- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (JPM) Reports Q2 Earnings With US$23 Billion Net Interest Income

Reviewed by Simply Wall St

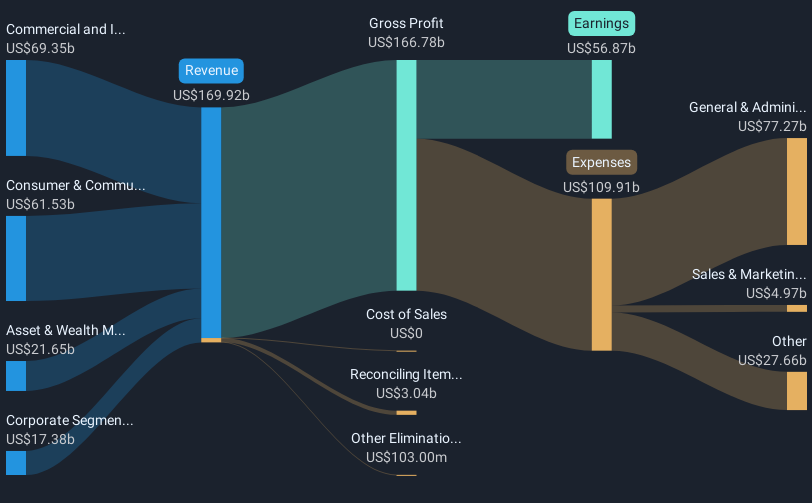

JPMorgan Chase (JPM) recently reported its second-quarter earnings with a net interest income of $23.2 billion, up from the previous year, though net income and earnings per share saw declines. Despite this, the company’s shares rose 24% over the last quarter, likely influenced by a new $50 billion share repurchase program and sustained investor interest amid a mixed market environment. While major indexes showed varied performances and the tech sector rallied, events like JPM's dividend affirmation and executive changes possibly added momentum, contrasting pressures on bank stocks from broader market dynamics.

The recent earnings report from JPMorgan Chase, which highlighted a 24% share price increase over the last quarter, suggests investor confidence buoyed by the company's decision to implement a $50 billion share repurchase program. Despite the mixed market environment, these factors have likely overshadowed challenges such as decreased net income and earnings per share. The dividend affirmation and executive changes could further stimulate investor interest, although higher credit losses and expenses pose risks to future profitability.

Looking at a broader timeframe, JPMorgan Chase's total shareholder return across five years reached 239.32%, underscoring solid long-term performance. Over the past year, JPM surpassed the US Banks industry's 24.9% return and outpaced the US market's 11.4% return. The introduction of new guidance anticipating rate cuts and a cautious outlook for investment banking may influence revenue and earnings forecasts negatively, despite strong performances in certain segments.

With a current share price of $288.70, it closely aligns with the price target of $291.54, suggesting limited upside in the short term. This proximity indicates that recent market movements may have largely incorporated the current expectations from investors and analysts alike, reflecting a potential stabilization in share value relative to the target. However, ongoing market dynamics and company-specific actions should be monitored as they could reassess these assumptions.

Explore JPMorgan Chase's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives