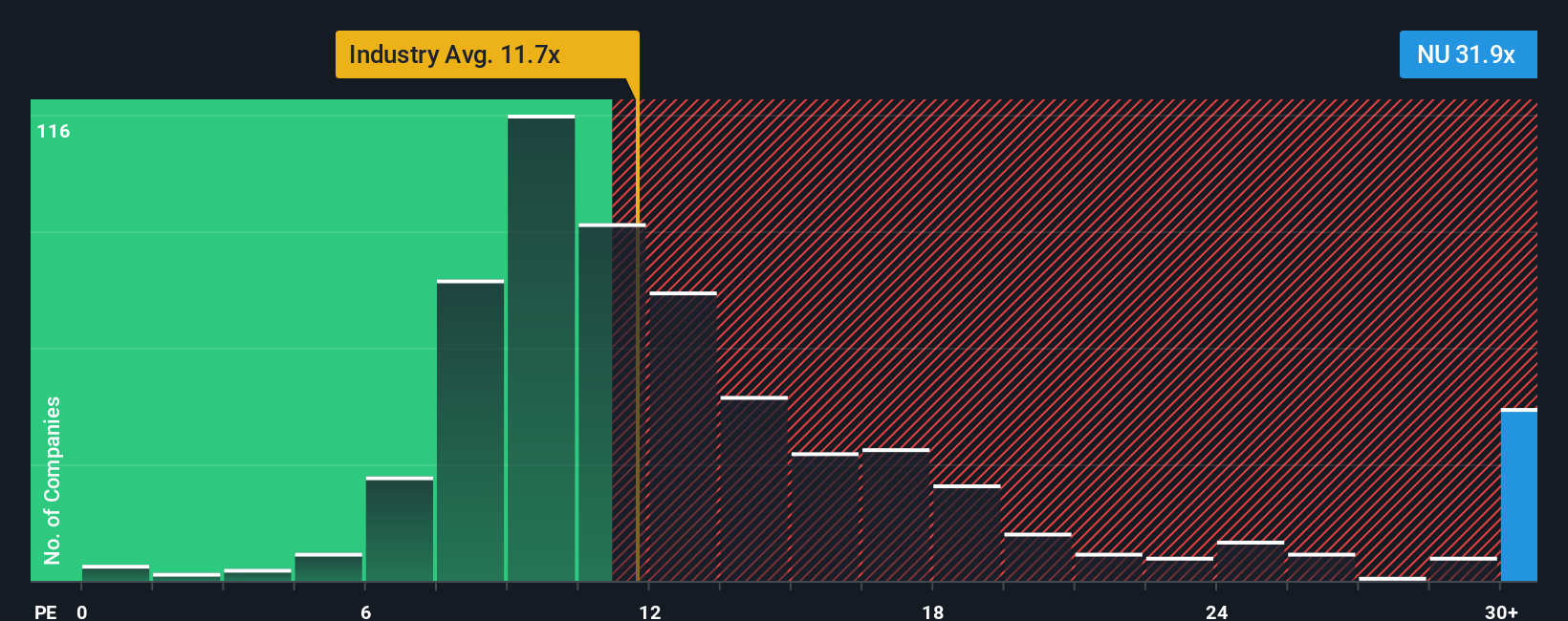

Nu Holdings currently trades at a PE ratio of 33.85x. For context, the Banks industry average PE is 11.16x, and its peer group averages 11.48x, suggesting Nu is commanding a significant premium to both benchmarks. This premium usually reflects higher anticipated growth, stronger profitability, or lower perceived risk.

Rather than relying solely on these market benchmarks, Simply Wall St introduces the concept of a Fair Ratio, a PE multiple tailored to Nu Holdings' unique profile, including factors like forecast earnings growth, profit margins, industry dynamics, market capitalization, and risk. This approach offers a more individualized, thorough comparison than simple peer or industry averages.

Nu Holdings’ Fair Ratio is calculated at 22.69x, meaning the current PE of 33.85x is noticeably higher. This sizeable gap suggests the market is pricing in an ambitious growth scenario that may not be fully supported by the fundamentals as they stand today.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nu Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, personalized investment story that connects your view of Nu Holdings' future to a concrete forecast of its revenue, profits, and margins. This turns your perspective into an estimate of fair value, not just a gut feeling.

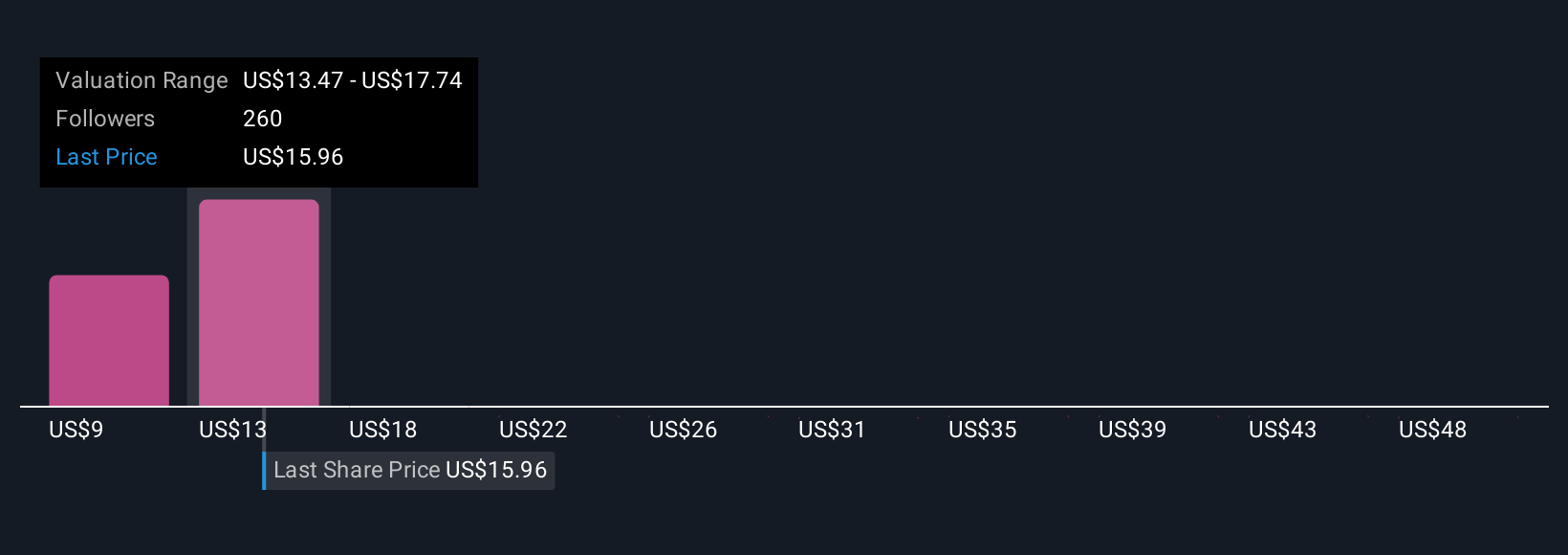

On Simply Wall St's platform, Narratives are an easy-to-use tool found on the Community page, enabling millions of investors to link real company stories to live financial forecasts and fair value estimates. Narratives allow you to confidently decide when to buy or sell by comparing your assumed fair value (based on your expectations) to the current market price, so you are always investing within your framework.

What makes this tool powerful is that Narratives update dynamically as news or earnings releases come in, ensuring your valuation stays current with fresh data. For example, one investor may believe Nu can keep growing fast and assigns a high fair value of $20 per share, while another, more cautious, sees risks from increased competition and values it at $14. Both are using the same Narrative system but very different assumptions.

Do you think there's more to the story for Nu Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives