- United States

- /

- Banks

- /

- NYSE:LOB

Assessing Live Oak Bancshares (LOB) Valuation Following Continued Share Price Weakness

Reviewed by Simply Wall St

See our latest analysis for Live Oak Bancshares.

Shares have steadily lost ground over the past year, with a 1-day share price return of -1.49% adding to a year-to-date decline of 19.2%. The total shareholder return over the past year now sits at -23.9%, reflecting a stretch of underwhelming momentum even as some regional peers have shown recovery signs.

If you’re curious about what other sectors might offer stronger near-term momentum, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

Given Live Oak Bancshares’ underperformance despite double-digit revenue and net income growth, is the market missing a potential rebound or accurately reflecting the company’s future outlook? Could this be a compelling entry point for buyers?

Most Popular Narrative: 25.9% Undervalued

Live Oak Bancshares closed at $31.14, while the most widely followed narrative sets fair value at $42, significantly above the current price. This contrast points to a sharp disconnect between market sentiment and expectations surrounding the company’s digital ambitions.

“The rapid scaling of new digital products, such as Live Oak Express and checking account offerings (both essentially at zero in 2023 and now meaningfully contributing to loan and deposit growth), positions the company to capture increased demand from the ongoing shift toward tech-enabled banking and digital-native small business owners, supporting sustained revenue and margin growth.”

What’s fueling the massive gap between Wall Street’s target and today’s price? The narrative hinges on aggressive profit margin expansion and a forecast for turbocharged revenue growth. These numbers could redefine what investors expect from a regional bank. Curious about how these ambitious growth targets support such a bold valuation? It’s all in the details awaiting your next click.

Result: Fair Value of $42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on government-backed loans or the rise of new digital competitors could quickly challenge Live Oak Bancshares' positive outlook.

Find out about the key risks to this Live Oak Bancshares narrative.

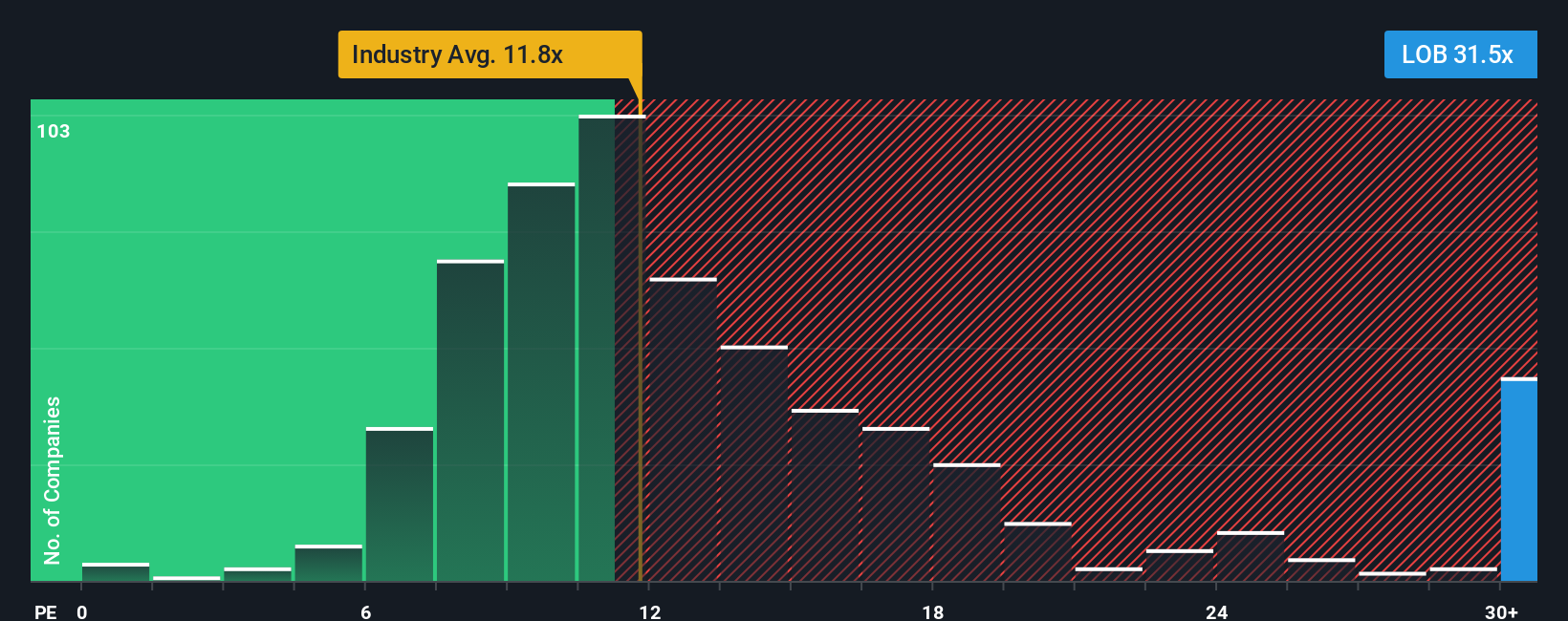

Another View: The Earnings Multiple Perspective

Looking at valuation through one key earnings ratio, Live Oak Bancshares trades at 20.8 times earnings, which is well above the US banking industry average of 11 times. Even when compared to its closest peers, it still appears attractive, as the peer group trades at a much loftier 60 times earnings. However, its ratio also sits slightly above the estimated fair ratio of 19.2, which is where the market could settle over time. This kind of gap suggests that investors may be paying up for perceived growth, but it also leaves less margin for error if that growth slows. Could this be cautious optimism, or a risk that the market grows impatient?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Live Oak Bancshares Narrative

If you see things differently or want to test your own investment logic, you can pull the numbers together and shape a unique perspective in just minutes. Do it your way

A great starting point for your Live Oak Bancshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing game by tapping into exclusive opportunities the crowd often misses. These powerful screeners could help you spot the next big winner before everyone else.

- Tap into strong, regular payouts by using these 22 dividend stocks with yields > 3% to target stocks offering consistent income with yields above 3%.

- Get ahead of the tech curve and ride the next AI revolution with these 26 AI penny stocks, which spotlights companies breaking new ground in artificial intelligence.

- Zero in on great bargains with these 840 undervalued stocks based on cash flows, which highlights stocks trading below their true cash flow value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOB

Live Oak Bancshares

Operates as the bank holding company for Live Oak Banking Company that provides various banking products and services in the United States.

High growth potential and good value.

Market Insights

Community Narratives