- United States

- /

- Banks

- /

- NYSE:NIC

Nicolet Bankshares (NIC): Assessing Valuation After Recent Steady Share Performance

Reviewed by Kshitija Bhandaru

See our latest analysis for Nicolet Bankshares.

Over the past year, Nicolet Bankshares has quietly posted a 0.46% total shareholder return, suggesting steady momentum even as its recent share price has seen only minor movement. As markets weigh shifting risk and growth prospects, the longer-term view still signals gradual confidence in the company's position.

If you’re looking to branch out beyond banks, now is a great moment to expand your search and discover fast growing stocks with high insider ownership.

Yet with shares trading at a discount to some analyst targets and a moderate valuation, the real question remains: is the market underestimating Nicolet Bankshares’ future potential, or is everything already baked into the price?

Price-to-Earnings of 14.6x: Is it justified?

Nicolet Bankshares shares closed at $133.57, trading at a price-to-earnings ratio of 14.6x. This sits below the peer average, hinting at potential value relative to other regional banks.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of the company’s earnings and provides insight into market expectations for future profit growth. For a bank like Nicolet, this is a central indicator of market sentiment and sector confidence.

Currently, Nicolet Bankshares’ P/E is lower than the average among its peers (18.6x). This suggests the market may be discounting the company’s future outlook. However, when compared to the estimated fair P/E ratio of 11.5x, the stock actually looks somewhat expensive, indicating that investors might be pricing in higher-than-justified growth or quality expectations.

The level the market could move toward, guided by fair-value regression models, is the fair P/E ratio of 11.5x. This benchmark serves as a potential anchor for future valuation adjustments.

Explore the SWS fair ratio for Nicolet Bankshares

Result: Price-to-Earnings of 14.6x (ABOUT RIGHT)

However, slowing revenue growth and modest net income gains could present challenges. This may prompt investors to reassess the company's near-term prospects.

Find out about the key risks to this Nicolet Bankshares narrative.

Another View: DCF Model Offers a Different Angle

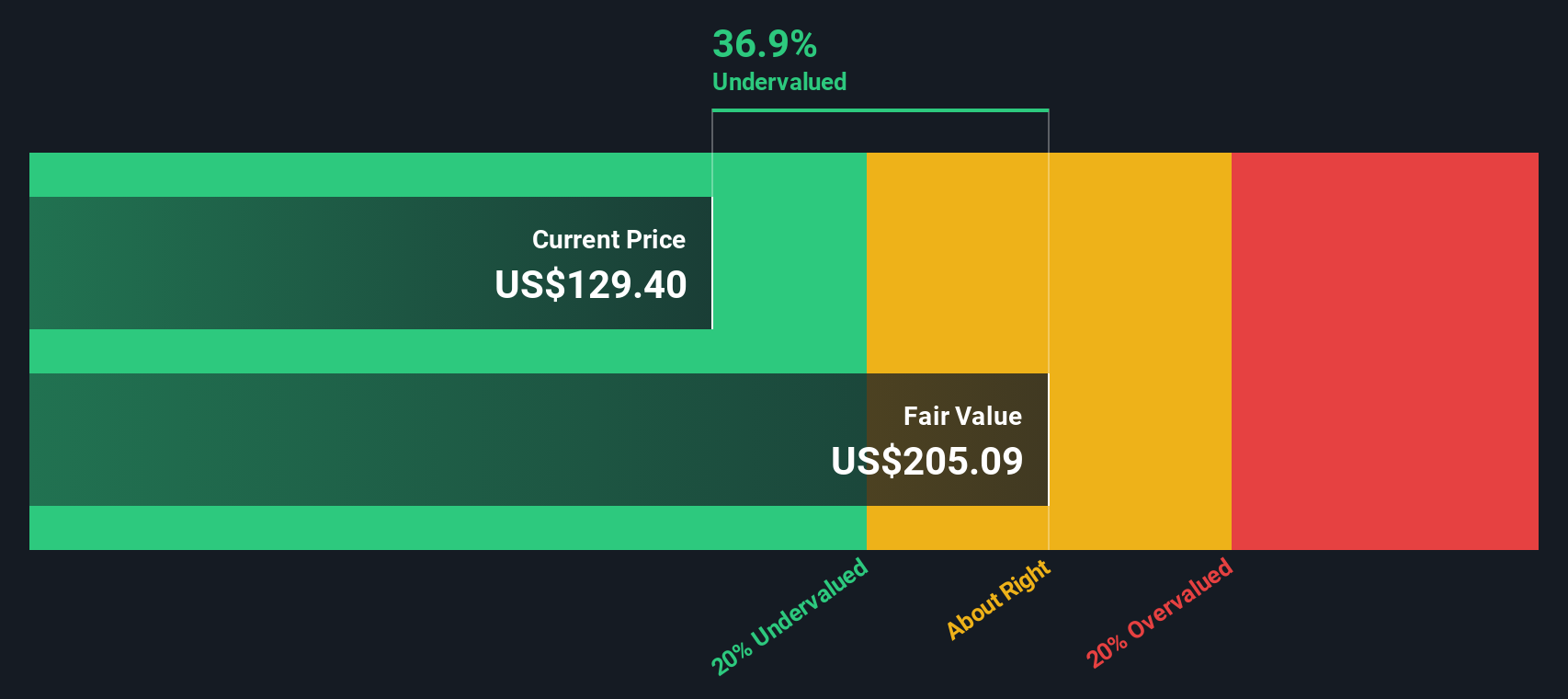

Switching perspectives, the SWS DCF model paints a much more optimistic picture for Nicolet Bankshares. According to this approach, the shares are trading about 34% below their estimated fair value. Could the market be missing this deeper value, or is the risk profile higher than it seems?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nicolet Bankshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nicolet Bankshares Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own take on Nicolet Bankshares in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Nicolet Bankshares.

Looking for more investment ideas?

Don’t wait on opportunities. Propel your investing goals forward with a range of hand-picked stock ideas using Simply Wall Street’s powerful screener tools.

- Grow your portfolio’s yield by tracking top income generators among these 19 dividend stocks with yields > 3% offering steady payouts above 3%.

- Stay ahead of the tech curve and capitalize on breakthroughs with access to these 24 AI penny stocks shaping tomorrow’s innovations today.

- Uncover potential market mispricings by hunting for these 901 undervalued stocks based on cash flows and get in before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nicolet Bankshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIC

Nicolet Bankshares

Operates as the bank holding company for Nicolet National Bank that provides banking products and services for businesses and individuals in Wisconsin, Michigan, and Minnesota.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives