- United States

- /

- Banks

- /

- NYSE:KEY

Unveiling Three US Stocks That May Be Undervalued In July 2024

Reviewed by Simply Wall St

As the U.S. markets experience fluctuations, with the S&P 500 and Nasdaq Composite showing recent declines amid pressures on big tech stocks, investors may find potential opportunities in undervalued stocks. In such a market environment, identifying stocks that are priced below their intrinsic value could offer attractive investment prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Noble (NYSE:NE) | $47.70 | $93.44 | 49% |

| UMB Financial (NasdaqGS:UMBF) | $97.72 | $189.32 | 48.4% |

| Marriott Vacations Worldwide (NYSE:VAC) | $85.37 | $169.56 | 49.7% |

| Victory Capital Holdings (NasdaqGS:VCTR) | $52.67 | $100.35 | 47.5% |

| Daqo New Energy (NYSE:DQ) | $17.23 | $32.91 | 47.6% |

| Duckhorn Portfolio (NYSE:NAPA) | $7.22 | $14.40 | 49.9% |

| Open Lending (NasdaqGM:LPRO) | $5.82 | $11.15 | 47.8% |

| TAL Education Group (NYSE:TAL) | $10.40 | $19.88 | 47.7% |

| Genius Sports (NYSE:GENI) | $6.58 | $12.57 | 47.7% |

| MediaAlpha (NYSE:MAX) | $14.44 | $27.82 | 48.1% |

We're going to check out a few of the best picks from our screener tool.

Atlassian (NasdaqGS:TEAM)

Overview: Atlassian Corporation operates globally, designing, developing, licensing, and maintaining a range of software products with a market capitalization of approximately $43.63 billion.

Operations: The company generates its revenue primarily from software and programming services, totaling approximately $4.17 billion.

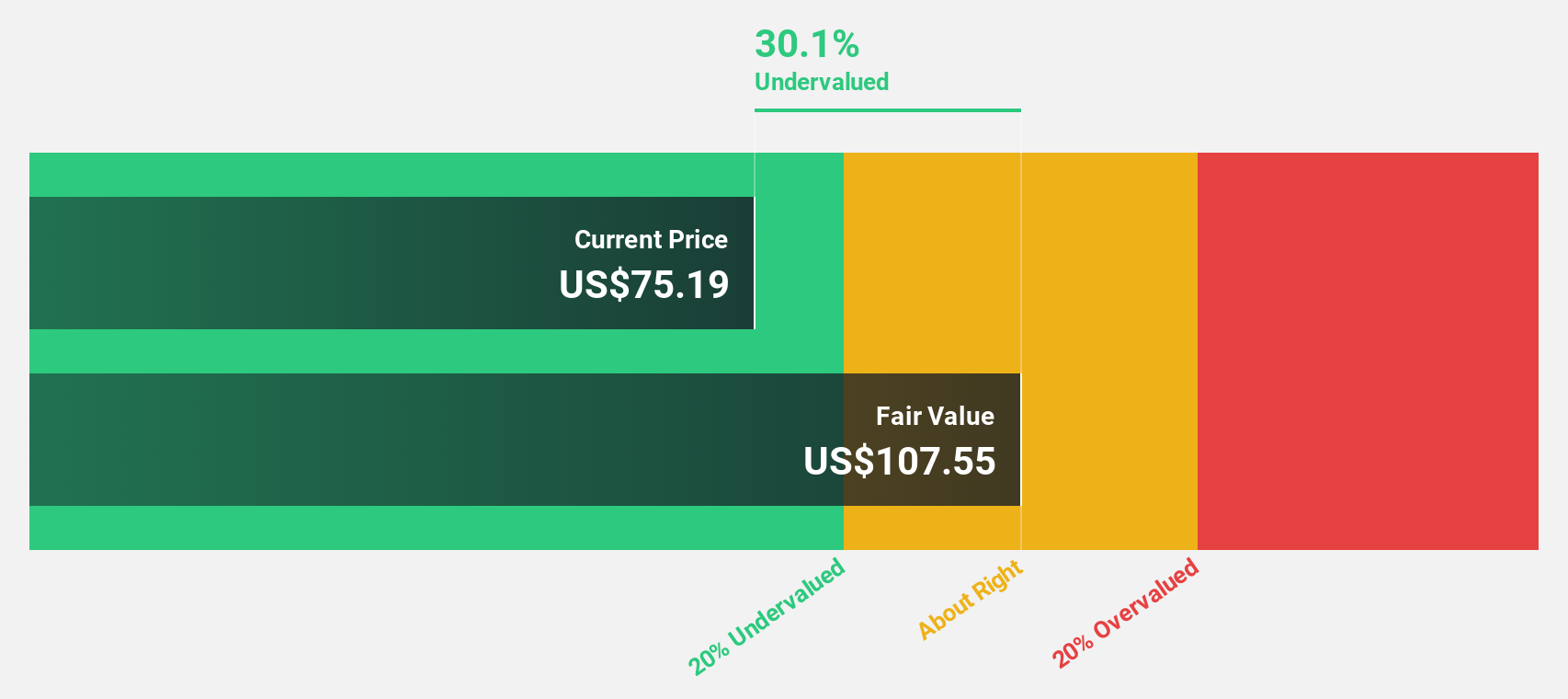

Estimated Discount To Fair Value: 31.6%

Atlassian, currently trading at US$178.22, appears undervalued based on a discounted cash flow (DCF) analysis with an estimated fair value of US$260.46. Despite recent debt issuances totaling nearly US$1 billion in senior notes, the company's strategic board appointments and integration of AI tools signal robust forward-looking strategies. These efforts align with its financial trajectory, as Atlassian is expected to achieve substantial revenue growth (15.9% annually) and turn profitable within three years, outpacing average market projections.

- The analysis detailed in our Atlassian growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Atlassian's balance sheet health report.

Estée Lauder Companies (NYSE:EL)

Overview: Estée Lauder Companies Inc. operates globally, specializing in the manufacturing, marketing, and sales of skin care, makeup, fragrance, and hair care products with a market capitalization of approximately $35.78 billion.

Operations: The company's revenue is segmented into skin care at $7.62 billion, makeup at $4.46 billion, fragrance at $2.55 billion, and hair care at $0.63 billion.

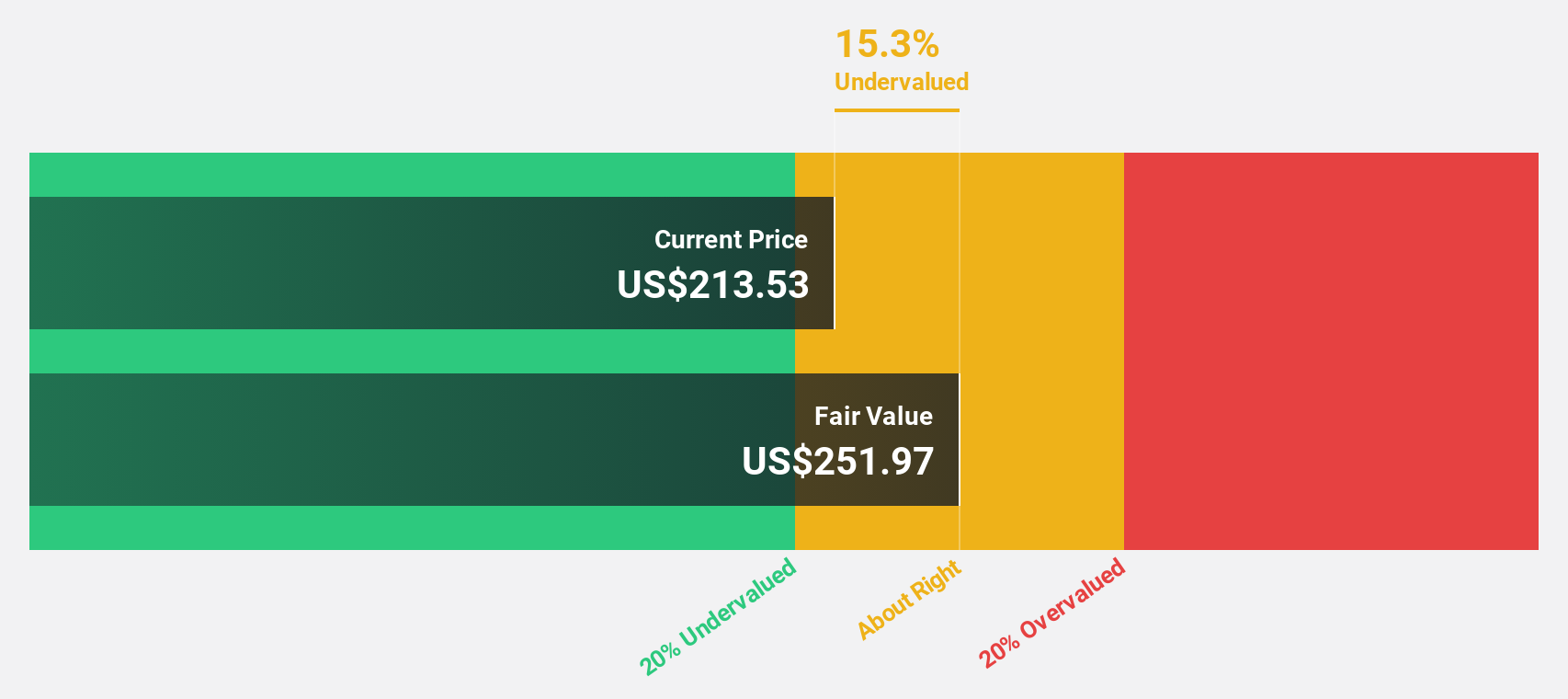

Estimated Discount To Fair Value: 27.4%

Estée Lauder, trading at US$99.9, is perceived as undervalued based on cash flow analyses, with a fair value estimated at US$137.57. Despite slower revenue growth projections of 6.1% annually compared to the market average, its profit growth is expected to exceed market trends significantly over the next three years. Recent executive transitions could infuse new strategies in finance and operations, potentially enhancing governance and long-term value creation amidst high debt levels and underwhelming profit margins from the previous year.

- Our earnings growth report unveils the potential for significant increases in Estée Lauder Companies' future results.

- Delve into the full analysis health report here for a deeper understanding of Estée Lauder Companies.

KeyCorp (NYSE:KEY)

Overview: KeyCorp, functioning as the holding company for KeyBank National Association, offers a range of retail and commercial banking products and services in the United States, with a market capitalization of $14.89 billion.

Operations: The company generates revenue through a variety of retail and commercial banking products and services across the United States.

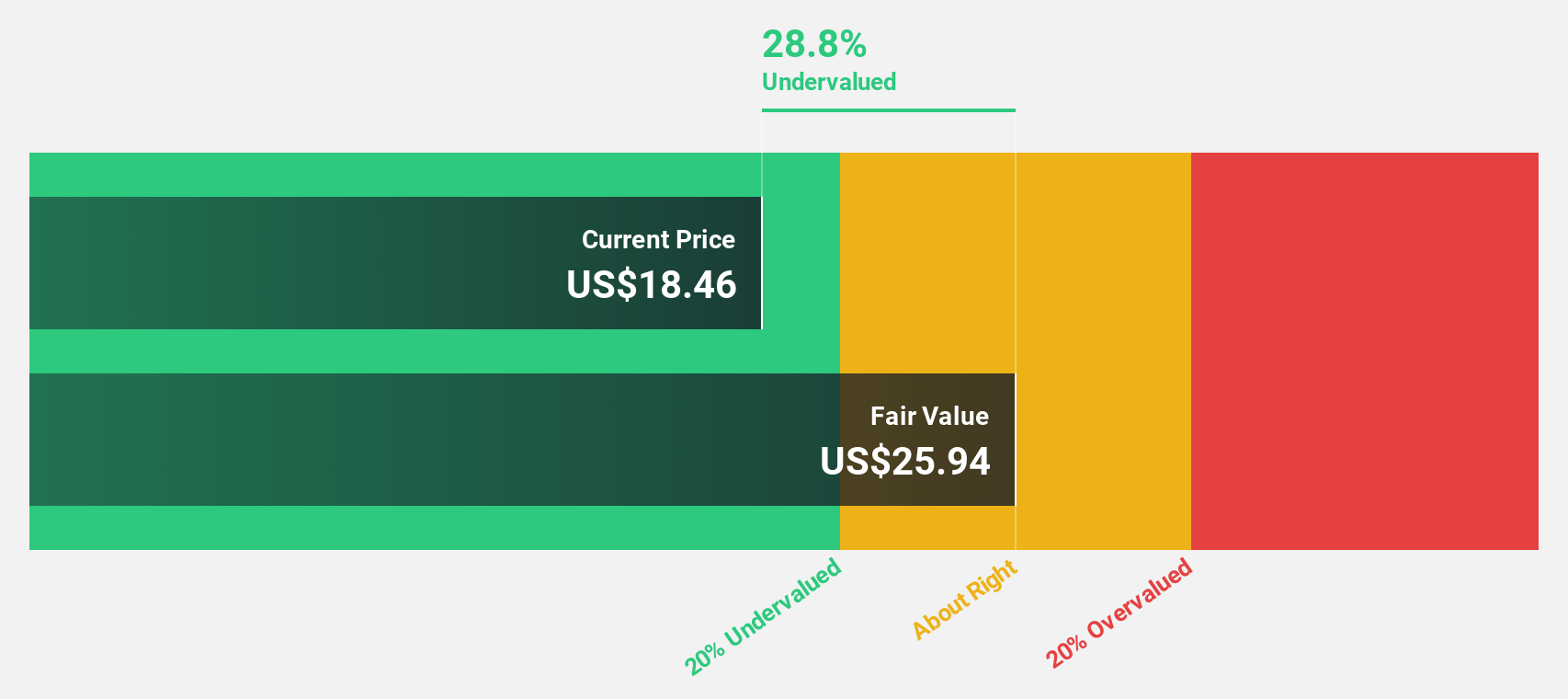

Estimated Discount To Fair Value: 29.3%

KeyCorp, currently priced at US$16.13, is identified as undervalued with a DCF-based fair value of US$22.82, reflecting significant potential upside. Despite a recent dip in net interest income and net income as reported in its latest quarterly results, KeyCorp's earnings are expected to grow robustly at 34.5% annually over the next three years, outpacing the US market forecast of 14.9%. However, challenges include a low forecasted return on equity and shrinking profit margins year-over-year, necessitating cautious optimism for investors looking at cash flow valuations.

- Upon reviewing our latest growth report, KeyCorp's projected financial performance appears quite optimistic.

- Get an in-depth perspective on KeyCorp's balance sheet by reading our health report here.

Summing It All Up

- Delve into our full catalog of 185 Undervalued US Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KeyCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEY

KeyCorp

Operates as the holding company for KeyBank National Association that provides various retail and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.