- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (JPM) Partners With Coinbase To Integrate Banking And Crypto Services

Reviewed by Simply Wall St

JPMorgan Chase (JPM) has recently announced a strategic partnership with Coinbase, signaling a move towards integrating traditional banking with the digital asset economy. These strategic maneuvers, along with the reported increase in customer choice through enhanced bank-to-wallet connections, may have contributed to the company's 21% price rise over the last quarter. During this period, JPMorgan also increased its dividend and expanded its share buyback program, aligning with broader market trends. This suggests continued investor confidence amid a generally positive market environment, where the S&P 500 and Nasdaq saw consistent upward trends fueled by earnings optimism and economic data.

Find companies with promising cash flow potential yet trading below their fair value.

The announcement of JPMorgan Chase's partnership with Coinbase could have significant implications for its future performance. This move towards integrating traditional banking with digital assets may boost revenue streams and strengthen its market position in the evolving financial landscape. Over the past five years, JPMorgan Chase achieved a strong total return of 255.52%, showcasing its capacity to deliver consistent shareholder value. In contrast, the past year's performance shows JPMorgan surpassed the broader US Market, which recorded a 17.5% return, indicating that the company has been resilient in shorter time frames as well.

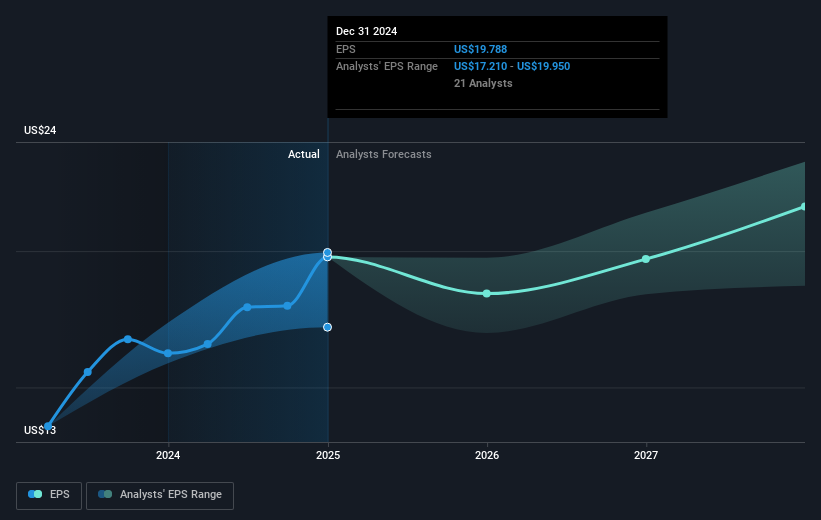

The recent price increase aligns closely with analyst predictions, as the current share price of $297.04 approaches the price target of $303.57, reflecting minimal discount. This proximity to the target suggests that the positive investor sentiment might already be factored into the current valuation, leaving limited room for upside based on those estimates. However, the impact of the Coinbase partnership might lead to adjustments in future revenue and earnings forecasts, potentially affecting analyst outlooks if integration proves beneficial. Should the anticipated improvements in revenue and earnings deliver as expected, there could be a revision in price targets by analysts optimistic about the partnership's contributions to JPMorgan's growth.

Evaluate JPMorgan Chase's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives