- United States

- /

- Banks

- /

- NYSE:NBHC

A Look at National Bank Holdings's Valuation as Fed Signals Boost Optimism for Regional Banks

Reviewed by Simply Wall St

Recent remarks from the New York Federal Reserve President have sparked optimism for regional banks. National Bank Holdings (NBHC) shares responded positively as the likelihood of an upcoming interest rate cut increased. This development provided some relief amid ongoing sector concerns.

See our latest analysis for National Bank Holdings.

National Bank Holdings has seen its share price bounce recently on hopes that looser Fed policy could support regional lenders after a tough stretch. While the year-to-date share price return of -12.08% reflects ongoing sector pressures, the 1-year total shareholder return stands at -22.94%, showing longer-term investors are still waiting for renewed momentum.

If you’re watching how rate shifts are shaking up the market, it might be time to explore fresh opportunities and discover fast growing stocks with high insider ownership

The question for investors now is whether National Bank Holdings is trading at a compelling discount given its recent underperformance, or if the market has already anticipated a brighter outlook and priced in future growth.

Most Popular Narrative: 15.5% Undervalued

National Bank Holdings’ most popular narrative places fair value well above its last close, signaling room for the shares to move higher if projections play out. This narrative reflects optimistic assumptions about the company's future growth and strategic moves in digital banking.

The successful launch of the 2UniFi platform, with positive early feedback and plans for further feature expansion (including fee-based membership offerings and integrated fintech services for SMBs), positions the company to capitalize on the shift toward digital banking and technology-driven financial solutions. This could potentially drive incremental noninterest income and expand high-margin fee revenue streams.

Curious about what powers this bold valuation? The underlying forecast builds on sharply rising revenues, innovative digital rollout, and ambitious margin improvements. Want to see which forward-looking financial assumptions make this price target tick?

Result: Fair Value of $43.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a heavy concentration in regional markets and risks related to digital adoption could challenge the optimistic outlook for National Bank Holdings going forward.

Find out about the key risks to this National Bank Holdings narrative.

Another View: Is the Market Missing Something?

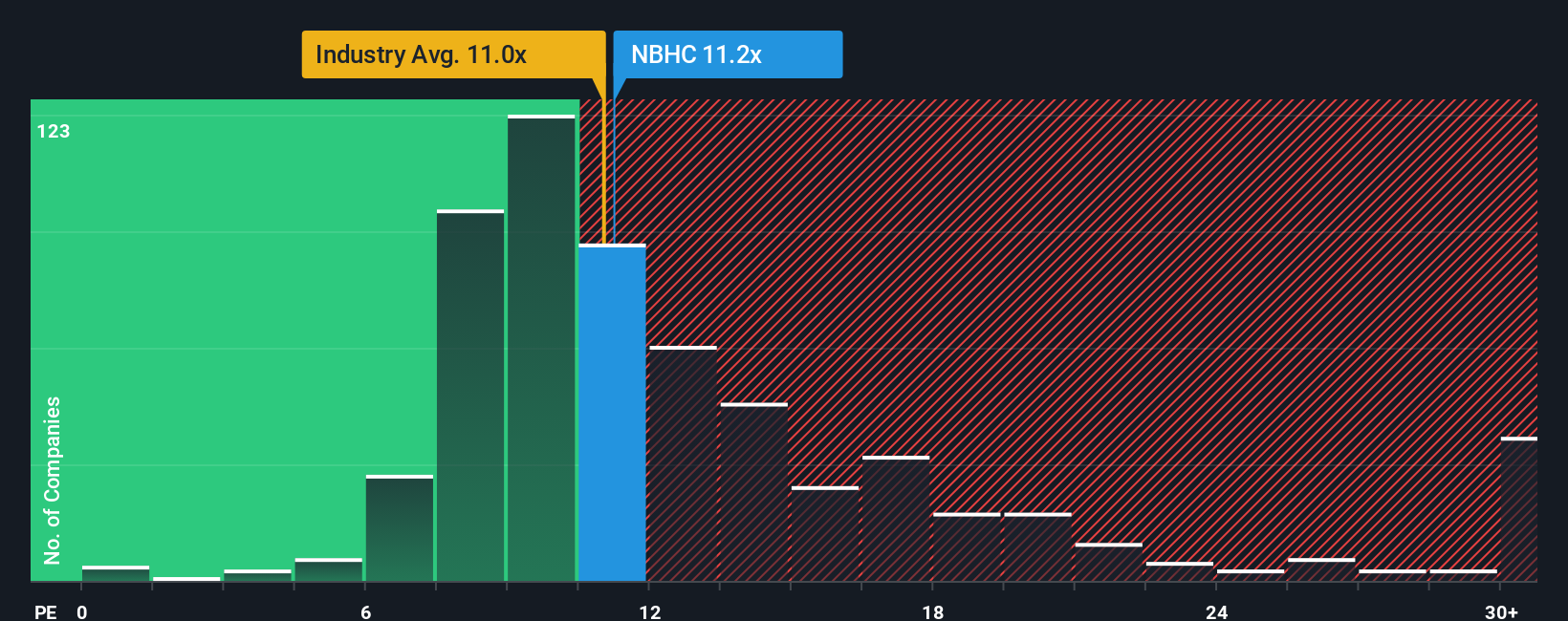

Looking through another lens, National Bank Holdings appears more expensive than both the US Banks industry average and its closest peers when judged by its price-to-earnings ratio: 11.6x for NBHC compared to 11.2x for the industry and 10.9x for peers. This suggests investors are already paying up relative to rivals, and the company trades below its fair ratio of 12.8x. This is a level the market could eventually move toward. Does this gap point to a real opportunity or is it a red flag for valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own National Bank Holdings Narrative

If you’d rather chart your own course or want to dig deeper into the numbers behind National Bank Holdings, you can build a personalized outlook in just a few minutes with Do it your way.

A great starting point for your National Bank Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Don't just wait on the sidelines when there are smarter ways to put your money to work. Uncover promising stocks tailored to unique investment goals today.

- Unlock tomorrow's winning ideas by checking out these 26 AI penny stocks, which are fueling innovations in artificial intelligence and disruption across industries.

- Tap into steady income and robust returns with these 14 dividend stocks with yields > 3%, an option well suited for investors seeking reliable yields over time.

- Capitalize on overlooked value and gain an edge by reviewing these 924 undervalued stocks based on cash flows that may benefit from strong fundamentals and attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NBHC

National Bank Holdings

Operates as the bank holding company for NBH Bank that provides various banking products and financial services to commercial, business, and consumer clients in the United States.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.