- United States

- /

- Banks

- /

- NYSE:LOB

Why Live Oak Bancshares (LOB) Is Down 8.0% After Delaying Its 10-Q SEC Filing And What's Next

Reviewed by Sasha Jovanovic

- On November 12, 2025, Live Oak Bancshares announced it would be unable to file its upcoming 10-Q quarterly report by the SEC deadline.

- Such delays in regulatory filings can prompt concerns about compliance and may raise questions among stakeholders regarding operational or financial transparency.

- We'll explore how the delayed SEC filing announcement could impact investor confidence and shift perspectives on Live Oak Bancshares' future outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Live Oak Bancshares Investment Narrative Recap

To be a shareholder in Live Oak Bancshares right now, you need to believe in the company's ability to grow through digital product adoption and its strength in SBA lending, while accepting exposure to regulatory and operational risks. The delayed 10-Q filing is unlikely to materially affect Live Oak’s most important near-term catalyst, continued digital banking and loan origination growth, but it does heighten attention on regulatory compliance, which is among the company’s biggest current risks.

One recent announcement that stands out in the context of compliance and operational transparency is the substantial increase in net charge-offs in Q3 2025, which rose to $16.82 million from $1.71 million a year earlier. While this news isn’t directly related to the filing delay, it spotlights the importance of robust risk controls and clear disclosures as Live Oak scales its digital lending platforms, both of which remain near-term catalysts for the business.

Yet, investors should also be mindful of what happens if regulatory scrutiny and compliance costs start to escalate…

Read the full narrative on Live Oak Bancshares (it's free!)

Live Oak Bancshares' outlook anticipates $1.1 billion in revenue and $328.0 million in earnings by 2028. This hinges on a 37.6% annual revenue growth rate and a $271.9 million increase in earnings from the current $56.1 million level.

Uncover how Live Oak Bancshares' forecasts yield a $42.00 fair value, a 42% upside to its current price.

Exploring Other Perspectives

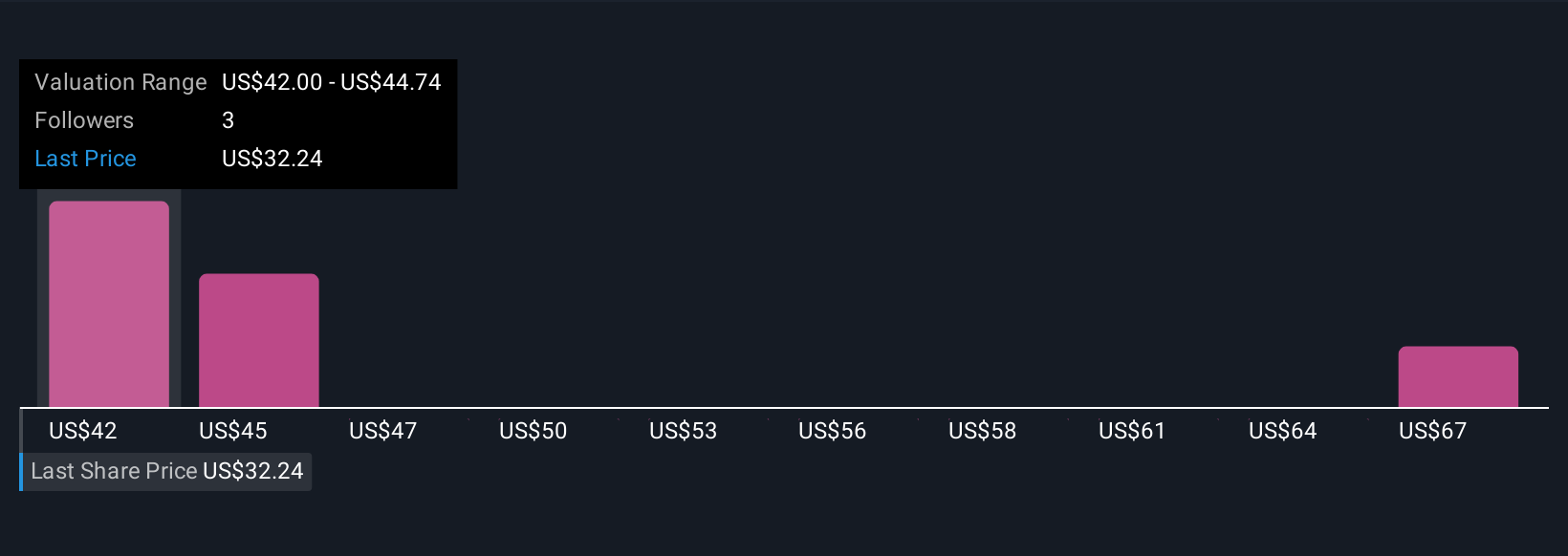

Simply Wall St Community members have set fair value estimates for Live Oak Bancshares as high as US$69.40, with the lowest at US$42.00, reflecting three independent views. Given recent news around delayed financial reporting, questions about regulatory pressure may have broader consequences for future margins and growth, so it is worth comparing these differing expectations.

Explore 3 other fair value estimates on Live Oak Bancshares - why the stock might be worth over 2x more than the current price!

Build Your Own Live Oak Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Live Oak Bancshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Live Oak Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Live Oak Bancshares' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOB

Live Oak Bancshares

Operates as the bank holding company for Live Oak Banking Company that provides various banking products and services in the United States.

High growth potential and good value.

Market Insights

Community Narratives