- United States

- /

- Banks

- /

- NYSE:HOMB

Should Improved Earnings and Capital Returns Prompt Reassessment by Home Bancshares (HOMB) Investors?

Reviewed by Simply Wall St

- In July 2025, Home Bancshares (Conway AR) reported higher net interest income and net income for the second quarter compared to the previous year, affirmed a quarterly US$0.20 cash dividend for September, reduced quarterly net loan charge-offs, and completed a tranche of its ongoing share buyback program.

- Sustained earnings growth paired with steady dividend payments and buybacks signals management's continued focus on shareholder returns and operational resilience.

- We will explore how improved earnings and sustained capital returns inform the company's investment narrative moving forward.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Home Bancshares (Conway AR) Investment Narrative Recap

Home Bancshares shareholders typically focus on the company’s ability to generate consistent earnings growth while prioritizing capital returns through dividends and share buybacks. The latest quarterly results reinforce this investment narrative, with higher net income and reduced loan charge-offs supporting the view that operational resilience remains a short-term catalyst; at the same time, ongoing reliance on acquisitive growth continues as a key risk, though this news does not materially shift that concern.

Among recent announcements, the second quarter’s reduced net loan charge-offs stand out as especially relevant. This improvement in credit quality not only supports current earnings, but also may help mitigate some of the sensitivity around the company's concentrated loan exposure, an important consideration for those weighing short-term risks and catalysts alike.

In contrast, investors should be aware that even strong credit results could be offset by challenges if the company’s acquisition strategy faces...

Read the full narrative on Home Bancshares (Conway AR) (it's free!)

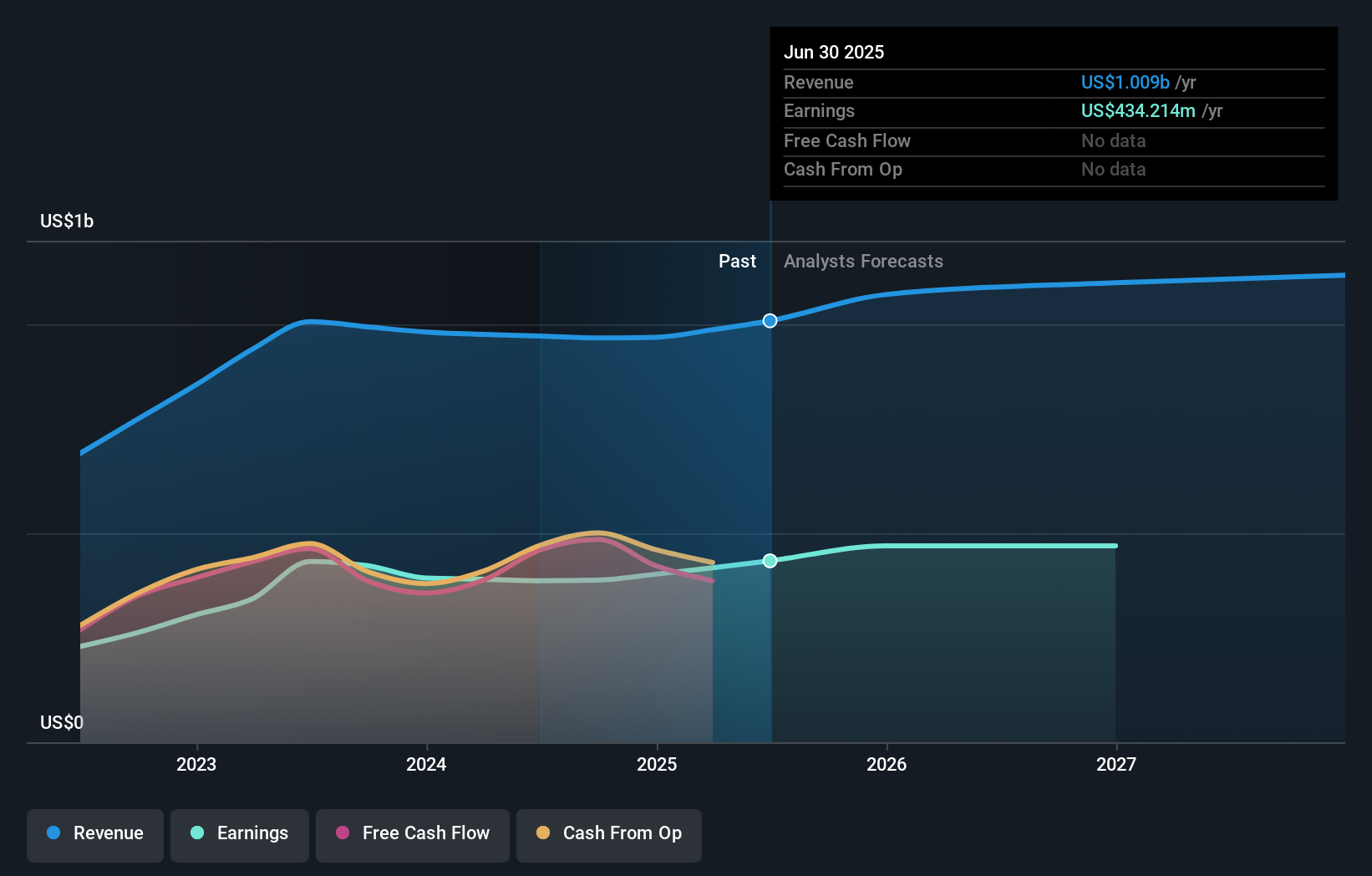

Home Bancshares (Conway AR)'s outlook forecasts $1.2 billion in revenue and $512.9 million in earnings by 2028. This scenario assumes 4.7% annual revenue growth and a $78.7 million increase in earnings from the current $434.2 million.

Uncover how Home Bancshares (Conway AR)'s forecasts yield a $33.71 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Fair value estimates from three Simply Wall St Community members for Home Bancshares range from US$25.71 to US$51.90. While opinions differ, ongoing reliance on finding suitable acquisitions remains crucial to future growth, potentially impacting both earnings and risk-adjusted returns ahead.

Explore 3 other fair value estimates on Home Bancshares (Conway AR) - why the stock might be worth 11% less than the current price!

Build Your Own Home Bancshares (Conway AR) Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Home Bancshares (Conway AR) research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Home Bancshares (Conway AR) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Home Bancshares (Conway AR)'s overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Bancshares (Conway AR) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOMB

Home Bancshares (Conway AR)

Operates as the bank holding company for Centennial Bank that provides commercial and retail banking, and related financial services to businesses, real estate developers and investors, individuals, and municipalities in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives