- United States

- /

- Banks

- /

- NYSE:JPM

How JPMorgan Chase's Move to Accept Crypto as Loan Collateral Will Impact JPM Investors

Reviewed by Sasha Jovanovic

- In recent days, JPMorgan Chase announced it will allow institutional clients to use their Bitcoin and Ethereum holdings as collateral for loans, utilizing third-party custodians for asset security.

- This development marks a significant step for the integration of digital assets into traditional finance, demonstrating growing acceptance of cryptocurrencies by major banks amid evolving client needs and regulatory landscapes.

- We'll examine how this expansion into crypto collateralization could reshape JPMorgan Chase's competitive positioning and long-term growth prospects.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

JPMorgan Chase Investment Narrative Recap

To be a JPMorgan Chase shareholder, you need to believe in its strengths as a diversified, globally scaled bank, with the balance sheet and technology investments to compete and grow in a rapidly evolving financial sector. The recent move to let institutional clients use Bitcoin and Ethereum as loan collateral signals active participation in new financial technologies, but it is not likely to materially alter the most important near-term catalyst, ongoing growth in asset and wealth management, or shift the core risk, which remains intensifying digital and fintech competition.

One of JPMorgan’s more relevant recent announcements is its strategic partnership with Versana to introduce real-time, digital cashless roll capability for syndicated loan management. This move, like the crypto-collateral initiative, underscores the bank’s focus on digital transformation to better serve clients and defend market share, reinforcing its position amid industry catalysts around technology and operational efficiency.

Yet, against these forward-looking developments, investors should be aware of emerging risks such as…

Read the full narrative on JPMorgan Chase (it's free!)

JPMorgan Chase's outlook anticipates $186.7 billion in revenue and $55.5 billion in earnings by 2028. This scenario requires 4.5% annual revenue growth and a minimal $0.3 billion increase in earnings from the current $55.2 billion level.

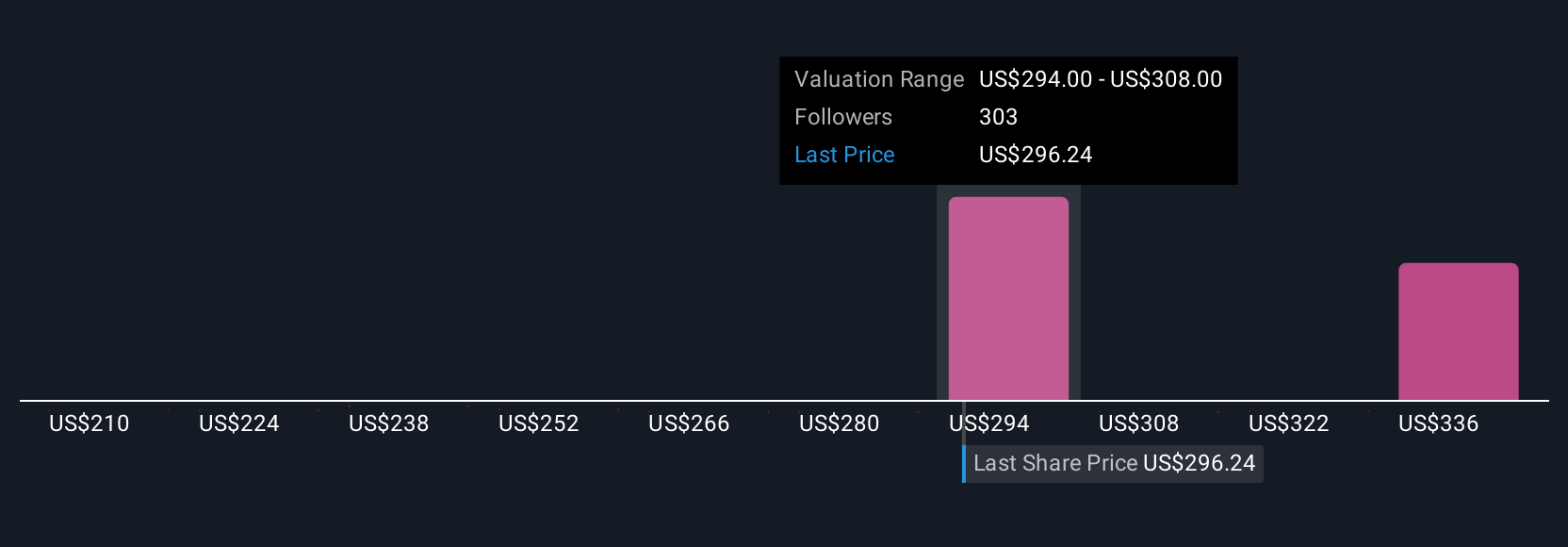

Uncover how JPMorgan Chase's forecasts yield a $326.43 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Some analysts take a more pessimistic stance, projecting future earnings could fall to US$53.2 billion and margins shrink if credit losses and costs rise. If you lean cautious, these forecasts remind you that opinions differ widely, and the latest news may shift even the lowest expectations.

Explore 22 other fair value estimates on JPMorgan Chase - why the stock might be worth 20% less than the current price!

Build Your Own JPMorgan Chase Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JPMorgan Chase research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JPMorgan Chase research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JPMorgan Chase's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives