- United States

- /

- Banks

- /

- NYSE:KEY

KeyCorp (KEY): Assessing Valuation Opportunities After a Month of Mixed Share Price Moves

Reviewed by Simply Wall St

See our latest analysis for KeyCorp.

KeyCorp’s share price has seen moderate ups and downs lately, but over the past year, patient shareholders have enjoyed a 6.6% total return, helped along by dividends. While recent momentum has been mixed, the longer-term trend remains positive.

If sector shifts in banking have you looking for new opportunities, it could be the right moment to broaden your search and discover fast growing stocks with high insider ownership

With KeyCorp’s shares currently trading at a notable discount to analyst price targets and showing solid recent financial growth, readers may wonder whether this is an overlooked value opportunity or if the market has already priced in the bank’s future potential.

Most Popular Narrative: 19.1% Undervalued

KeyCorp’s latest fair value estimate from the most closely watched narrative puts the stock notably above its recent close, suggesting room for upside. Market-watchers will want to scrutinize the drivers and see if the bullish thesis stands up.

Expansion in the wealth management and commercial payments sectors, marked by record production volumes and significant client growth, is poised to drive noninterest income upwards. This influences both revenue and net margins positively. Strong growth in the national third-party commercial loan servicing business provides a counter-cyclical revenue stream and insights into the commercial real estate market. This could bolster diversified revenue streams and enhance earnings stability.

What aggressive growth levers are behind this compelling valuation story? One future-facing factor—hint: it is not just about lending—could turn industry expectations upside down. Only the full narrative lays out the bold assumptions fueling this target. Want the specifics that might lead KeyCorp to outperform? Dive in for a breakdown of the projections.

Result: Fair Value of $21.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, an uptick in nonperforming loans or weaker loan demand could quickly challenge the bullish case and put pressure on KeyCorp's improving outlook.

Find out about the key risks to this KeyCorp narrative.

Another View: Checking the Numbers Against What Peers Pay

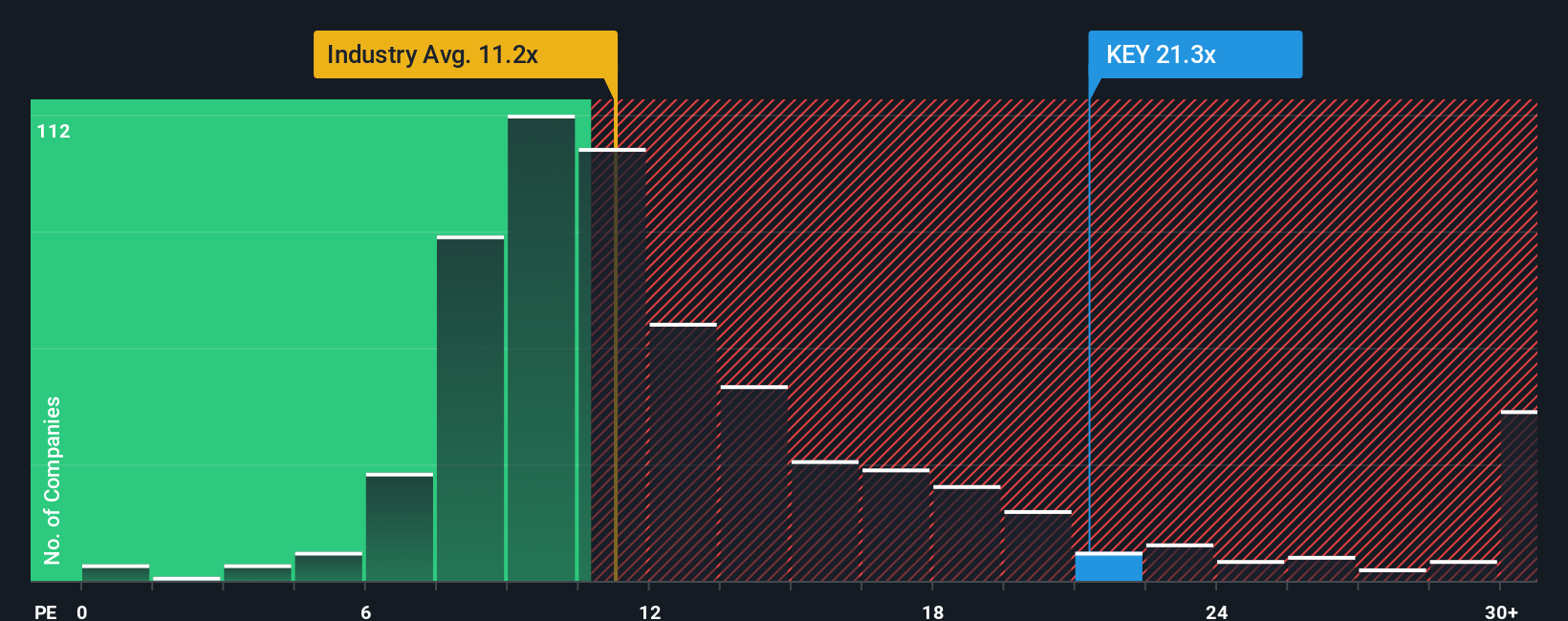

Looking at market-based measures, KeyCorp trades at a price-to-earnings ratio of 20.9x, which is well above both the average US Banks industry ratio (11.3x) and its peers (11.8x). Even compared to the fair ratio, calculated at 18.6x, KeyCorp appears expensive. This could suggest over-optimism, or it may indicate that the market is factoring in something significant that others do not see.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KeyCorp Narrative

If you have a different perspective or want to shape your own insights, take a few minutes to dig into the numbers and build your own view. Do it your way

A great starting point for your KeyCorp research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors constantly expand their horizons. Use the Simply Wall Street Screener now to uncover standout opportunities that could sharpen your portfolio edge before everyone else catches on.

- Capitalize on innovation and check out these 27 AI penny stocks, which are driving advancements in artificial intelligence for real-world impact across industries.

- Boost your search for reliable returns with these 17 dividend stocks with yields > 3%. This features companies consistently rewarding shareholders with robust yields above 3%.

- Catch the next financial trend and assess these 80 cryptocurrency and blockchain stocks, which showcases businesses at the forefront of cryptocurrency and blockchain disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KeyCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEY

KeyCorp

Operates as the holding company for KeyBank National Association that provides various retail and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives