As the stock market continued its relentless climb, the financial sector took the lead in August, with JPMorgan Chase & Co. (NYSE: JPM) being one of the winners.

However, the US$475b bank failed to surpass an all-time high from June and remains modestly valued at a P/E of 10.64. In this article, we will examine current trends and their return on equity (ROE).

Payments, Fossil Fuels, and Interest rates

JP Morgan just bought a majority stake in Volkswagen's (XTRA: VOW3) payments business. The bank acquired a 74.9% stake in Volkswagen Payments S.A, which offers in-vehicle payments, fueling and electric vehicle charging, insurance, and other products in the automotive payments sector. Details of the transaction are not known yet, except that it is subject to regulatory approvals.

According to the 2021 report by the Rainforest Action Network, JP Morgan Chase is the world's biggest funder of coal, oil, and gas extraction. This certainly doesn't help the branding, as the bank became a target for Extinction Rebellion activists who staged a protest demanding an end to fossil fuel finance.

Meanwhile, the Federal Reserve Bank of Dallas recently reported that rent prices are likely to rise in the years to come as home prices continue to grow. This implies that transitory inflation seems less likely by the day, especially with the growing divergence between the 10-year treasury rate and Consumer Price Index.

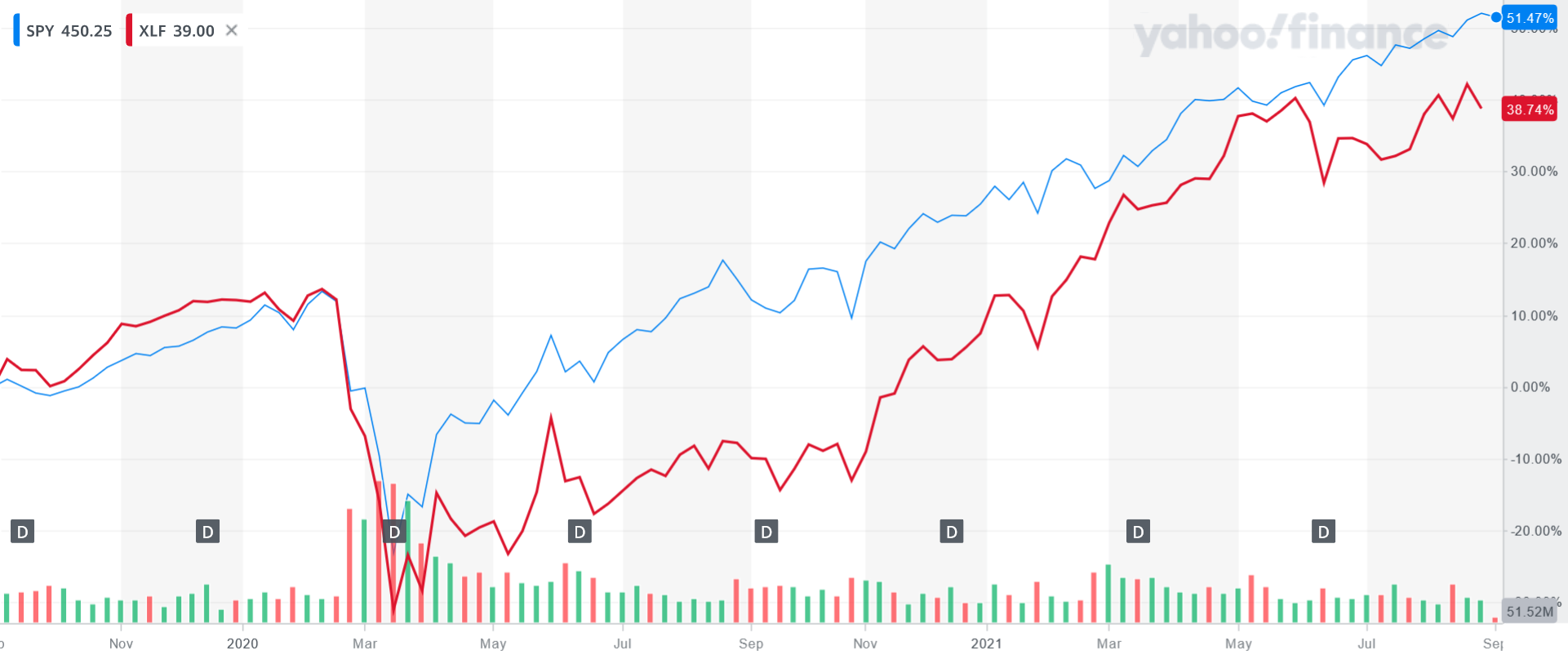

However, this is not the only divergence that might start narrowing once the liquidity spigots start closing. In the chart below, you see the divergence between the S&P 500 and the financial sector that has been prevalent in the last few years. Once the interest rate momentum finally shifts, this might flip as financials would look to outperform.

View our latest analysis for JPMorgan Chase

A look at the ROE

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio that measures the rate of return on the capital provided by the company's shareholders.

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for JPMorgan Chase is:

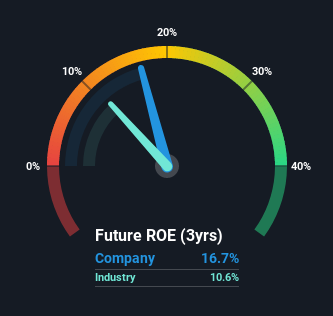

17% = US$48b ÷ US$286b (Based on the trailing twelve months to June 2021).

The 'return' is the income the business earned over the last year. One way to conceptualize this is that for each $1 of shareholders' capital it has, the company made $0.17 in profit.

Does JPMorgan Chase Have A Good Return On Equity?

Arguably the easiest way to assess a company's ROE is to compare it with the average in its industry. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. As is clear from the image below, JPMorgan Chase has a better ROE than the average (11%) in the Banks industry.

However, bear in mind that a high ROE doesn't necessarily indicate efficient profit generation. A higher proportion of debt in a company's capital structure may also result in a high ROE, which could be a huge risk.

The Impact Of Debt On Return On Equity

Virtually all companies need money to invest in the business, to grow profits. That cash can come from issuing shares, retained earnings, or debt. In the first and second options, the ROE will reflect this use of cash for growth. In the latter case, the use of debt will improve the returns but will not change the equity. In this manner, the use of debt will boost ROE, even though the core economics of the business stay the same.

JPMorgan Chase does use a high amount of debt to increase returns. It has a debt-to-equity ratio of 2.49. While its ROE is respectable, it is worth keeping in mind that there is usually a limit on how much debt a company can use. Debt does bring extra risk, so it's only really worthwhile when a company generates decent returns.

Conclusion

Return on equity is one way we can compare the business quality of different companies. In our books, the highest quality companies have high returns on equity, despite the low debt. If two companies have around the same level of debt to equity, and one has a higher ROE, you'd generally prefer the one with higher ROE.

While JP Morgan Chase looks to be outperforming the industry and positioned well for the eventual convergence in returns between the market and the financial sector, incidents with activists certainly pose questions about corporate social responsibility.

ROE is a useful indicator of business quality but you'll have to look at a whole range of factors to determine the right price to buy a stock. The rate at which profits are likely to grow, relative to the expectations of profit growth reflected in the current price, must be considered, too. So you might want to take a peek at this data-rich interactive graph of forecasts for the company.

But note: JPMorgan Chase may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:JPM

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives