- United States

- /

- Banks

- /

- NYSE:KEY

KeyCorp (KEY): Assessing Valuation Against Analyst Targets and Industry Multiples

Reviewed by Simply Wall St

See our latest analysis for KeyCorp.

KeyCorp's share price has moved with the market's mood swings over the past year, recently closing at $17.62. While short-term momentum has softened after a modest 30-day gain, its one-year total shareholder return remains slightly negative. This signals that the road ahead may hinge on renewed confidence or shifting fundamentals.

If recent movements have you wondering where else opportunity may be building, this could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With the stock near $17.62 and both analyst price targets and internal valuations suggesting upside, the question now becomes: is KeyCorp an undervalued pick, or is the market already factoring in any future gains?

Most Popular Narrative: 18.1% Undervalued

KeyCorp's widely followed narrative places its fair value at $21.51, well above the recent close of $17.62. This sets the stage for a discussion driven by robust growth expectations and shifts in revenue drivers.

The anticipated shift from net interest income (NII) headwinds to tailwinds is due to a pivot in fixed asset repricing and the structure of swap and treasury maturities. This is expected to significantly enhance NII in the forthcoming quarters, positively impacting revenue growth. Improved deposit costs dynamics, with a more stable increase in deposit costs and a strategic focus on high-value consumer and commercial deposits, are aimed at fortifying net interest margins and overall profitability.

Why do analysts think KeyCorp deserves a premium? The foundation of this narrative is bold profit margin expansion, underpinned by ambitious earnings and revenue growth. Discover which assumptions give this story its upside surprise.

Result: Fair Value of $21.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent asset quality challenges or weaker loan demand could quickly undermine the current optimism about KeyCorp's future earnings potential.

Find out about the key risks to this KeyCorp narrative.

Another View: What Do Market Ratios Suggest?

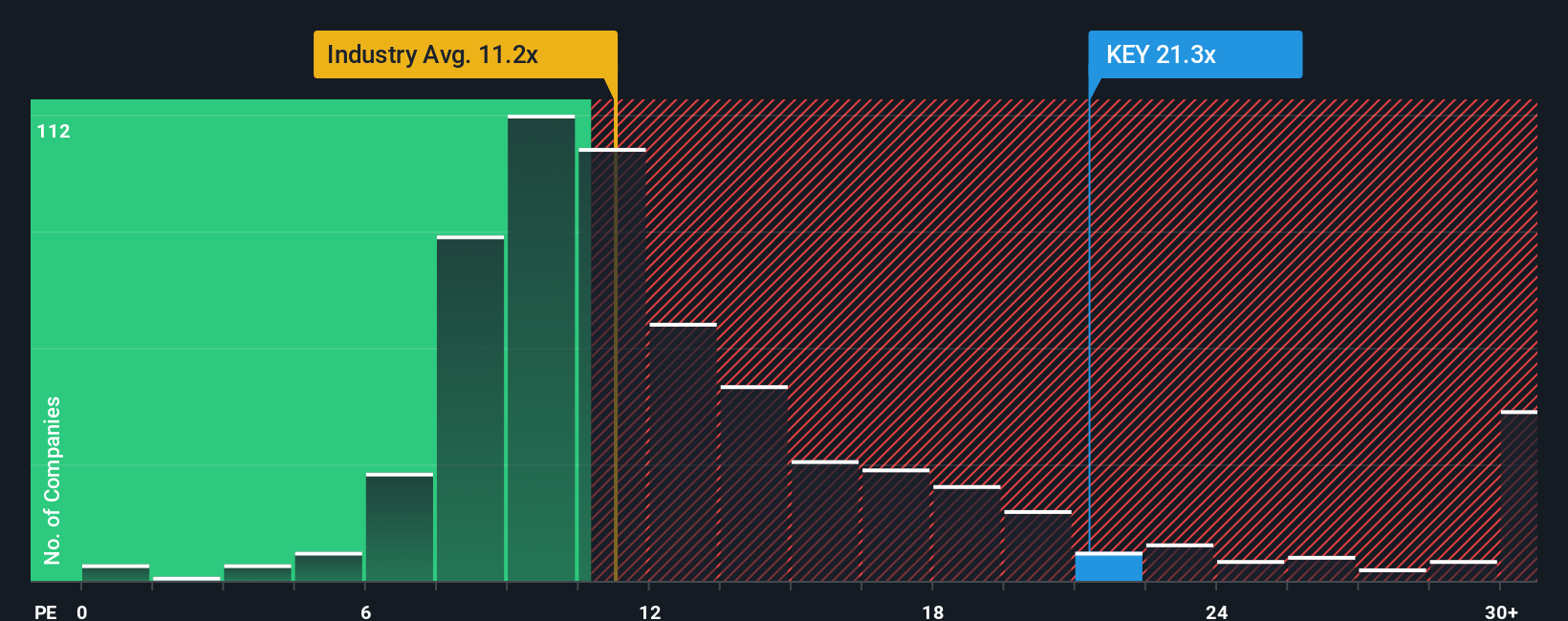

Looking at valuation through the lens of price-to-earnings, KeyCorp trades at 20.7x earnings, which is noticeably higher than both the US Banks industry average of 11.2x and its peers at 11.9x. Even relative to its fair ratio of 17.4x, KEY looks expensive. This discrepancy raises important questions about valuation risk: has the market run too far ahead, or is optimism justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KeyCorp Narrative

If the prevailing narratives do not match your perspective, you are welcome to dig into KeyCorp’s performance and build your own investment thesis in just a few minutes. Do it your way

A great starting point for your KeyCorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip past you. The right screener can help you discover stocks that may offer growth potential, strong dividends, or exposure to breakthrough tech trends.

- Tap into the potential for outsized gains with emerging leaders found in these 3584 penny stocks with strong financials.

- Accelerate your portfolio’s income with steady performers by searching among these 16 dividend stocks with yields > 3%.

- Position yourself at the cutting edge by acting on the latest advances with these 24 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KeyCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEY

KeyCorp

Operates as the holding company for KeyBank National Association that provides various retail and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives