- United States

- /

- Banks

- /

- NYSE:HOMB

Is Home BancShares (HOMB) Undervalued After Its Dividend Boost and Strong Earnings?

Reviewed by Simply Wall St

Home Bancshares (Conway AR) just announced a higher quarterly cash dividend of $0.21 per share, up 5% from the previous payout. This signals continued confidence in its performance and shareholder-focused approach.

See our latest analysis for Home Bancshares (Conway AR).

Shares of Home Bancshares (Conway AR) have softened in recent months, with a 30-day share price return of -4.87% and year-to-date performance still slightly negative. However, the latest 12-month total shareholder return stands at 4.58%. That steady, positive long-term result reflects resilience, especially against the backdrop of accelerating earnings growth and continued buybacks, which are helping to maintain investor momentum.

If you want to see how other growth-focused financials or shareholder-friendly stocks are performing, this is a great opportunity to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading well below analyst targets and a strong track record of growth and returns, the question for investors is clear: Is Home Bancshares undervalued today, or is the market already pricing in its future momentum?

Most Popular Narrative: 17.4% Undervalued

The widely followed narrative sets a fair value for Home Bancshares (Conway AR) well above the last close price, suggesting upside based on projected growth. The discussion frames this premium through the company's expansion strategy and disciplined execution, which are positioned to drive results over time.

Management is actively seeking bank acquisition targets in its core footprint, leveraging its historical track record of disciplined, accretive M&A to drive asset growth and EPS expansion. Any successful deals would be directly additive to earnings and tangible book value.

Curious what ambitious growth projections convinced analysts to peg fair value so much higher? The real story includes bold expansion plans, rising profit margins, and analyst expectations that defy conventional industry averages. Explore the full narrative and uncover what quantifies this premium call.

Result: Fair Value of $33.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on acquisitions and regional loan concentration could challenge sustained earnings growth if integration proves difficult or if economic cycles turn less favorable.

Find out about the key risks to this Home Bancshares (Conway AR) narrative.

Another View: What Do Market Multiples Suggest?

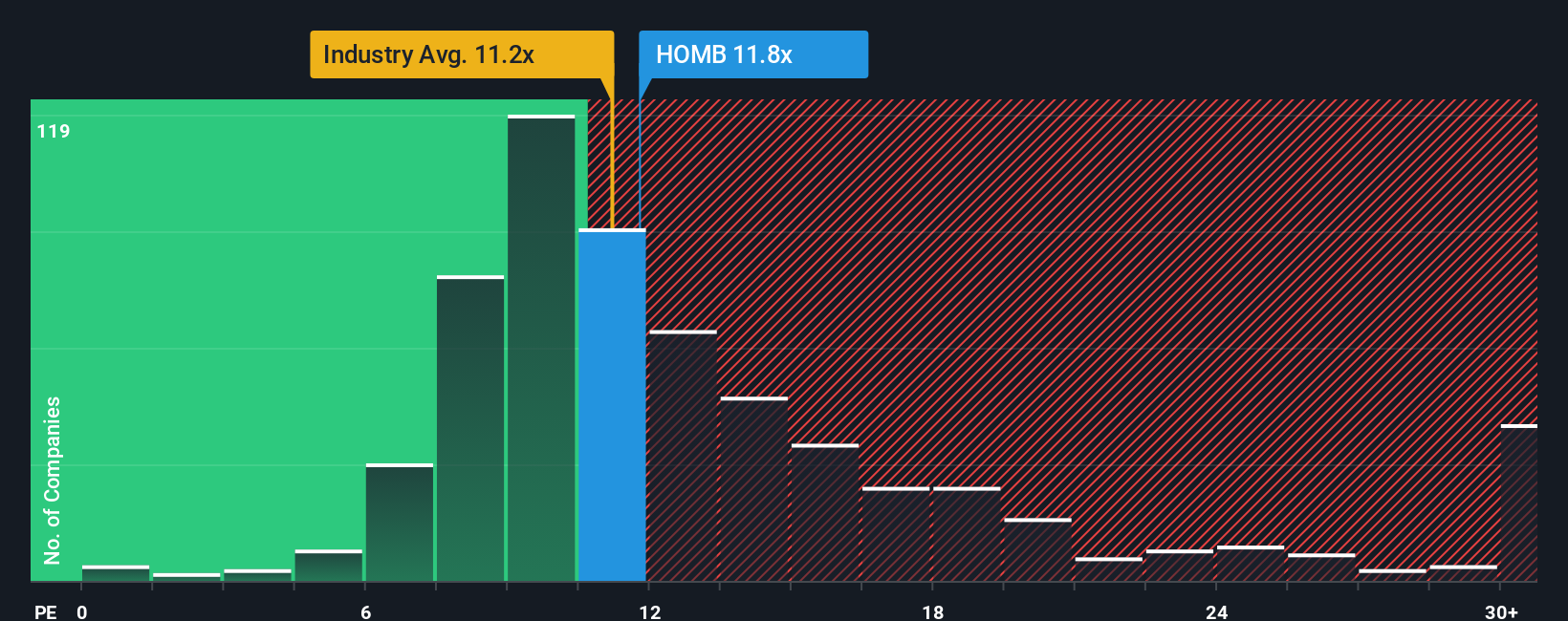

Looking from a different angle, the market is pricing Home Bancshares at a price-to-earnings ratio of 11.8x. That is not only higher than the US Banks industry average of 11.2x, but also above its closest peers at 10.8x, and even the fair ratio of 11.7x. This suggests the stock may be a bit expensive compared to the sector. Is the market expecting more, or missing something?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Home Bancshares (Conway AR) Narrative

If you see things differently or want to shape your own view, it only takes a few minutes to explore the data and create your personal perspective. Do it your way

A great starting point for your Home Bancshares (Conway AR) research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Turn your next move into an advantage by tapping into Simply Wall Street’s stock screener. The smartest opportunities are just a click away and waiting for you.

- Capture steady income streams with these 17 dividend stocks with yields > 3% and access companies offering reliable yields above 3%.

- Pounce on tomorrow’s health breakthroughs when you unlock these 33 healthcare AI stocks for a unique take on cutting-edge healthcare technology innovators.

- Outsmart the market by focusing on value with these 876 undervalued stocks based on cash flows, which spotlights stocks poised for gains based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Bancshares (Conway AR) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOMB

Home Bancshares (Conway AR)

Operates as the bank holding company for Centennial Bank that provides commercial and retail banking, and related financial services to businesses, real estate developers and investors, individuals, and municipalities in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives