- United States

- /

- Banks

- /

- NYSE:KEY

Reassessing KeyCorp (KEY) Valuation After Its Recent Share Price Momentum

Reviewed by Simply Wall St

KeyCorp (KEY) has quietly delivered a solid stretch of gains, with the stock up about 19% over the past month and 13% in the past 3 months, outpacing many regional banking peers.

See our latest analysis for KeyCorp.

Zooming out, that strong 1 month share price return sits on top of a 24.9% year to date share price gain and a 1 year total shareholder return of about 29%, suggesting momentum is still building as investors reassess regional bank risk and growth potential.

If KeyCorp's run has you thinking about where capital could work harder next, it might be worth scanning other banks and financials through solid balance sheet and fundamentals stocks screener (None results).

With shares already near analyst targets and trading at a sizable discount to some intrinsic value estimates, investors now face a key question: Is KeyCorp still underappreciated, or are markets already pricing in the next leg of growth?

Most Popular Narrative Narrative: 4.6% Undervalued

KeyCorp's most followed narrative pegs fair value just above the recent 21.21 close, implying modest upside if its growth story plays out.

The anticipated shift from net interest income (NII) headwinds to tailwinds due to a pivot in fixed asset repricing and the structure of swap and treasury maturities, expected to significantly enhance NII in the forthcoming quarters, impacting revenue growth positively. Improved deposit costs dynamics, with a more stable increase in deposit costs and a strategic focus on high value consumer and commercial deposits, aiming to fortify net interest margins and overall profitability.

Want to see how this interest income pivot translates into earnings power and valuation multiples usually reserved for sector leaders? The full narrative explains the potential for a sharper revenue trajectory, a reset in margins, and a shifting profit path that together support this fair value, along with the key assumptions analysts are using in their assessment of KeyCorp.

Result: Fair Value of $22.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising nonperforming loans, tighter capital requirements, or softer loan demand could quickly erode the currently optimistic earnings and valuation narrative.

Find out about the key risks to this KeyCorp narrative.

Another Way to Look at Value

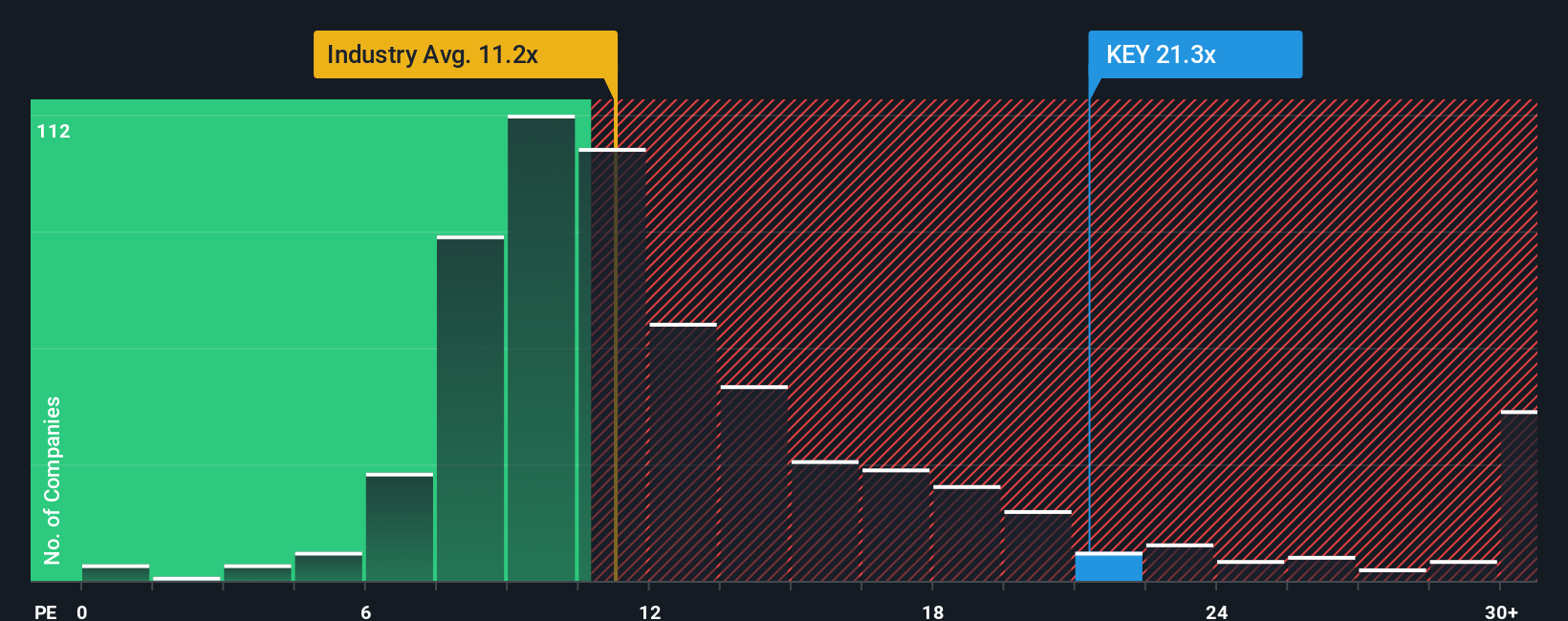

Even though the latest narrative suggests KeyCorp is 4.6% undervalued, our earnings based lens tells a different story. At about 24.9 times earnings versus 11.9 times for US banks, peers at 13.6 times, and a fair ratio of 19 times, the stock looks richly priced, leaving less room for error if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KeyCorp Narrative

If you see things differently or want to dig into the numbers yourself, you can build a complete narrative in minutes, Do it your way.

A great starting point for your KeyCorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Before you move on, consider using the Simply Wall Street Screener to uncover focused ideas that match the way you invest.

- Identify potential multi baggers early by targeting under the radar names through these 3629 penny stocks with strong financials with solid balance sheets and improving business momentum.

- Align your portfolio with structural growth by focusing on innovators in machine learning and automation via these 24 AI penny stocks.

- Support your income objectives by finding companies offering higher yields and resilient cash flows using these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if KeyCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEY

KeyCorp

Operates as the holding company for KeyBank National Association that provides various retail and commercial banking products and services in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion