- United States

- /

- Banks

- /

- NYSE:JPM

Is JPMorgan Ready for Another Rally After Digital Banking Expansion?

Reviewed by Bailey Pemberton

- Wondering if JPMorgan Chase is undervalued or ready for new highs? You are not alone. Many investors are asking the same question as the stock continues to make headlines.

- JPMorgan’s share price just climbed 5.1% over the past week, and it is now up 30.4% year-to-date, building on an impressive 192.5% gain over the last five years.

- Recent news includes JPMorgan’s push into digital banking and its expansion into new wealth management markets, both signaling confidence in future growth. The company’s moves are generating buzz around its long-term prospects and shaping investor expectations.

- On our valuation scorecard, JPMorgan Chase scores just 2 out of 6 for being undervalued, but there is more than one way to value a stock. By the end of this article, we will spotlight a smarter approach to finding the real opportunity.

JPMorgan Chase scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: JPMorgan Chase Excess Returns Analysis

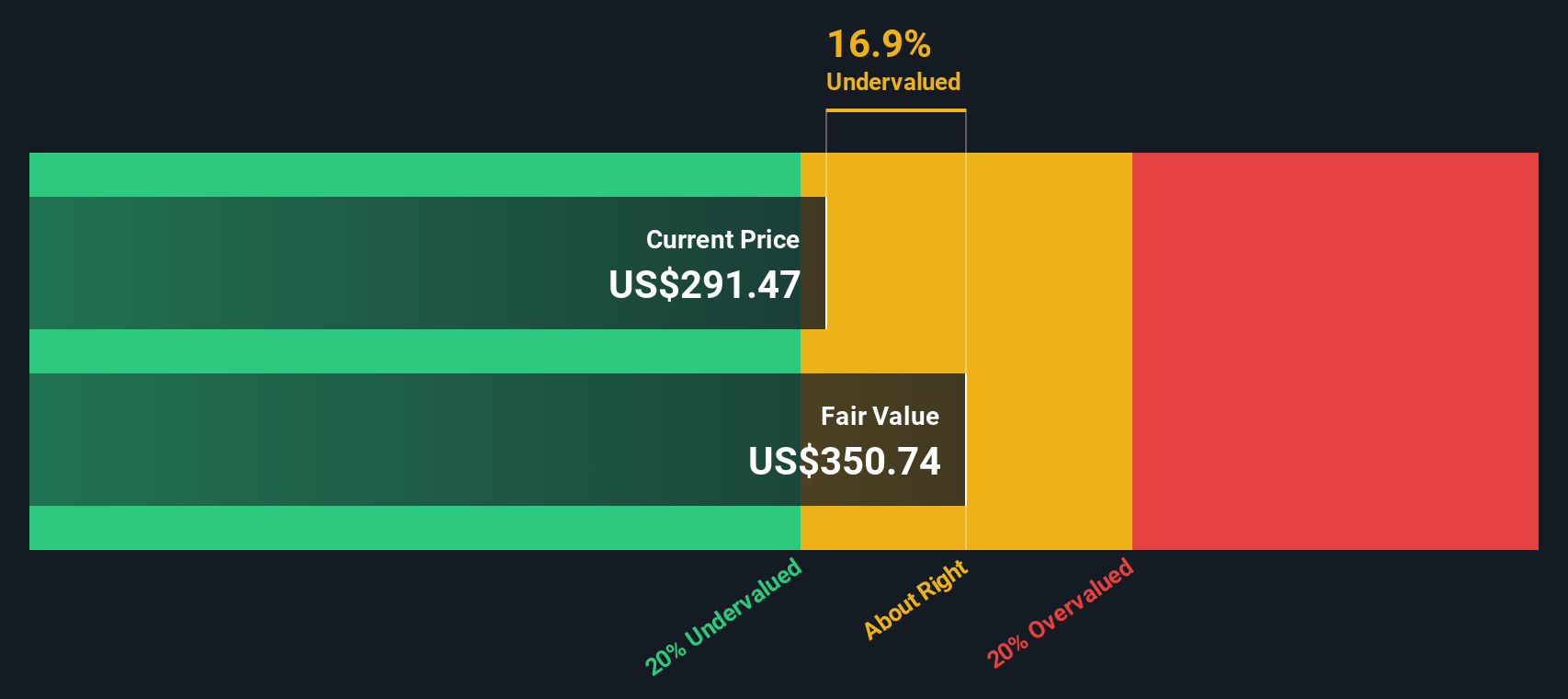

The Excess Returns valuation model examines how effectively a company can generate returns on its invested capital above its cost of equity. For JPMorgan Chase, this method focuses on the relationship between the book value per share, the company's expected earnings power, and the cost that shareholders require in return for their investment.

According to the latest estimates, JPMorgan Chase's book value stands at $124.96 per share, and its stable earnings per share (EPS) are forecast to be $22.49, based on future return on equity projections from 13 analysts. The cost of equity, which measures the minimum rate shareholders expect, is $11.10 per share. The resulting excess return, representing value created on top of this cost, is $11.40 per share, with an average return on equity of 16.63%. Analysts project the stable book value to rise to $135.24 per share in the coming years.

This framework yields an estimated intrinsic value that is 14.4% higher than the current stock price, suggesting the market may be undervaluing JPMorgan's future earnings potential. The current share price offers a notable discount compared to the excess returns calculated by this model.

Result: UNDERVALUED

Our Excess Returns analysis suggests JPMorgan Chase is undervalued by 14.4%. Track this in your watchlist or portfolio, or discover 915 more undervalued stocks based on cash flows.

Approach 2: JPMorgan Chase Price vs Earnings

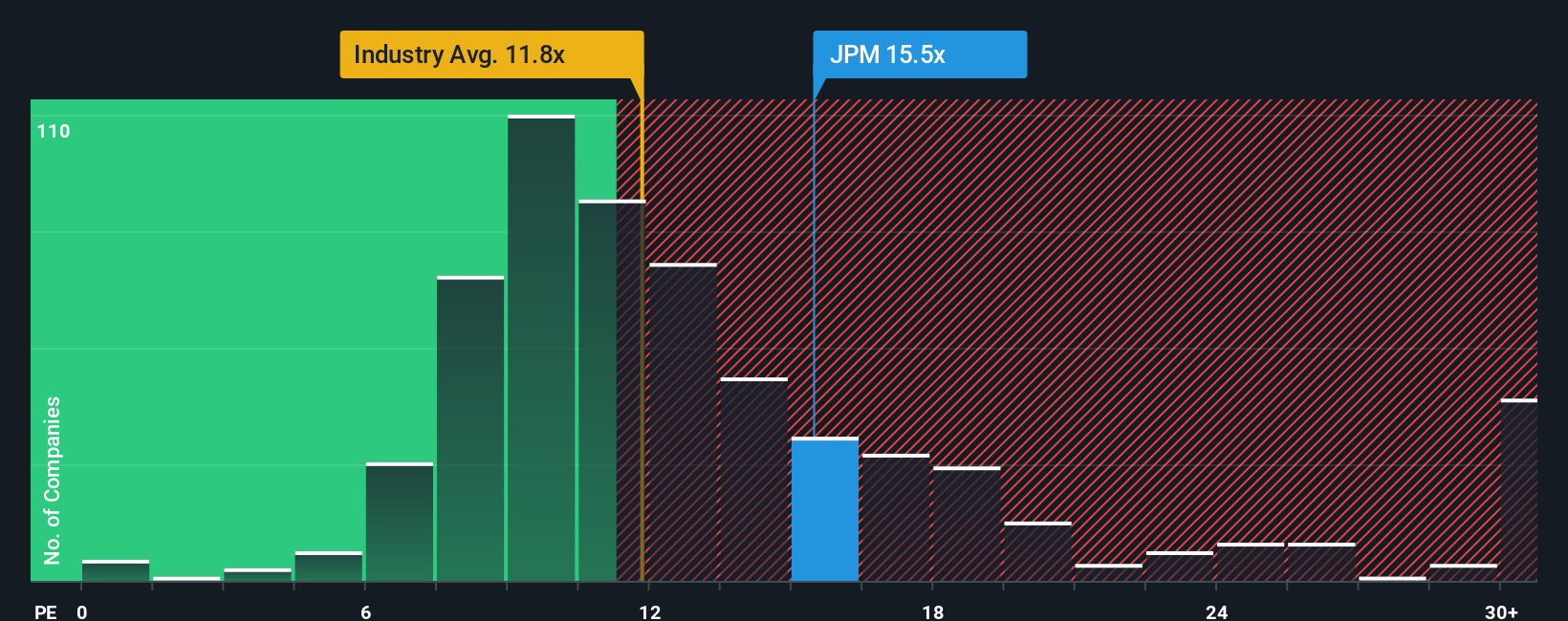

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies like JPMorgan Chase. It allows investors to assess how much they are paying for each dollar of current earnings. Since JPMorgan consistently generates stable profits, the PE ratio provides a relevant snapshot of how the market values its earnings power today.

Determining what makes a “normal” or “fair” PE ratio depends on several factors, including growth expectations and perceived risk. Companies with higher projected earnings growth or lower risk profiles generally command higher PE ratios. On the other hand, riskier or slower-growing firms tend to trade at lower multiples.

JPMorgan Chase currently trades at a PE ratio of 15.04x. This is above the banking industry average of 11.40x and higher than the peer group average of 13.09x. Simply Wall St’s proprietary Fair Ratio for JPMorgan, which considers the company’s growth, profit margin, industry, market cap and risks, is 15.48x.

The Fair Ratio metric is especially valuable because, unlike a simple comparison to sector averages or peer stocks, it calibrates what is reasonable for JPMorgan specifically. It recognizes when the company merits a premium for its growth or stability, rather than treating all banks alike.

In this case, JPMorgan’s current PE of 15.04x is only slightly below the Fair Ratio of 15.48x. The small gap suggests the stock is valued about right given both its growth prospects and risk factors.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your JPMorgan Chase Narrative

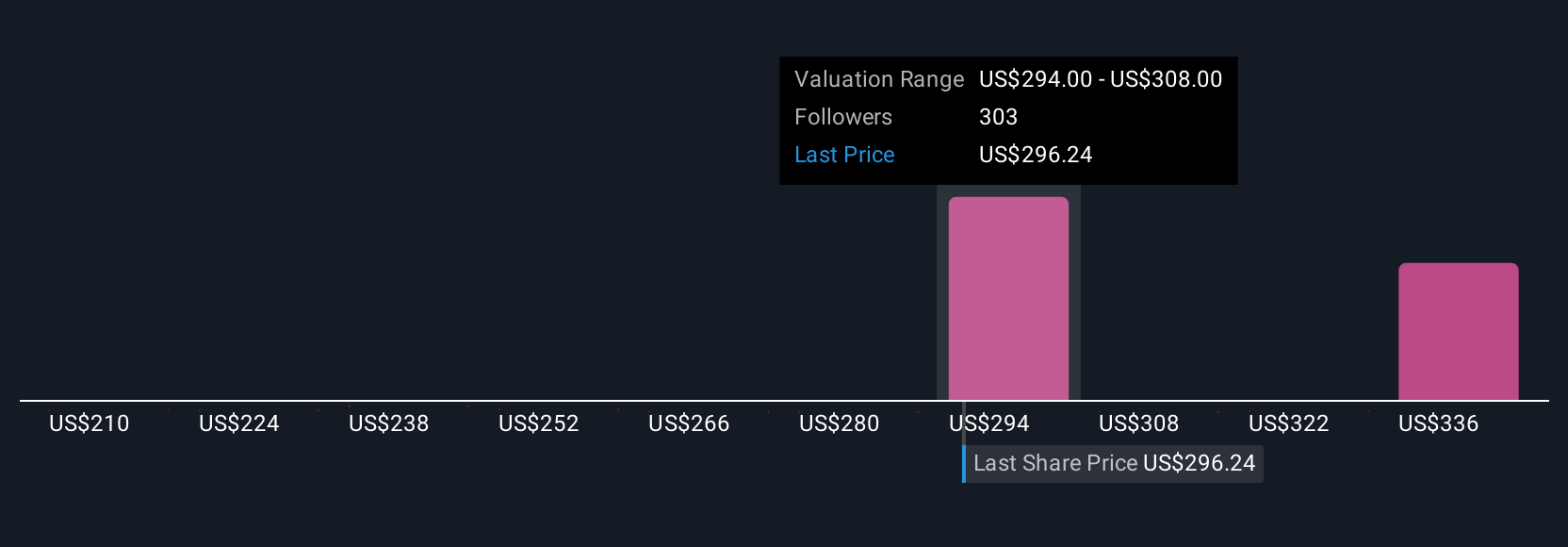

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your chance to build a story, your own investment perspective, about a company by linking its business drivers and recent developments to your own assumptions about future revenue, profit margins, and fair value.

Unlike traditional valuation, which often focuses on a single model or number, Narratives combine your view of JPMorgan Chase's journey, whether it is their growth in digital banking, the risks of fintech disruption, or evolving regulations, with a dynamically-updated forecast and fair value estimate. On Simply Wall St’s Community page, Narratives are accessible and easy for all investors to use, helping you see how your expectations compare to the crowd or to professional analysts.

Narratives empower investors to decide when to buy or sell by directly comparing their Personalized Fair Value to the latest share price, while instantly reflecting new information like earnings or major news events. For example, one investor might use recent momentum and JPMorgan's global expansion to justify a bullish fair value of $350 per share, while another, concerned by rising costs and regulation, could see a more cautious narrative and set fair value closer to $235. This demonstrates how Narratives transform valuation into a living story tailored to your conviction.

For JPMorgan Chase, we’ll make it really easy for you with previews of two leading JPMorgan Chase Narratives:

Fair Value: $328.09

Current discount: 4.6% undervalued

Projected revenue growth: 6.1%

- Growth in wealth management, payments, and digital banking is expected to drive higher fee revenue, improved customer acquisition, and enhanced margins.

- Strategic investments in new financial technology, alongside diversified business expansion, should help the firm remain resilient and competitive through various market cycles.

- Main risks include intensifying fintech competition, strict regulation, potential volatility in business lines, demographic headwinds, and product commoditization.

Fair Value: $247.02

Current premium: 26.8% overvalued

Projected revenue growth: 4.1%

- Rising credit loss allowances and higher expenses highlight challenges to margins, potentially straining future earnings.

- Expectations for rate cuts and cautious investment banking outlook may reduce net interest income and advisory revenue, impacting overall profitability.

- Despite some business momentum, analysts on the bearish side believe the market's expectations are too high, given macroeconomic uncertainties and potential for higher costs.

Do you think there's more to the story for JPMorgan Chase? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026