- United States

- /

- Banks

- /

- NYSE:GBCI

Glacier Bancorp (GBCI): Reviewing Valuation After Strong Q3 Growth and Recent Acquisitions

Reviewed by Simply Wall St

Glacier Bancorp (GBCI) posted strong third quarter results, with net interest income and net income rising meaningfully from the prior year. Management pointed to successful integrations and disciplined expense control as drivers of their performance.

See our latest analysis for Glacier Bancorp.

Despite an earnings beat and expanding into new markets through recent acquisitions, Glacier Bancorp’s share price has lost momentum lately, with a 1-month share price return of -12.14%. Longer term, the 1-year total shareholder return sits at -9.0%, reflecting the market’s cautious stance even as fundamental growth remains solid.

If you're interested in finding what's next for banks showing strong fundamentals and insider support, now is a good time to explore fast growing stocks with high insider ownership

With fundamentals looking strong but recent returns lagging, investors are left to wonder whether Glacier Bancorp’s shares now offer compelling value or if the market has fairly accounted for all future growth prospects.

Most Popular Narrative: 18.5% Undervalued

At $43.85, Glacier Bancorp is trading well below the most widely followed fair value estimate of $53.83. This creates a potential value gap for investors watching the stock’s next move.

Investments in digital platforms, such as the new commercial loan system and enhanced treasury solutions, are improving operational efficiency, lowering cost-to-income ratios, and attracting younger, tech-savvy customers. These factors support higher net margins and the potential for future margin expansion.

Want to know the catalyst behind this valuation? The narrative leans on ambitious growth expectations and surprisingly bullish margin forecasts. Curious which combinations of expansion and efficiency justify that higher price? Unpack the numbers that could flip market sentiment.

Result: Fair Value of $53.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration challenges from recent acquisitions or a prolonged slowdown in Glacier Bancorp’s rural core markets could quickly weaken the bullish outlook.

Find out about the key risks to this Glacier Bancorp narrative.

Another View: What Do the Ratios Say?

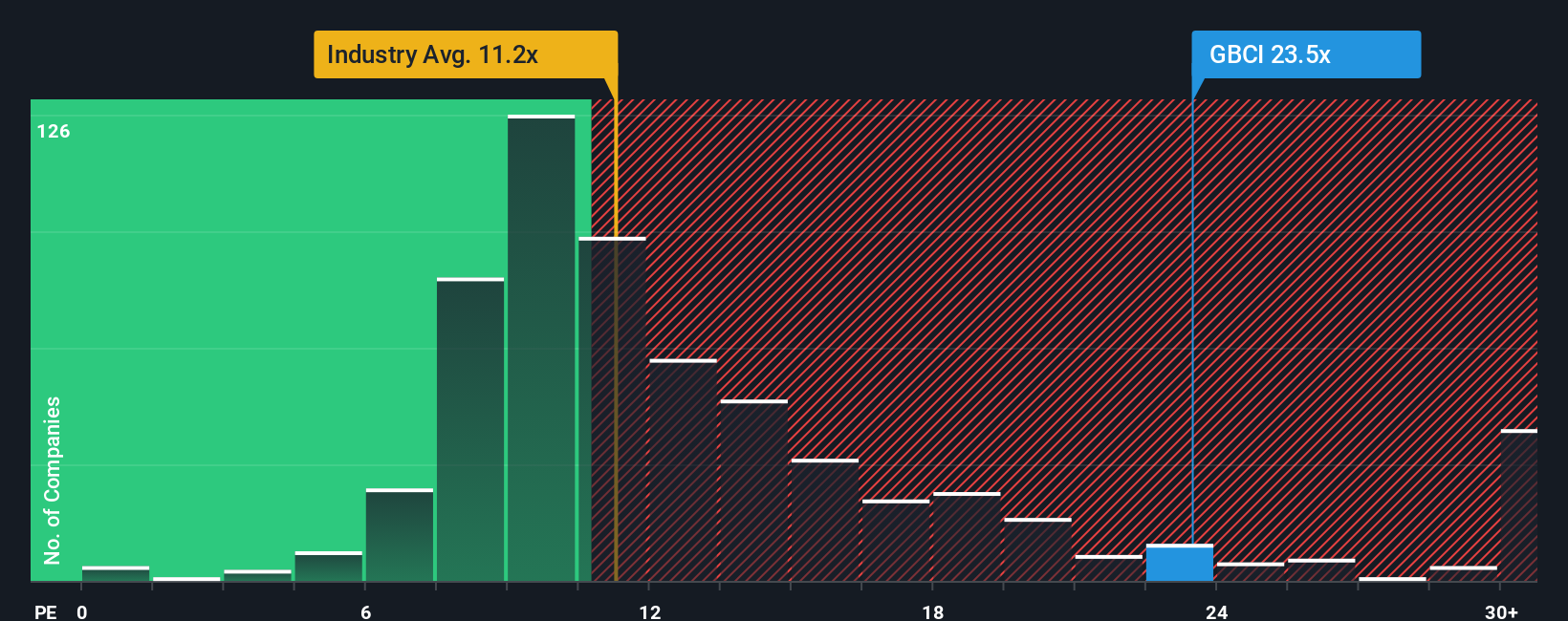

Looking at Glacier Bancorp through the lens of its price-to-earnings ratio, things look less rosy. The company trades at 24 times earnings, which is noticeably higher than both the US banks industry average of 11.2 and the peer average of 10.7. Even compared to the fair ratio of 18.5, the current valuation leaves less margin for error and hints at a premium price investors are paying.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Glacier Bancorp Narrative

If you see things differently or want to uncover your own story in the numbers, you can run your own analysis in just minutes, Do it your way

A great starting point for your Glacier Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stand still. You could miss tomorrow’s winners if you settle for what you know. Unlock fresh opportunities with these tailored stock ideas trusted by thousands.

- Power up your portfolio with growth by checking out these 27 AI penny stocks, which are reshaping industries through artificial intelligence, automation, and data-driven innovation.

- Capture overlooked value and invest ahead of the crowd as you review these 876 undervalued stocks based on cash flows identified through rigorous cash flow analysis.

- Strengthen your income stream by tapping into these 17 dividend stocks with yields > 3%, offering reliable yields and sustainable payout potential above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBCI

Glacier Bancorp

Operates as the bank holding company for Glacier Bank that provides commercial banking services to individuals, small to medium-sized businesses, community organizations, and public entities in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives