- United States

- /

- Machinery

- /

- NasdaqGS:CECO

Undervalued Small Caps With Insider Buying In November 2025

Reviewed by Simply Wall St

As the U.S. stock market faces renewed concerns over AI valuations and economic uncertainty, small-cap stocks in the S&P 600 have been particularly sensitive to these shifts. Despite broader market challenges, opportunities may exist within this segment for investors seeking value plays with potential insider confidence. In such a volatile environment, identifying stocks that demonstrate strong fundamentals and insider buying can be a promising strategy for those looking to navigate current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanmi Financial | 10.9x | 3.2x | 49.96% | ★★★★★☆ |

| PCB Bancorp | 8.8x | 2.8x | 30.27% | ★★★★★☆ |

| Peoples Bancorp | 9.9x | 1.8x | 47.01% | ★★★★★☆ |

| Limbach Holdings | 26.2x | 1.6x | 47.37% | ★★★★★☆ |

| Citizens & Northern | 11.0x | 2.7x | 45.06% | ★★★★☆☆ |

| S&T Bancorp | 10.9x | 3.7x | 40.31% | ★★★★☆☆ |

| Farmland Partners | 6.4x | 7.9x | -38.03% | ★★★★☆☆ |

| First Northern Community Bancorp | 9.8x | 2.9x | 46.49% | ★★★★☆☆ |

| Washington Trust Bancorp | NA | 4.6x | 25.57% | ★★★☆☆☆ |

| Shore Bancshares | 9.4x | 2.5x | -49.93% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

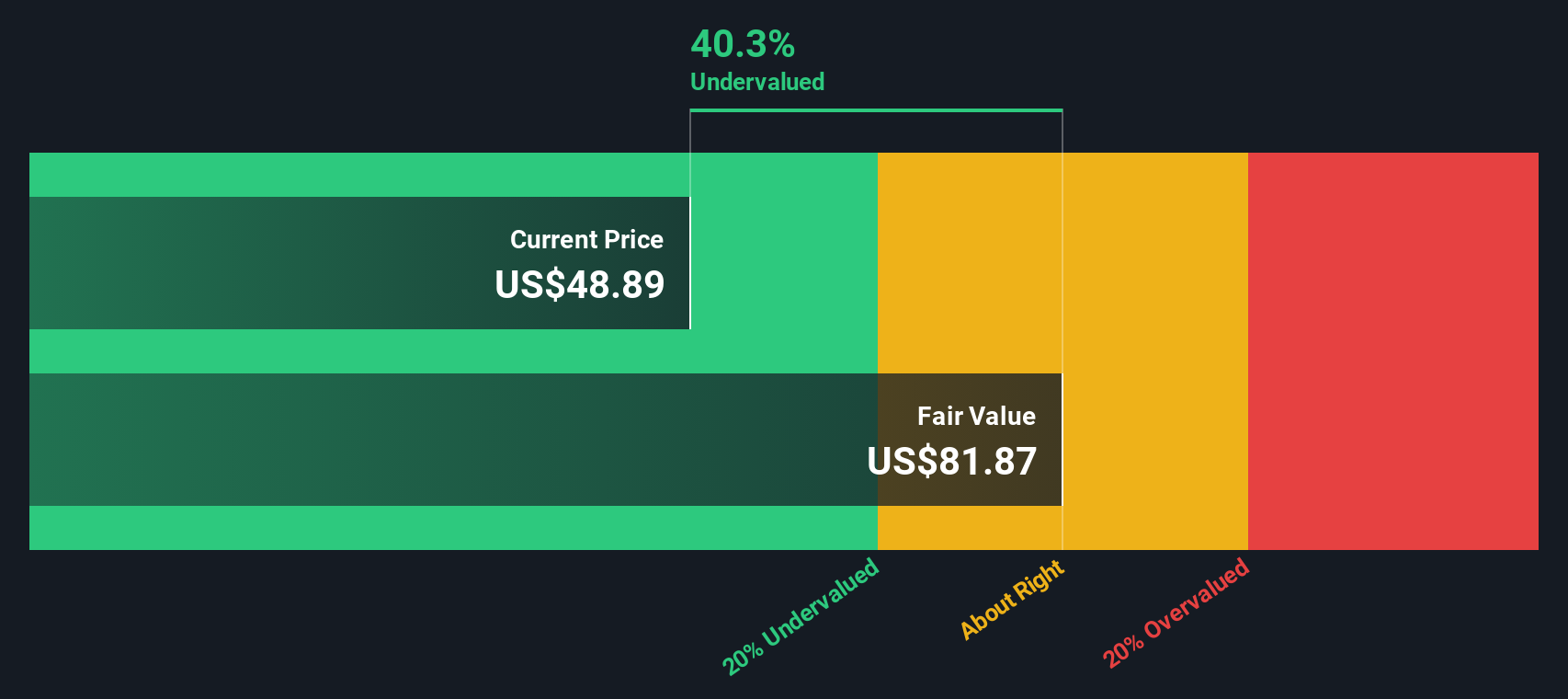

CECO Environmental (CECO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: CECO Environmental is a company specializing in providing engineered systems and industrial process solutions, with a market cap of approximately $0.76 billion.

Operations: CECO Environmental generates revenue primarily through its Engineered Systems and Industrial Process Solutions segments, with recent revenues of $498.61 million and $219.65 million, respectively. The company's cost of goods sold (COGS) has shown variability, impacting its gross profit margin, which reached 35.24% in the most recent period. Operating expenses are a significant portion of costs, with general and administrative expenses being a major component.

PE: 36.8x

CECO Environmental, a smaller U.S. company, shows potential with its forecasted 13.19% annual revenue growth and recent insider confidence through share purchases in the last quarter of 2025. Despite earnings being impacted by one-off items and reliance on external borrowing, CECO's nine-month sales surged to US$559.69 million from US$399.37 million year-over-year, while net income rose significantly to US$46.99 million from US$8.08 million previously, indicating operational improvements amid financial challenges and market opportunities ahead with projected revenues for 2026 between US$850 million and US$950 million.

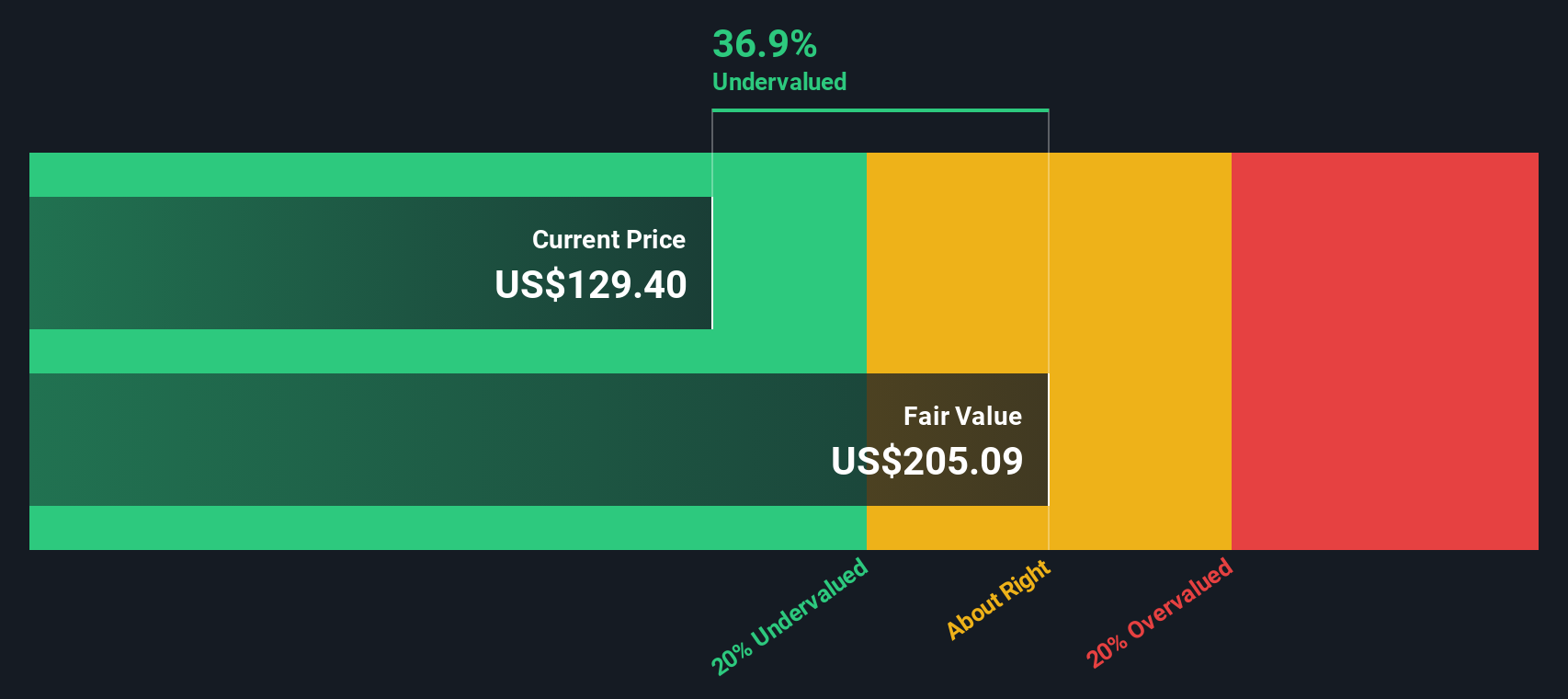

Babcock & Wilcox Enterprises (BW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Babcock & Wilcox Enterprises specializes in providing energy and environmental technologies and services, with a focus on thermal, renewable, and environmental segments, and has a market capitalization of approximately $0.51 billion.

Operations: Babcock & Wilcox Enterprises generates revenue primarily from its Thermal, Renewable, and Environmental segments. The company's gross profit margin has shown fluctuations, reaching 26.52% in the third quarter of 2024. Operating expenses have been a significant cost factor, with general and administrative expenses consistently being a major component.

PE: -7.5x

Babcock & Wilcox Enterprises, a smaller U.S. company, is making strategic moves despite financial challenges. Recently unprofitable with volatile shares, it has no customer deposits and relies on external borrowing. The firm is enhancing its AI Data Center power supply market presence with a $1.5 billion project for Applied Digital AI Factory and exploring clean energy through partnerships like Cache Power's hydrogen hub in Canada. Insider confidence is evident as they continue to buy shares, signaling potential value recognition in the current market environment.

Nicolet Bankshares (NIC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nicolet Bankshares operates as a financial holding company that provides consumer and commercial banking services, with a market capitalization of approximately $1.02 billion.

Operations: Nicolet Bankshares generates revenue primarily from consumer and commercial banking services, reaching $375.96 million in the latest period. The company consistently reports a gross profit margin of 100%, indicating no cost of goods sold is recorded in its financials. Operating expenses are significant, with general and administrative expenses accounting for a large portion, totaling $167.15 million recently. Net income margin has shown variability over time, with the most recent figure at 38.53%.

PE: 12.7x

Nicolet Bankshares, a smaller player in the U.S. market, has shown promising financial growth with net income rising to US$41.74 million for Q3 2025 from US$32.52 million the previous year. Earnings per share also increased significantly during this period. Insider confidence is evident as they have actively purchased shares recently, signaling potential value recognition within the company. Additionally, Nicolet's ongoing acquisition of MidWestOne could further enhance its market position and growth prospects in coming years.

Turning Ideas Into Actions

- Take a closer look at our Undervalued US Small Caps With Insider Buying list of 63 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CECO

CECO Environmental

Provides critical solutions in industrial air quality, industrial water treatment, and energy transition solutions in the United States, the United Kingdom, the Netherlands, China, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives